Why the big picture?

The JPMorgan Global Macro Opportunities Fund targets positive performance regardless of the market environment, investing in shares, bonds and other assets to build portfolio resilience.

![]()

Provided for illustrative purposes, subject to change from time to time not to be construed as investment recommendation or advice.

Why now?

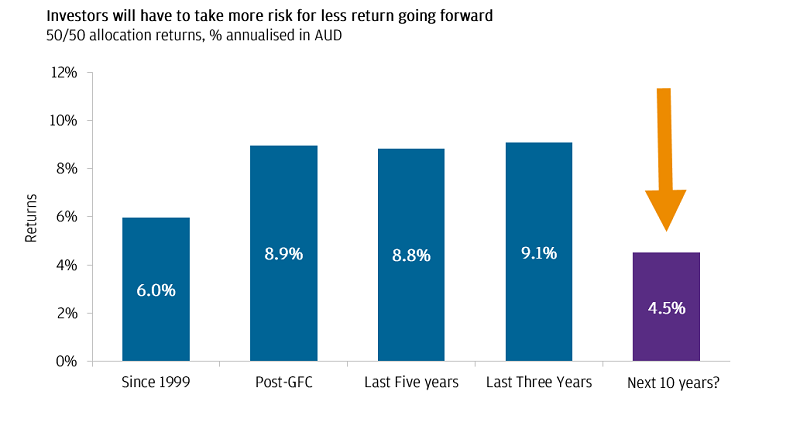

1. Return expectations for traditional assets have fallen

Long-term capital market assumptions have fallen in recent years, suggesting that returns will be much harder to generate from traditional assets over the next 10-15 years versus the last. To bridge this return gap, investors need to consider funds that are not reliant solely on market beta to drive returns.

Source: J.P. Morgan Asset Management, Bloomberg. Expectations are based on JPMAM’s Long-Term Capital Market Assumptions (LTCMA) for the relevant years. The indices used for the 50/50 allocation are: 50% MSCI All-Country World Index in AUD and 50% FTSE World Government Bond Index hedged to AUD. Data as at 30.11.2019 (updated annually). Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. Past performance and forecasts are not reliable indicators of current and future results.

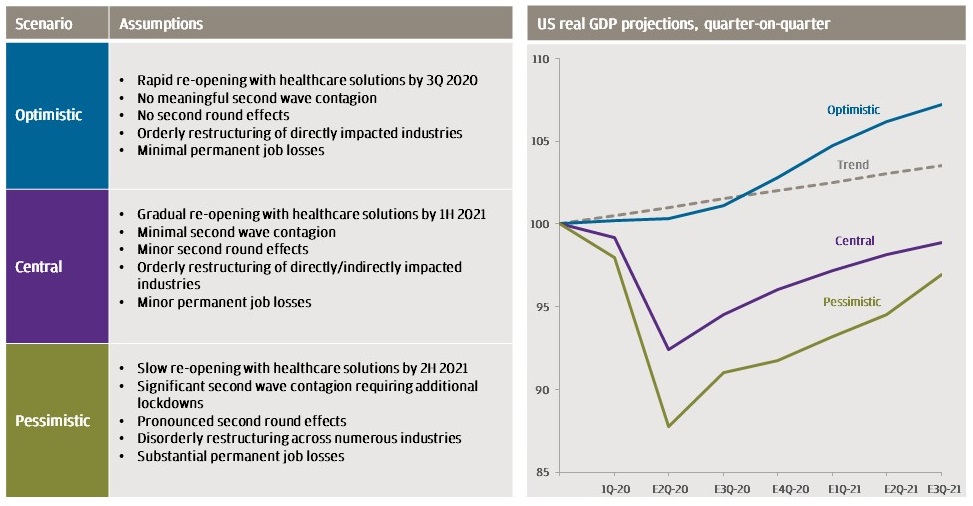

2. Flexibility in different market environments

The depth and breadth of the human and economic impact of the COVID-19 pandemic is still unfolding, and the speed and sustainability of the recovery remains quite uncertain. With a wide range of economic outcomes, we anticipate higher volatility in the months to come and continue to monitor high frequency activity data as economies re-open alongside continued support from policy globally. One of the Fund’s key characteristics that helps us to seek positive returns in different market environments is flexibility. We are able to quickly shift our positioning should the macro backdrop change, for example if we see a sustained strength in recovery or greater risks of rising cases of infection.

