Why the big picture?

The JPMorgan Global Macro Opportunities Fund targets positive performance through varying market environments, investing in shares, bonds and other assets to build portfolio resilience.

How we see the world?

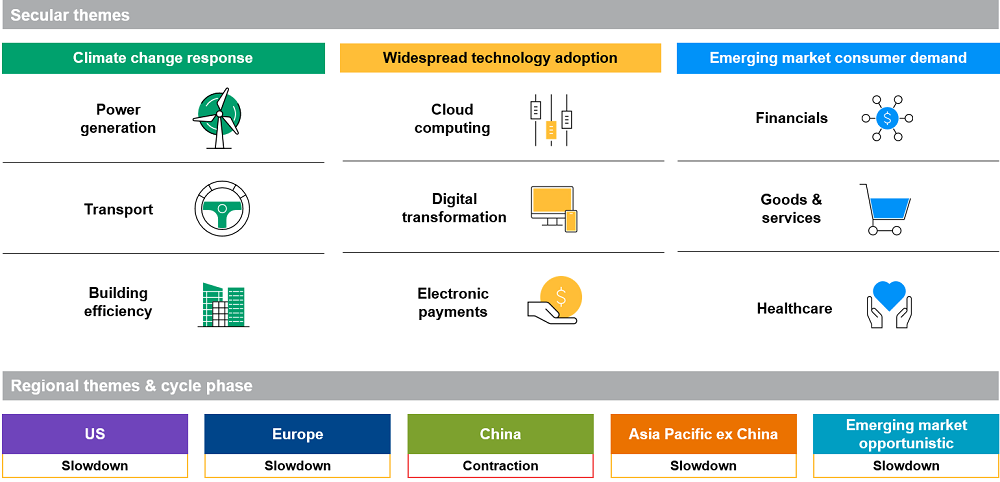

The JPMorgan Global Macro Opportunities Fund seeks to exploit the inefficiencies in markets presented by the mispricing of macro trends and changes, which might be cyclical or secular in nature.

We delineate our world view into a set of macro themes to provide an efficient framework for focusing our research and the basis of profitable investment opportunities. We implement these themes through a focused set of strategies and can flexibly adjust portfolio exposures when the macro landscape and market environment are shifting. Risk awareness is central to the investment approach.

Source: J.P. Morgan Asset Management, as at 10.01.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

Flexibility in different market environments

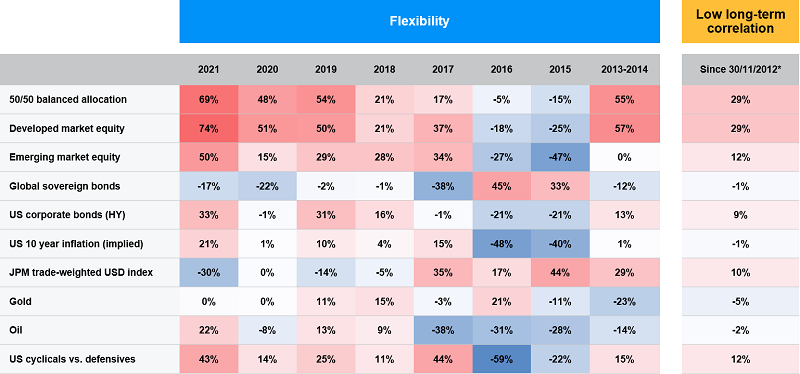

One of the Fund’s key characteristics that helps us to seek positive returns in different market environments is flexibility. We are able to quickly shift our positioning should the macro backdrop change, for example, heightened market volatility arising from geopolitical conflicts, or the impact of rising inflation and interest rates on investments.

The grid shows how the Fund’s correlation to different assets has varied over time as we have reflected our views in different strategies and, importantly, stayed low in the long term.

