Private Credit Outlook

Creative destruction and market growth continue

12/01/2022

Meg McClellan

Leander Christofides

Brad Demong

Brian Coleman

Brian Van Elslander

Vincent Lu

Candace Chao

Whitney Wilcox

Ettie Philitas

Jason Hempel

Jonathan Segal

Jay DeWaltoff

One year ago, heading into the 2020–21 winter resurgence of COVID-19, we identified two themes to define the coming year for private credit. First, we believed temporary disruption would not mean value destruction. Second, we believed that defaults were delayed (not done).

Once prescient, these themes are now present. As consumers and investors continue to reinvent themselves, the economy – and the real estate and infrastructure that undergird it - are transforming to meet the needs of an ever-evolving “new normal.”

What does this mean for private credit investing? What were considered disruptive startup and early-stage companies two years ago have grown into middle market corporations that seek lenders to help finance their growth and acquisitions.

Real estate investing continues to transform, embracing greater work flexibility, data centers, infill and what appears to be an insatiable demand for online shopping and the distribution, storage and transport it requires.

Infrastructure investment is seizing opportunities in the accelerating transition from traditional energy to alternative fuels as consumers demand sustainability in goods, services and spaces.

We see growth in private credit supply and demand – and ample opportunity – ahead. On the supply side, borrowers continue to look to the private markets due to its relatively greater speed and certainty of execution, after many were burned by public markets and banks pulling back capital during more uncertain times. Equally, borrowers value the adaptability and partnership of private lenders, often the only – or the lead – investor in deals.

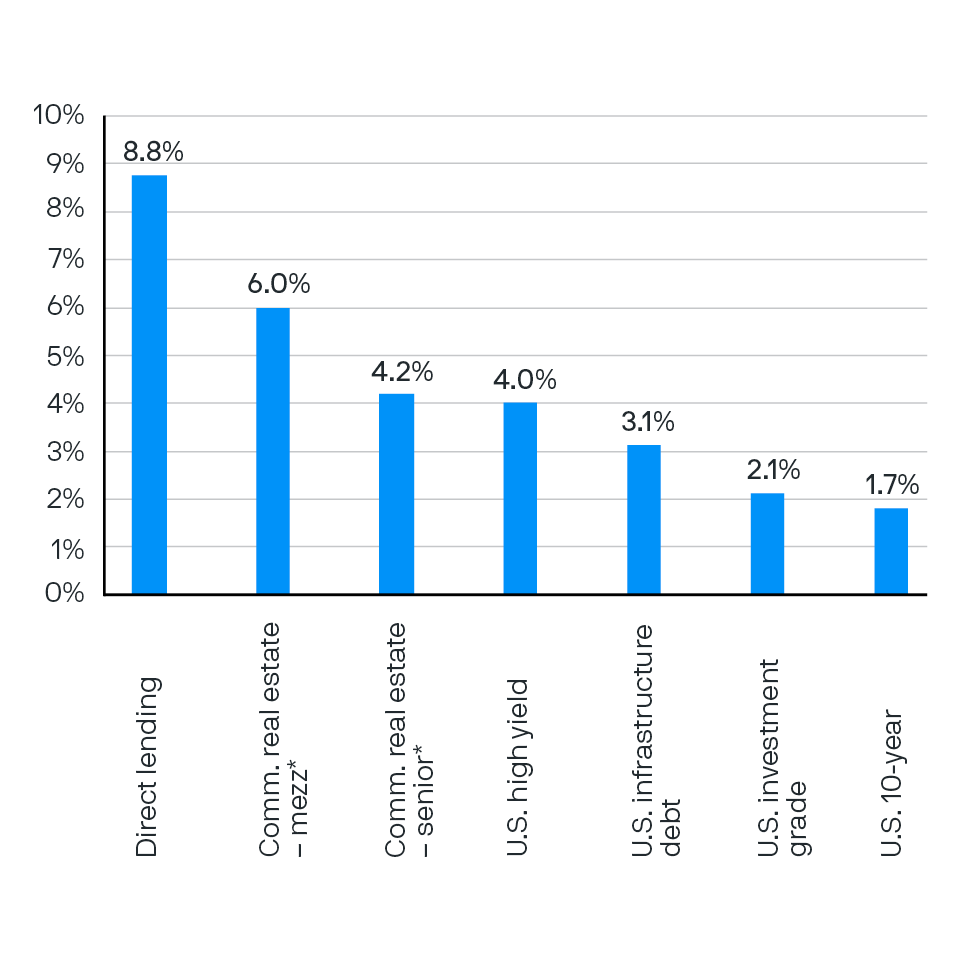

On the demand side, the global search for yield continues but today also includes a demand for assets that can hedge inflation and protect capital in still-unknown market environments. As a result, investors are increasing their allocations to private credit. It still offers relatively high spreads over public markets (Exhibit 1), covenants (lender protection), and floating rate or asset-based inflation protection, and it will likely continue to exhibit low volatility due to its less liquid nature.