Source: Bloomberg, J.P. Morgan Asset Management as of 30.04.2020. GDP data based on 62 economic forecasts. Provided for information only, to illustrate various broad market trends not to be construed as research or investment advice. Forecasts or estimates are indicative, may or may not come to pass.

Why JPMorgan Global Macro Opportunities Fund?

The JPMorgan Global Macro Opportunities Fund is a multi-asset, unconstrained fund that is managed with a strong focus on risk with less than 10% expected realised volatility. In a client portfolio, the Fund can be:

![]()

Unconstrained by an asset-based benchmark

![]()

Not solely reliant on rising markets to generate return

![]()

Focused implementation helps boost return potential

![]()

Daily liquidity can improve profile of alternatives allocation

![]()

Lower cost than traditional macro hedge funds

![]()

Transparent and clear reporting of portfolio holdings

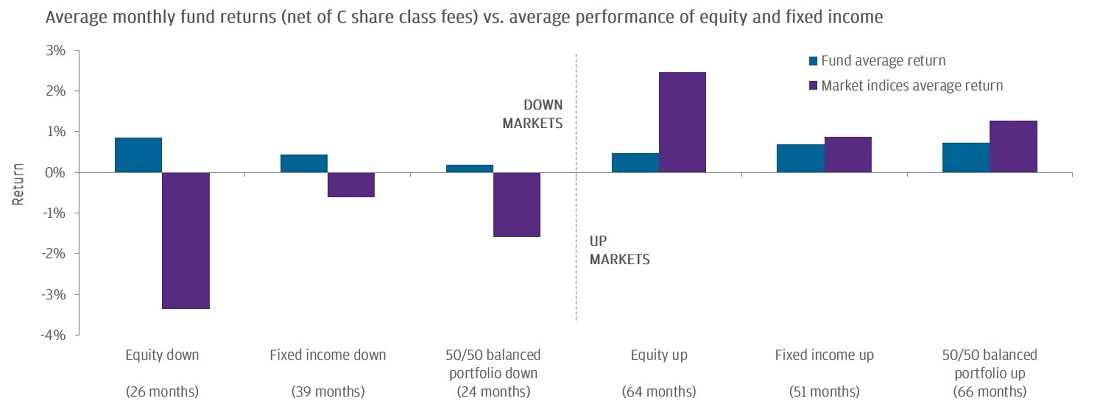

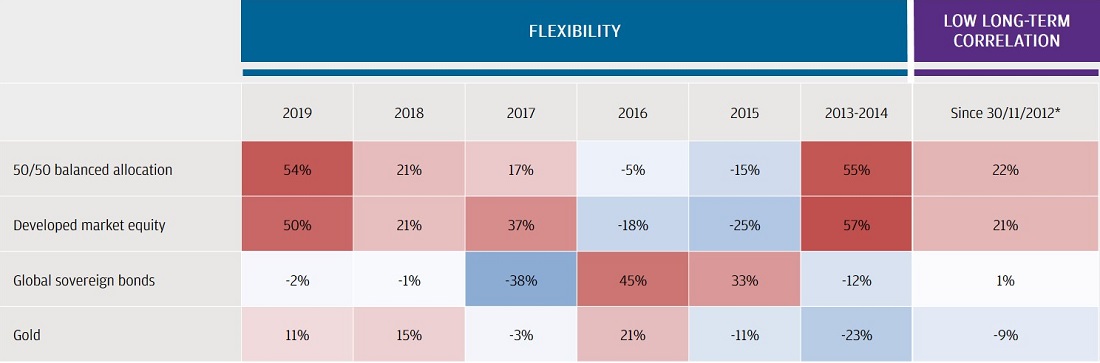

By employing a macro, focused and flexible investment approach, we draw on a broad opportunity set with long and short exposures, generating positive returns in up and down markets. This return profile is demonstrated in the chart, which shows our average returns versus the average for equity, fixed income and a balanced allocation.

