The rise of active

Thematic ETFs have become popular in recent years. The demand is partly due to the rapidly increasing interest in key themes such as disruptive technology, healthcare and ESG (environment, social and governance) investing. As an example of thematic trends, according to Trackinsight’s 2022 ETF survey, there were 300 new thematic ETFs launched in 2021 globally. Thematic ETFs now account for over USD 141 billion (source: Bloomberg, 30 June 2022).

Much of this rise in demand for thematic ETFs has been met by passive strategies, which track benchmarks that are specially constructed to give a broad exposure to a particular theme. However, active strategies are now becoming increasingly popular, as investors recognise their greater flexibility.

Active thematic ETFs are more flexible

Passive thematic ETFs attempt to track specialist thematic indices. These indices are compiled using rules-based stock selection which aims to create an economic linkage to the theme to which investors want to gain exposure. For example, the widely used S&P Global Clean Energy and MSCI ACWI IMI New Energy indices provide exposure to the energy transition theme by selecting the companies with the largest overlap with the selected theme. The inclusion criteria are prescriptive, with potential constituents drawn mainly from companies that derive a particular amount of their revenues from the theme.

Because they are constructed based on prescriptive rules, thematic indices tend to focus on what are often referred to as pure-play stocks – companies whose activities predominantly lie within the scope of a particular theme. The result can be a narrow focus on just a small number of stocks. For example, in a clean energy index, only companies heavily involved in the generation of renewable energy may be included. They may exclude more diversified companies that also have a key role to play in the energy transition theme, such as companies providing software and infrastructure to enhance the electric grid or companies enabling electrification such as EV charging.

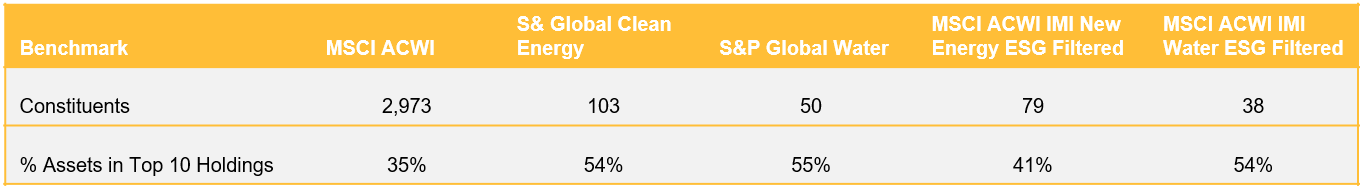

Thematic indices are also often weighted by market cap, or by a simple equal-weighting construction. Given the growing number of thematic ETFs and the relatively small number of pure-play stocks, many funds can therefore end up chasing the same stocks and investing in highly crowded positions. The chart displays the heavy concentration that some leading thematic index providers have in their top ten holdings. This high concentration can increase investment risk and reduce the diversification benefits investors may expect.

Thematic benchmarks can be highly concentrated

Source: Index provider website, J.P. Morgan Asset Management; as of 21 June 2022.

Compared to tracking a thematic benchmark, an active approach has much more embedded flexibility in the construction of the ETF portfolio. Active thematic ETFs often have a much broader investment universe, such as the MSCI All Country World Index, which can give access to the full opportunity set of a theme, beyond the narrow focus of thematic benchmarks. Active portfolio managers can also implement investment ideas without being limited to the stock selection and rebalancing rhythms set by index providers . This flexibility can be particularly important if there is negative newsflow around a company. Passive ETFs usually rebalance only every three months and so cannot adapt to changing market conditions as quickly.

An integrated thematic view

Another advantage of active thematic managers is their ability to take a granular approach to portfolio construction and give more weight to companies that they believe can provide the most impactful and effective exposure to the selected theme, from across the market rather than only from certain sectors or types of stocks.

Gaining exposure to some of the largest structural themes, such as climate change, does not – in our view – require a narrow approach. The climate challenge touches almost all areas of the global economy. Greenhouse gases come from a wide variety of areas – energy in industry, buildings, transportation, and agriculture – with investable opportunities existing across the broad spectrum. To gain full exposure to the climate change investment theme with a passive approach, several different passive ETFs would have to be selected – perhaps clean energy, water and sustainable food ETFs – putting the burden of theme selection and monitoring on the investor.

Active asset managers can apply a much broader approach to the theme and select companies from different sectors, as long as these companies have a significant overlap with the selected theme. They can also position the portfolio towards different sub-themes and companies depending on the current market dynamics. However, given the breadth of the investment universe, it is important to select an active manager that has access to a global investment team with the capabilities to support deep thematic research across markets and sectors.

At J.P. Morgan Asset Management, our active thematic ETFs use our proprietary natural language processing tool, Themebot. This artificial intelligence tool helps our portfolio managers cover more than 13,000 companies globally, at speed, generating a manageable list of opportunities from which to start the investment process.

Companies are rated for their exposure to the theme by both textual relevance and revenue. The use of this technology helps us identify stocks that fit a particular theme across a broader investment universe and also to cover the breadth of a global opportunity set using one consistent framework.

Once a stock has been identified by Themebot, our investment team conducts fundamental research and management meetings to gain a fuller picture, only investing in high conviction investment ideas.

This combination of artificial intelligence and human insight enables us to build flexible portfolios of companies exposed to the relevant theme across sectors, industries and countries, and across the market cap spectrum.

Diversification does not guarantee positive returns or eliminates risks of loss. Provided for educational purposes to illustrate general characteristics of ETFs, not to be construed as offer, research. Investments involve risks and are not similar or comparable to deposits. Not all investments are suitable for all investors.

JPMAM defines ESG integration as the systematic inclusion of financially material ESG factors (alongside other relevant factors) in investment analysis and investment decisions. In actively managed assets deemed by J.P. Morgan Asset Management to be ESG integrated under our governance process, we systematically assess financially material ESG factors including sustainability risks in our investment decisions with the goals of managing risk and improving long-term returns.