The bigger picture is sustainable

Our clients are increasingly looking for investment solutions that reflect not only their financial goals but also their values.

The JPMorgan Global Macro Sustainable Fund employs our tried and tested macro process sustainably to help investors align their goals with their values1.

As macro investors, we invest in shares, bonds and other assets. But rather than starting with specifics, we start with the big picture. We seek to identify the large external forces that can drive the performance of companies, asset classes and markets over time.

| Economic developments | Social change | Demographic shifts |

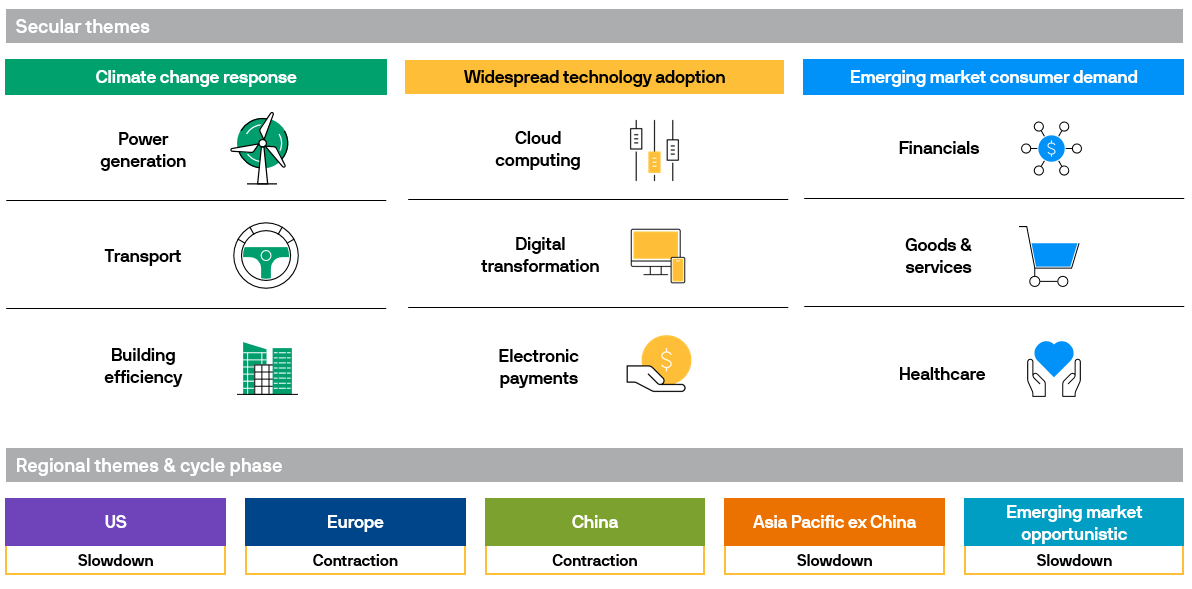

For illustrative purposes only based on current market conditions, subject to change from time to time.

We invest in the companies and other assets, across sectors and regions, that we think have the potential to benefit from these global themes – and we also try to profit from short exposure areas that we expect to be challenged as a result of those themes. We don’t have a benchmark to constrain us, and we aren’t solely reliant on rising markets to generate returns on your investment1.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investing sustainably is a way to align your values with your goals for your money. It is also a way to seek to manage the risks and capture the opportunities as the world adapts to changes in our climate, the broader environment and society.

Our clients’ values are reflected through robust environmental, social and governance (ESG) research, systematic exclusions to certain industries, and a tilt towards companies and issuers screening better on ESG and sustainable criteria.

The potential to generate positive returns in various market environments

A complement to traditional single-asset funds and other multi-asset funds

Built to reflect your values

For illustrative purposes only based on current market conditions, subject to change from time to time.

The JPMorgan Global Macro Sustainable Fund seeks to reflect our clients’ values through a three-pillar approach to building a sustainable portfolio.

Integration of ESG2 into decision-making

Consideration of ESG materiality forms part of the security research and is factored into decision-making across the entire Macro Strategies platform.

Systematic exclusions based on client values

Systematic exclusions3 are applied to certain industries and sectors to reflect our clients’ values and expected business practices. Exclusions are applied to single companies and broader exposures via derivatives.

Positive positioning to sustainable securities

We lean into better ESG and more sustainable outcomes. We also maintain an average weighted ESG score for equity and fixed income above the respective universes.

2. Integration of ESG factors in the investment process does not imply it incorporates ESG factors as its key investment focus.

3. The current exclusion policy can be found on our website. Exclusion and inclusion criteria are subject to periodic changes without advanced notice.

We delineate our world view into a set of macro themes to provide an efficient framework for focusing our research and the basis of profitable investment opportunities. We implement these themes through a focused set of strategies and can flexibly adjust portfolio exposures when the macro landscape and market environment are shifting. Risk4 awareness is central to the investment approach.

Source: J.P. Morgan Asset Management, as at 30.04.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. Not all investments are appropriate for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

4. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

What differentiates JPMorgan Global Macro Sustainable Fund?

Leverages the flagship macro strategies investment process, reflecting macro views through a portfolio of sustainable investments.

A daily-liquid alternatives strategy that seeks to deliver diversification5 benefits while striving for attractive risk-adjusted returns in varying market environments.

5. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

ESG Integration is the systematic inclusion of financially material ESG factors, alongside other relevant factors, in investment analysis and investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not by itself change this product’s investment objective, exclude specific types of companies or constrain its investable universe. This product is not designed for investors who are looking for a product that meets specific ESG goals or wish to screen out particular types of companies or investments, other than those required by any applicable law such as companies involved in the manufacture, production or supply of cluster munitions.