Representative performance using JPMorgan Investment Funds – Global Macro Opportunities Fund (LUX SICAV^) from 30.11.2012 to 31.05.2020

Source: J.P. Morgan Asset Management. Fund performance is shown based on the NAV of the share class C (acc) in EUR with income (gross) reinvested including actual ongoing charges excluding any entry and exit fees. Indices do not include fees or operating expenses. *Since people and process change on 30.11.2012 when the internal investment process and team changed with no impact on Fund investment policy and objective. Indices used: for equity, MSCI World Index Daily Net Total Return hedged to EUR; and for fixed income, JPM Global Government Bond Index hedged EUR. Indices do not include fees or operating expenses. Representative performance for the SICAV fund which is managed by the same team using the same investment approach. Past performance is not a reliable indicator of current and future results.

^ The JPMorgan Funds - Global Macro Opportunities Fund is a specific portfolio within the JPMorgan Funds, an open-ended investment company organised under Luxembourg law as a societe anonyme qualifying as a SICAV and authorised under Part 1 of the Luxembourg law of 17.12.2010. The Australian registered JPMorgan Global Macro Opportunities Fund is a locally managed fund and the performance of the two funds will differ due to the impact of fees, taxes, currency fluctuations and other factors applicable to the Australian fund which are set out in its Product Disclosure Statement. Past performance is not indicative of future results and performance.