Flexible with low long-term correlation to traditional assets

Source: J.P. Morgan Asset Management, as at 31.01.2022. Fund = JPMorgan Investment Funds – Global Macro Opportunities Fund (SICAV). Representative fund correlation data using the Global Macro Opportunities Fund, which is managed by the same team using the same investment approach. Fund correlation is based on the NAV of the share class C in EUR with income (gross) reinvested including actual ongoing charges excluding any entry and exit fees. Correlation data computed using weekly returns, Friday to Friday. Indices used for balanced allocation: 50% MSCI World Index:50% JPM GBI Index. *Since people and process change, 30.11.2012. In November 2012, the internal investment process and team changed with no impact on Fund investment policy and objective. Past performance is not a reliable indicator of current and future results.

The JPMorgan Funds - Global Macro Opportunities Fund is a specific portfolio within the JPMorgan Funds, an open-ended investment company organised under Luxembourg law as a societe anonyme qualifying as a SICAV and authorised under Part 1 of the Luxembourg law of 17.12.2010. The Australian registered JPMorgan Global Macro Opportunities Fund is a locally managed fund and the performance of the two funds will differ due to the impact of fees, taxes, currency fluctuations and other factors applicable to the Australian fund which are set out in its Product Disclosure Statement and Target Market Determination (available from www.jpmorganam.com.au).

Nicola Rawlinson, Head of Investment Specialists, Macro Strategies, explains during an interview at The Inside Network’s Alternatives Symposium, how our liquid alternative strategies are designed to achieve specific client outcomes, and built to deliver a low long-term correlation to traditional asset classes.

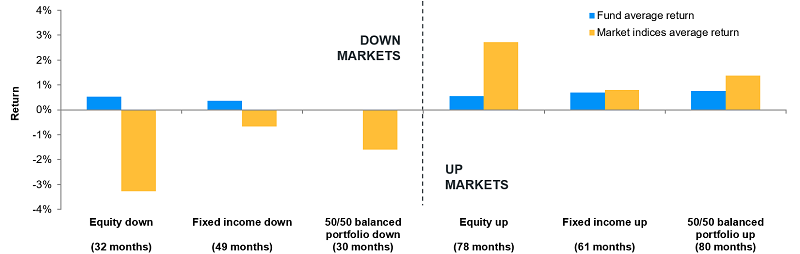

Delivering positive returns in varying market environments

In an environment in which long-term risk-adjusted return expectations have fallen across most traditional asset classes, the Fund stands for its proven ability to deliver positive returns in up and down markets on average.

Source: J.P. Morgan Asset Management. JPMorgan Investment Funds - Global Macro Opportunities Fund (SICAV) performance is shown based on the NAV of the share class C in EUR with income (gross) reinvested including actual ongoing charges excluding any entry and exit fees. Indices do not include fees or operating expenses. *Since people and process change on 30.11.2012 when the internal investment process and team changed with no impact on Fund investment policy and objective. Indices used: for equity, MSCI World Index Daily Net Total Return hedged to EUR; and for fixed income, JPM Global Government Bond Index hedged EUR. Indices do not include fees or operating expenses. Representative performance for the SICAV fund which is managed by the same team using the same investment approach. Past performance is not a reliable indicator of current and future results. Performance data from 30.11.2012 to 31.01.2022.

The JPMorgan Funds - Global Macro Opportunities Fund is a specific portfolio within the JPMorgan Funds, an open-ended investment company organised under Luxembourg law as a societe anonyme qualifying as a SICAV and authorised under Part 1 of the Luxembourg law of 17.12.2010. The Australian registered JPMorgan Global Macro Opportunities Fund is a locally managed fund and the performance of the two funds will differ due to the impact of fees, taxes, currency fluctuations and other factors applicable to the Australian fund which are set out in its Product Disclosure Statement and Target Market Determination (available from www.jpmorganam.com.au).

Our insights

With one of the longest track records in alternatives investing, the team has met and endeavours to continue to meet investor needs in different market conditions. We share our insights.