Alternatives outlook: Providing essential portfolio support

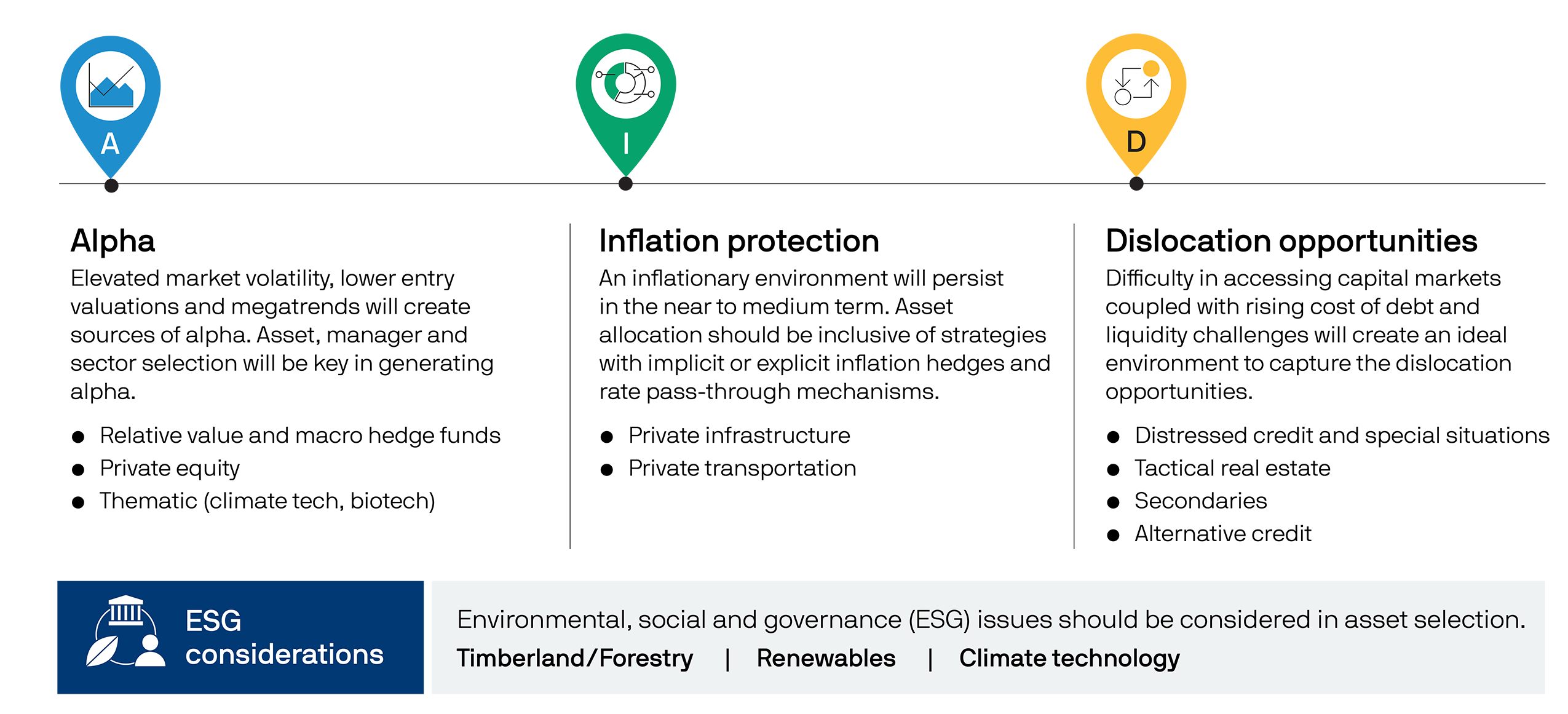

Alternatives can offer AID (alpha, inflation protection, dislocation opportunities) for the trek through 2023

13/01/2023

Jamie Kramer

Pulkit Sharma

Entering 2022, we encouraged investors to embrace hybrids – asset classes that exhibit characteristics of both fixed income and equity (examples include core real assets, hedge funds and special situations lending) – to navigate a changing investing environment. As the year unfolded, public markets suffered significant drawdowns and, unusually, public equities and fixed income were correlated to each other. Hybrids proved critical in delivering alpha, income and diversification. In a year of elevated market volatility, hybrids’ stable returns were especially attractive.