As the global search for yield continues, investors are increasing their allocations to private credit, which still offers relatively high yields over public markets

Exhibit 1: Asset class yields (%)

Source: BofA Securities, Bloomberg, Clarkson, Cliffwater, Drewry Maritime Consultants, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, Wells Fargo, J.P. Morgan Asset Management. *Commercial real estate (CRE) yields are as of September 30, 2021. CRE – mezzanine yield is derived from a J.P. Morgan survey and U.S. Treasuries of a similar duration. CRE – senior yield is sourced from the Gilberto-Levy Performance Aggregate Index (unlevered); U.S. high yield: Bloomberg US Aggregate Credit - Corporate - High Yield; U.S. infrastructure debt: iBoxx USD Infrastructure Index capturing USD infrastructure debt bond issuance over USD 500 million; U.S. 10-year: Bloomberg U.S. 10-year Treasury yield; U.S. investment grade: Bloomberg U.S. Corporate Investment Grade.

Key drivers of our private credit investment outlook

Since the onset of the pandemic, many people have practiced social distancing to help prevent the spread of COVID-19. In the same vein, we find that distancing ourselves from already crowded credit markets can be highly effective and potentially offer investors significant value. Specifically within less crowded areas, we find attractive opportunities relating to the trends mentioned above. These include consumer demand shifts and sustainability, whether they’re expressed through real estate debt, infrastructure debt or corporate lending.

Performing credit

Almost universally, investors express concern about the direct lending market being saturated with private credit capital and the subsequent deterioration of spreads and lender protections (“covenant-lite”). Indeed, with the surge of investment capital, private credit lenders have shifted upmarket and now participate in billion dollar-plus megadeals. Banks are returning as lenders, though they are less active than historically. Moreover, we are seeing the growth of in-house insurance origination capabilities and competition for deals from the newly formed private credit arms of private equity sponsors.