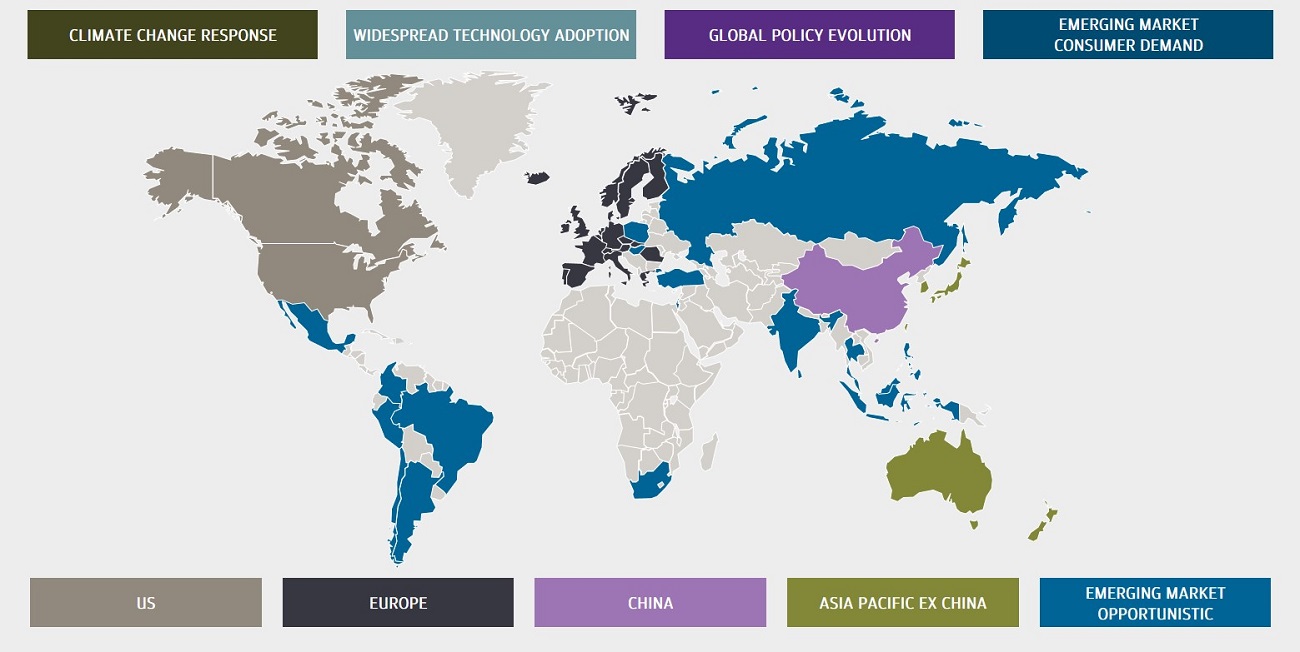

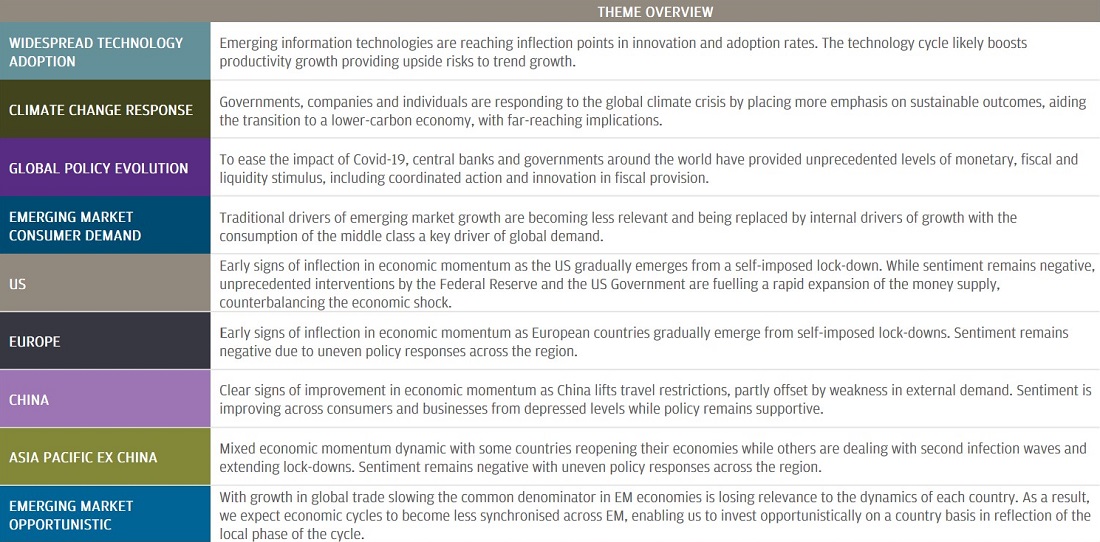

How we see the world?

The JPMorgan Global Macro Opportunities Fund seeks to exploit the inefficiencies in markets presented by the mispricing of macro trends and changes, which might be cyclical or secular in nature. We delineate our world view into a set of macro themes to provide an efficient framework for focusing our research and the basis of profitable investment opportunities. We implement these themes through a focused set of strategies and can flexibly adjust portfolio exposures when the macro landscape and market environment are shifting. Risk awareness is central to the investment approach.

Source: J.P. Morgan Asset Management, as at 31.05.2020. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