In prior publications, we discussed how alternatives can bring “AID” to the traditional asset portfolio in the form of alpha, income and diversification. We believe alternatives will continue to deliver on these outcomes over the long term. But as we look toward the forbidding terrain of 2023, we face new challenges: sticky inflation, higher interest rates and elevated volatility. In this environment, alternatives can provide the new essential AID that portfolios require: alpha, inflation protection and dislocation opportunities.

Thus armed, we can meet the opportunities and risks we are sure to encounter as we make the trek through 2023.

Alpha: Active portfolio design, hedge funds and private equity

Market volatility generally creates return dispersion and can serve as a vehicle for generating alpha. In this new environment, active management – through selecting investment categories, managers and assets – will be key to producing enhanced returns.

In the hedge fund space, strategies uncorrelated with traditional equity and fixed income investments, such as macro and relative value, seem best positioned to take advantage of alpha opportunities arising from market volatility. These strategies can operate across both geographies and asset classes, and are typically nimbler in terms of portfolio repositioning. This operational breadth may lead to outperformance vs. other hedge fund strategies.

In private equity, lower entry valuations and tailwinds from megatrends such as climate technology and biotech can be potential sources of alpha. Historically, private equity vintages tend to outperform coming out of a recessionary environment, suggesting that 2023 may be an ideal time to add to private equity.

Inflation protection: Infrastructure and transportation

As elevated inflation likely lingers through 2023, the case for allocating to alternatives becomes especially compelling, particularly for core real assets such as infrastructure and transportation. Typically, core real assets have implicit or explicit inflation hedges in place, which are generally applied with a modest time lag.

In infrastructure, an explicit inflation hedge might take the form of a utility’s embedded pass-through pricing mechanism, in which revenues adjust with inflation indices. Many regulated utilities in Europe and the UK operate with a link between their weighted-average cost of capital and their allowable return on equity, which allows corporate earnings to rise as inflation impacts a company’s cost of capital.

In transportation, an example of an implicit inflation hedge can be found in new leases, especially for liquefied natural gas (LNG) carriers, where asset values continue to benefit from pricing power via the ongoing energy crisis and the subsequent shift from fossil fuel to LNG. In addition, maritime transport assets are generally created using recyclable commodities (e.g., steel). Scrap values of those assets typically rise as commodity prices appreciate, which historically tracks closely with inflation.

Dislocation opportunities: Special situations, tactical real estate, secondaries and alternative credit

Diminished liquidity from nearly frozen capital markets, the rising cost of debt and overallocation to private markets from the “denominator effect”1 will likely push companies and investors to look to alternative lenders for liquidity solutions.

This should create opportunities in distressed credit and special situations lending, where lenders can provide rescue financing, acquiring the debt of high quality companies at attractive prices. Similar opportunities exist in tactical real estate, where managers can buy select assets from financially troubled owners at a discount.

As liquidity becomes harder to come by, the secondary market (buying preexisting private fund assets, called “secondaries”) looks to be well positioned. Secondaries can provide liquidity to the growing ranks of limited partners, such as pension funds and insurers, that are looking to rebalance their portfolios after alternatives grew and public assets shrank, exceeding their strategic target allocations. These mandated sales often come at a discount, potentially providing the purchaser with instant value capture.

Lastly, given a reduced volume of transactions in the real estate equity market, alternative credit providers (i.e., lenders) can step in, providing liquidity via commercial mortgage loans and mezzanine loans, at more favorable terms. Overall, active capital deployment will be key for managers to be able to capture value in these “dislocated” assets.

Long-term focus on ESG

For a successful trek through 2023, in our view, investors will also want to incorporate environmental, social and governance (ESG) factors into their investing decisions. As global policymakers and asset managers increasingly focus on ESG, it will become a critical consideration for investors as well. On the environmental front, opportunities in areas such as climate technology, timberland and renewable energy can offer direct exposure to the theme.

Conclusion

Alternatives have played a pivotal role in investors’ portfolios over the last decade by providing an uncorrelated source of alpha, income and diversification to traditional assets. Facing a rocky terrain of persistently rising consumer prices, higher interest rates and elevated market volatility in 2023, investors need sturdy active gear. With their ability to offer AID – alpha, inflation protection and dislocation opportunities – alternatives will be essential for the journey ahead.

1 Denominator effect refers to a scenario in which the value of one portion of the portfolio experiences a severe drawdown and other portfolio segments that did not experience a drawdown become overallocated in the overall portfolio.

09fk222712170706