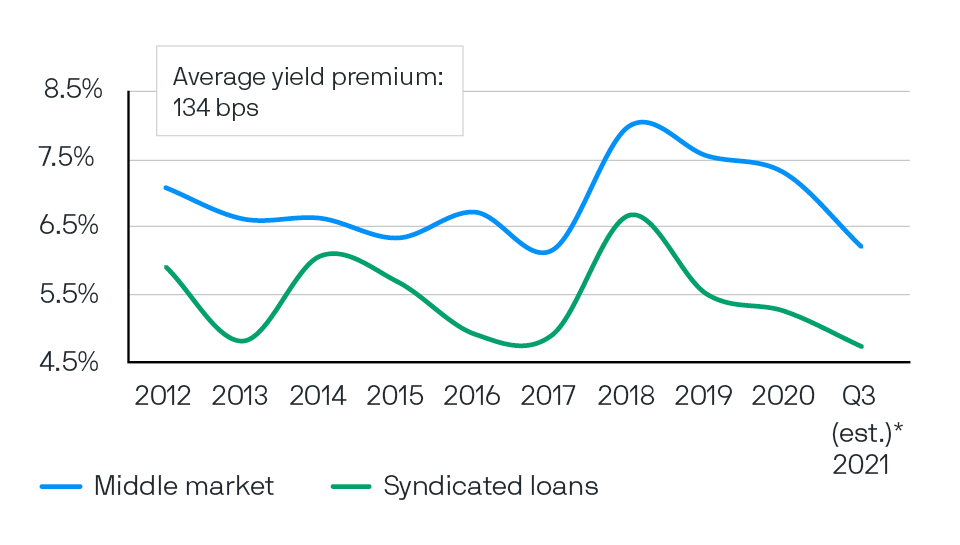

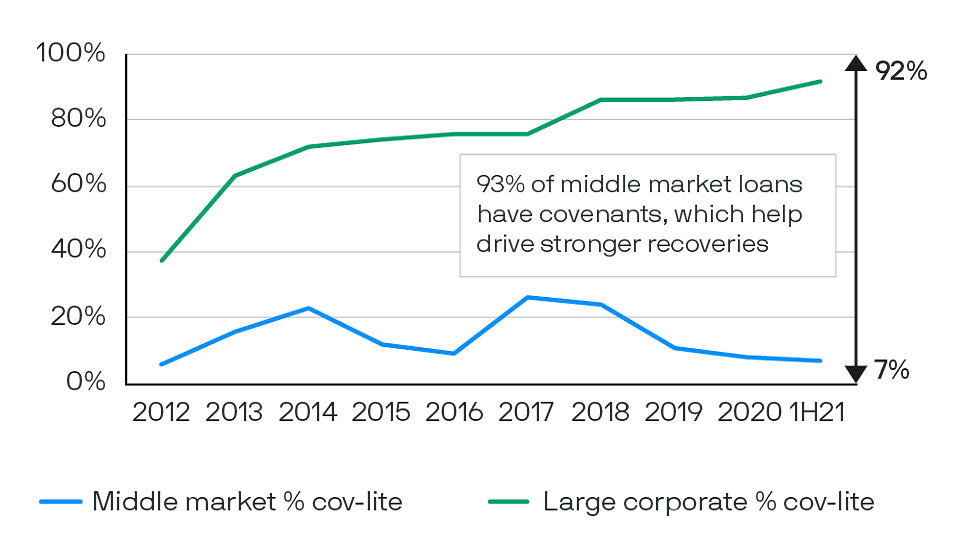

It is no surprise that at the large end of the market private credit has edged into the realm of investment banking syndicate desks. The demand for yield has driven spread compression and covenant reduction in loans to large middle market companies1 (Exhibit 2a and 2b). Spreads and terms in this segment of private credit markets have converged with public markets’ over the past 12 months, with investors seeking scale while syndicate desks look to defend their origination fees.

Greater competition from a wider range of private credit lenders has continued weakening covenants in loans to large middle market companies

Exhibit 2a: New issue yields

Exhibit 2b: Percentage of covenant-lite loans

Source: S&P LCD Quarterly Leverage Lending Review; data as of June 30, 2021, and U.S. Middle Market Stats Historical; data as of September 31, 2021.

Middle market: Syndicated loans for issuers with EBITDA less than or equal to USD 50 million. Syndicated loans: Loans for issuers with EBITDAof more than USD 50 million. Based on historical data. Average yield premium based on 2012–19 and 3Q 2021 data points (2020 data unavailable). Middle market % cov-lite represents sponsored and syndicated middle market loans. New issue yield for 3Q 2021 was estimatedby applying 2019 yield premium (204 basis points) to the 2020 syndicated loan data point.

In light of these dynamics, true core middle market companies – with USD 25 million to USD 75 million EBITDA – make up a less crowded niche that many of our investors prefer. We typically see better structures, pricing and terms in the core middle market than in the larger size, broadly syndicated sector.

Core middle market lending requires differentiated sourcing and access to deep networks, as well as a strong lending reputation. For lenders that meet those conditions, smaller core middle market lending opportunities allow for more flexibility, stronger structural protections and better financial covenants. This is where we are focused for the year ahead.

At the same time, we see opportunities to provide private capital market solutions to underfollowed small and mid-cap public companies, where there is less competition from traditional private credit lenders. The pipeline for new deals is at a historic high, and investors experienced in sourcing proprietary deal flow should be well positioned. It’s a diverse pipeline, both by sector and by geography. We continue to find meaningful opportunities, particularly in health care, which provides idiosyncratic return opportunities and defensive qualities.

Stressed, distressed and special situations investing

Over the next 12 to 18 months, we expect to see a unique deal pipeline within the special situations private credit space, stemming from the residual impacts of pandemic shutdowns on European businesses.

For the most part, larger European public companies have successfully refinanced, restructured or generally fared well during the pandemic. But an estimated 5 million small and medium-sized businesses have received European government-led, low interest unsecured loans and other subsidies totaling nearly USD 1 trillion, leaving many overlevered and facing the risk they may not survive. Because local court legal restructurings are complex, specialists often become capital solutions partners. Restructurings that succeed will likely need local knowledge, as well as legal and jurisdictional expertise.

Because these smaller and medium-sized enterprises’ highly levered balance sheets combine equity, senior debt, subordinated debt and now a layer of government debt – often with a senior claim – they are layered with complexity when these businesses run out of liquidity. As a result, the European government restructuring opportunity could be very large and take several years to remediate, providing deal flow well into the future.

