True ETF liquidity

Exchange-traded funds (ETFs) present many features that investors may be looking for, including flexible intraday trading, efficient market access and potentially lower costs than mutual funds. But one of the most important ETF features—their liquidity—is also one of the most widely misunderstood.

Dispelling the myths

Liquidity refers to the ability to buy or sell a security quickly, easily and at a reasonable transaction cost. ETFs and individual stocks both trade on a stock exchange, leading many investors to believe that the factors that determine the liquidity of the two securities must also be similar. They’re not. ETF liquidity can often be far greater than most investors assume.

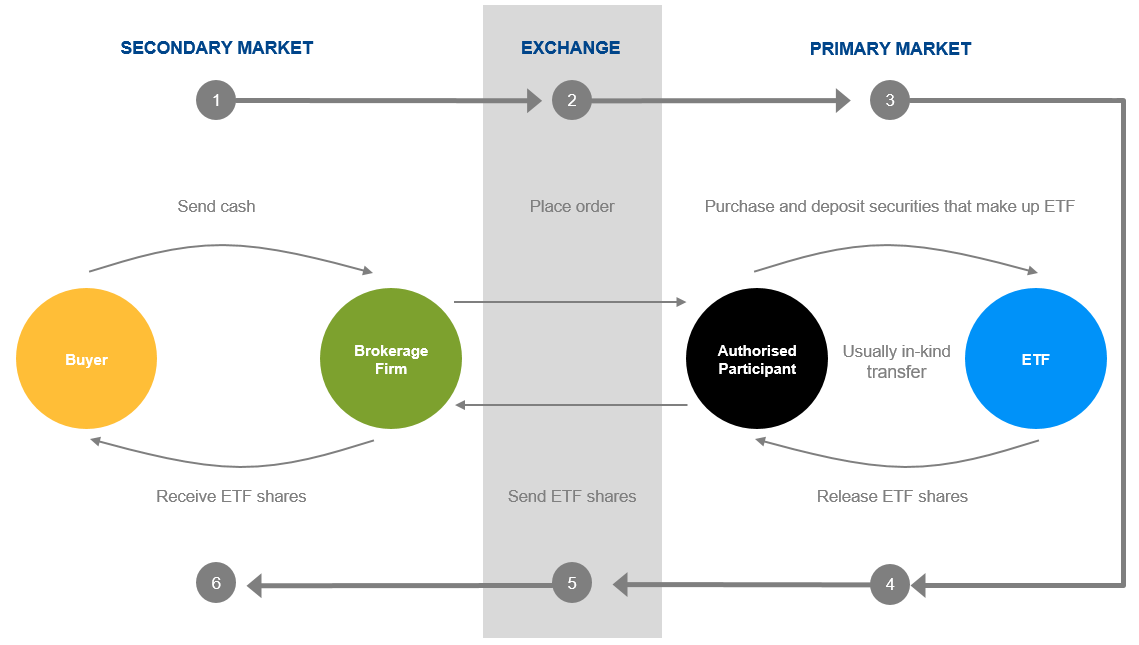

ETFs actually operate in a fundamentally different ecosystem to other instruments that trade on stock exchanges, such as individual stocks or closed-end funds. Whereas these securities have a fixed supply of shares in circulation, ETFs are open-ended investment vehicles with the ability to issue or withdraw shares on the secondary market according to investor supply and demand.

This unique creation and redemption mechanism means that ETF liquidity is much deeper and much more dynamic than stock liquidity. It also explains why an ETF‘s liquidity is predominantly determined by the liquidity of its underlying individual securities, rather than by the size of its assets or by trading volumes.

The ETF ecosystem: Trading occurs in the secondary market; creation and redemption occurs in the primary market

Source: J.P. Morgan Asset Management; for illustrative purposes only.

Guidelines for determining liquidity and trading ETFs

Although ETFs have many characteristics that are similar to stocks, liquidity is not one of them. Therefore, it‘s important to look beyond trading volumes and on-screen indicators when assessing ETF liquidity. Here are some of the dos and don’ts when assessing ETF liquidity.

Don’t use trading volumes or fund size as a guide. Perhaps the most common misconception is that funds with low daily trading volumes or with small amounts of assets under management will be difficult or expensive to trade. This is not the case. Due to the ETF creation and redemption mechanism, small- or low-trading-volume ETFs are usually able to absorb large buy or sell orders while continuing to trade at prices that are typically close to the net asset value of their underlying securities.

Look at total ETF liquidity in the secondary and primary markets. Because market makers—who maintain continuous two-way ETF orders and are a key input to exchange order books—typically display only a small fraction of the volume they are willing to trade, investors may find that secondary market liquidity is actually much higher than on-screen indicators suggest. Investors with large ETF trades can also tap into primary market liquidity by working with an authorised participant (AP) to create or redeem ETF shares directly with the fund company.

Use limit orders as the default order type when trading ETFs. A limit order—an order to buy or sell a set number of shares at a specified price or better—gives investors some control over the price at which the ETF trade gets executed. By contrast, a market order—an order to buy or sell immediately at the available price—may end up being executed at a price that is far higher (or lower) than an investor’s expectations as the order sweeps through standing orders on the order book.

Work with your financial adviser or ETF provider, especially when placing large trades. Most providers have capital markets desks whose role is to work with portfolio managers, APs, market makers and stock exchanges to help assess true ETF liquidity and assist investors with efficient trade execution.

Provided for educational purposes to illustrate general characteristics of ETFs, not to be construed as offer, research. Investments involve risks and are not similar or comparable to deposits. Not all investments are suitable for all investors.