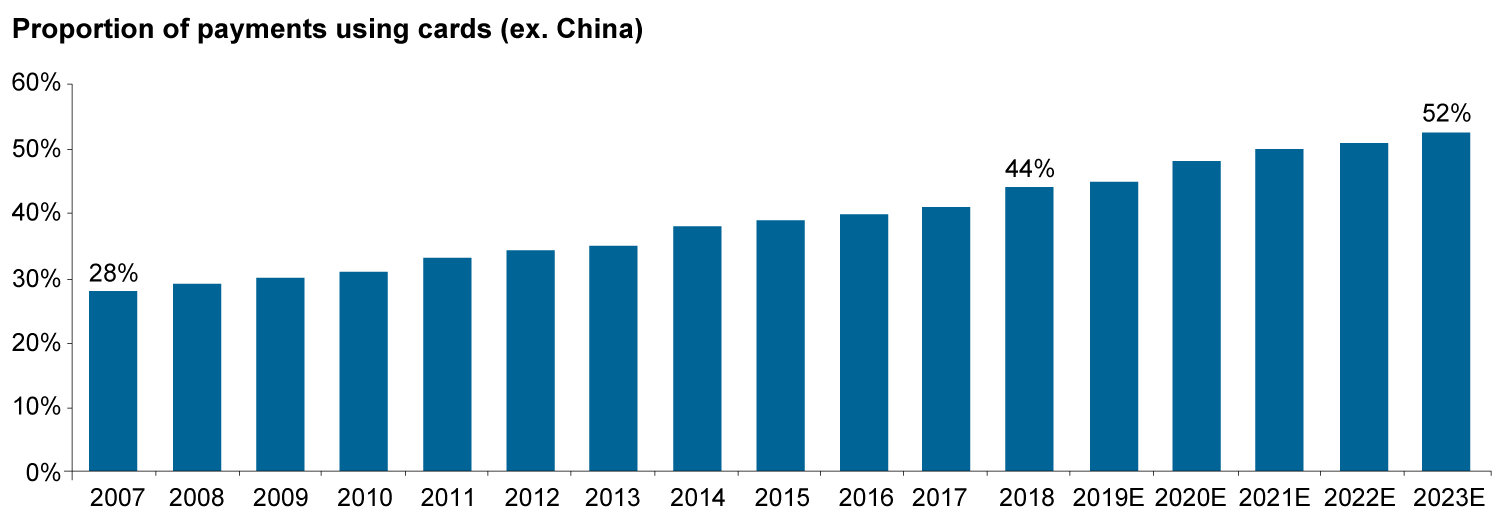

For example, the rapid development and widespread adoption of new technology is disrupting existing business models and creating opportunities, resulting in an environment of winners and losers. We are tapping into a number of trends and changes such as digital transformation, cloud computing and the increasing use of electronic payments, and are currently assessing what opportunities may arise from the advent of 5G.

Source: Bloomberg, J.P. Morgan Asset Management, Nilson, World Bank, IMF. Chart data as of 03.09.2019. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

In addition, demographic shifts and economic developments also carry global implications. Our strategy benefits from an unconstrained approach and is not reliant on rising markets to generate returns on your investment.

Source: J.P. Morgan Asset Management, as at 31.05.2020. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. Provided for information only, not to be construed as investment recommendation or advice. Investments involve risks, not all investment ideas are suitable for all investors.

How our macro themes and strategies are interlinked

Our team of macro investors draws on multiple asset classes to reflect their macro themes in focused investment strategies (involving multiple trades and securities) to deliver a high conviction portfolio.

Source: J.P. Morgan Asset Management, as at 31.03.2020. For illustrative purpose only. The Fund is an actively managed portfolio. Holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice.

Unconstrained, dynamic portfolio

We offer investors an unconstrained, dynamic portfolio that can invest across equities, fixed income and currencies with the ability to go long and short. As the macro landscape and direction of markets evolve, we can dynamically shift the JPMorgan Global Macro Opportunities Fund’s exposures, taking into account the correlations between asset classes.

With macro and markets evolving rapidly, investors need portfolios with the flexibility to navigate changes and generate return from different sources. The grid shows how the Fund’s correlation to different assets has varied over time as we have reflected our views in different strategies and, importantly, stayed low in the long term.

Source: J.P. Morgan Asset Management, as at 31.05.2020. Fund = JPMorgan Investment Funds – Global Macro Opportunities Fund. Fund correlation is based on the NAV of the share class C in EUR with income (gross) reinvested including actual ongoing charges excluding any entry and exit fees. Correlation data computed using weekly returns, Friday to Friday. Indices used for balanced allocation: 50% MSCI World Index:50% JPM GBI Index. *Since people and process change, 30.11.2012. In November 2012 the internal investment process and team changed with no impact on Fund investment policy and objective. Provided for information only, not to be construed as investment recommendation or advice. Investments involve risks, not all investment ideas are suitable for all investors. Past performance is not a reliable indicator of current and future results.

The JPMorgan Funds - Global Macro Opportunities Fund is a specific portfolio within the JPMorgan Funds, an open-ended investment company organised under Luxembourg law as a societe anonyme qualifying as a SICAV and authorised under Part 1 of the Luxembourg law of 17.12.2010. The Australian registered JPMorgan Global Macro Opportunities Fund is a locally managed fund and the performance of the two funds will differ due to the impact of fees, taxes, currency fluctuations and other factors applicable to the Australian fund which are set out in its Product Disclosure Statement. Past performance is not indicative of future results and performance.

Our Alternatives Investing Capabilities

290+

Investment Professionals^

US$ 144 billion

AUM*

14

Investment Offices Worldwide

Source: J.P. Morgan Asset Management as of 31.03.2020. ^ Includes portfolio managers, research analysts, traders and investment specialists with VP title and above. *AUM figures are representative of assets managed by the J.P. Morgan Global Alternatives group, and include some AUM managed by other J.P. Morgan Asset Management investment teams..

Our insights

With one of the longest track records in alternatives investing, the team has met and endeavours to continue to meet investor needs in different market conditions. We share our insights.