Real estate debt

Strong fundamentals in multifamily and industrial sectors continue to drive above trend rental rate growth. Core senior commercial mortgage loans secured by these sectors look attractive compared to traditional high quality fixed income in a rising rate environment, providing investors with higher yields and collateral that is inflation hedged. The fundamental outlook for office is more challenging to decipher, and even though many paint the entire sector in a negative light, similar to what we’ve seen with retail, we believe that a physical presence is critical to corporate growth and culture. A simple but effective discipline is to “follow the jobs” and focus on class-A, transit-oriented properties in tech-centric markets. We anticipate higher risk premiums the office sector – especially for higher leverage loans – as traditional lenders remain cautious, creating opportunities for core mezzanine lending.

In the year to come, opportunities to lend against transitional properties should be plentiful. Demand, we believe, will come from owners looking to upgrade or redevelop. There may also be dislocation, and even distressed opportunities, caused by COVID-19 as low rates have allowed underperforming loans to remain current. For multifamily, we like the reversion story in large metropolitan areas as the recovery continues. For suburban markets, especially in the U.S. Sunbelt, the renovation strategy to drive further rent growth looks interesting. In select office markets, office-to-lab conversions make sense given strong life science fundamentals. We should also see more bridge loans on traditional offices in need of recapitalization.

A return of investment sales volumes to pre-pandemic levels and declining commercial mortgage delinquency rates drive better current income expectations in private commercial real estate debt compared with public fixed income of equal risk. Covenants should remain intact, creating the unusual benefit of higher returns with better structure in the near term.

Infrastructure debt investing

Global infrastructure3 investment needs are large and growing, and we are focused on capitalizing on these investment opportunities.

Senior secured infrastructure debt offers an attractive risk-adjusted income opportunity – commanding a premium over corporate investment grade borrowers, and with lower volatility and historically low annual default rates4. This asset class can also be inherently sustainable. Infrastructure assets provide essential services, contributing to the economic and social development of communities.

Within infrastructure debt investing, renewable energy and the energy transition to decarbonization should be fruitful investment areas as new government policies target net-zero carbon emissions by 2050. Battery storage, electric vehicle charging infrastructure and merchant renewable energy markets5 may be poised to benefit from additional tailwinds as companies seek to meet emission reduction targets and focus on sustainability efforts that will reduce reliance on (and eventually replace) fossil fuel energy.6

Infrastructure sectors directly impacted by COVID-19, such as digital infrastructure and health care-related assets, are also promising. For example, hyperscalers – large providers of cloud, networking and internet services at scale – have evolved into a subset of premier-tier counterparties involved in the buildout of digital infrastructure. Health care-related infrastructure assets, such as clinics, outpatient services, care facilities, laboratories and testing facilities, play a vital role in the health care system, and have a growing demand for investment capital.

Consumer credit

U.S. household debt hit a historic low before the pandemic. Substantial government stimulus then helped many households and consumers build up even stronger balance sheets, leaving household debt coverage ratios and credit card delinquencies at multi-decade lows. We believe that the U.S. is early in the consumer credit cycle and that consumers should remain in robust health for the foreseeable future. This opportunity may generate unlevered returns in the teens, in some instances.

Consumer credit investing, however, faces high barriers to entry due to its complexity and risk. Typically, exposure to U.S. consumer credit can be accessed through loans to consumers or by purchasing pools of existing or newly originated consumer receivables. To succeed, strong modeling, structuring and financing capabilities are required, along with the ability to minimize regulatory risk and borrower fraud. Consumer credit has a relatively short-weighted average life, is tightly covenanted and can be shut down at the first sign of a borrower’s credit deterioration, further demonstrating the importance of manager selection.

Conclusion

Risks to investing in today’s private credit markets broadly include inflation, increased competition and ongoing pandemic uncertainty. Navigating the continued evolution of private markets requires seasoned investors with differentiated sourcing advantages, expertise in fundamental analysis and a disciplined and consistent underwriting approach. This approach to investing, coupled with the floating rate nature of many private credit assets, should serve market participants well in the year ahead.

1 Companies with more than USD 250 million EBITDA.

2 Real estate where cash flows are expected to improve over the short to medium term.

3 Infrastructure assets provide essential services and are characterized by stable, long-term cash flows, often from contracts with premier-tier counterparties, including governments.

4 “Default and recovery rates for project finance bank loans, 1983–2019,” Moody’s Investor Service, March 2021 and “Infrastructure default and recovery rates, 1983-2019,” Moody’s Investor Service, October 2020.

5 Merchant energy markets are nonutility or independent power generation markets designed for operators to sell wholesale power into competitive marketplaces.

6 The energy transition is already well underway, as shown by the secular growth in electric vehicle adoption, which has led to global electric vehicle penetration of 12%, a historical high for new vehicle sales.