Week in review

- China GDP for 1Q surprised on the upside at 5.3% y/y

- Japan core CPI softer at 2.6% y/y

- U.S. retail sales exceed expectations at 0.7% m/m

Week ahead

- U.S. preliminary PMI, durable goods orders, 1Q GDP

- Eurozone preliminary PMI

- Japan preliminary PMI

Thought of the week

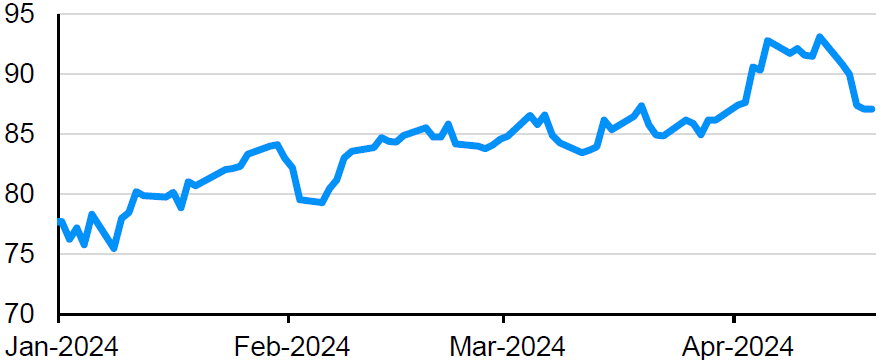

Events in the Middle East continue to cause jitters across markets the last few weeks. The concern is that current clashes in the region will escalate into full blown conflict involving multiple countries, disrupting production and shipping in the region. Oil price upheaval is a common result of such issues. Estimates put a geopolitical risk premium of about US$5-10 per barrel on crude oil, which could still move higher if the conflict widens. Brent oil breached US$90 per barrel in the lead up and immediate aftermath of Iran’s attack on Israel, before falling back down on reports that U.S. oil inventories were at a 9-month high. It spiked again on news of possible retaliation from Israel on Friday. Uncertainty adds to risk and has implications for the investment outlook. A rise in oil and energy prices complicates inflation issues and some worry that it could further delay central bank rate cuts due to spillover effects. Geopolitical tension tends to be unpredictable as tension rises and ebbs. Our usual view is that geopolitical headlines usually only have a short-term impact. Any negative market impact tends to recover quite quickly, but this will depend on the severity and size of events. Investors should still pay attention to oil prices as the war continues to evolve.

Oil prices have risen on geopolitical tensions

Brent crude oil, USD per barrel

Source: FactSet, Commodity Research Bureau, J.P. Morgan Asset Management. Data reflect most recently available as of 18/04/24.

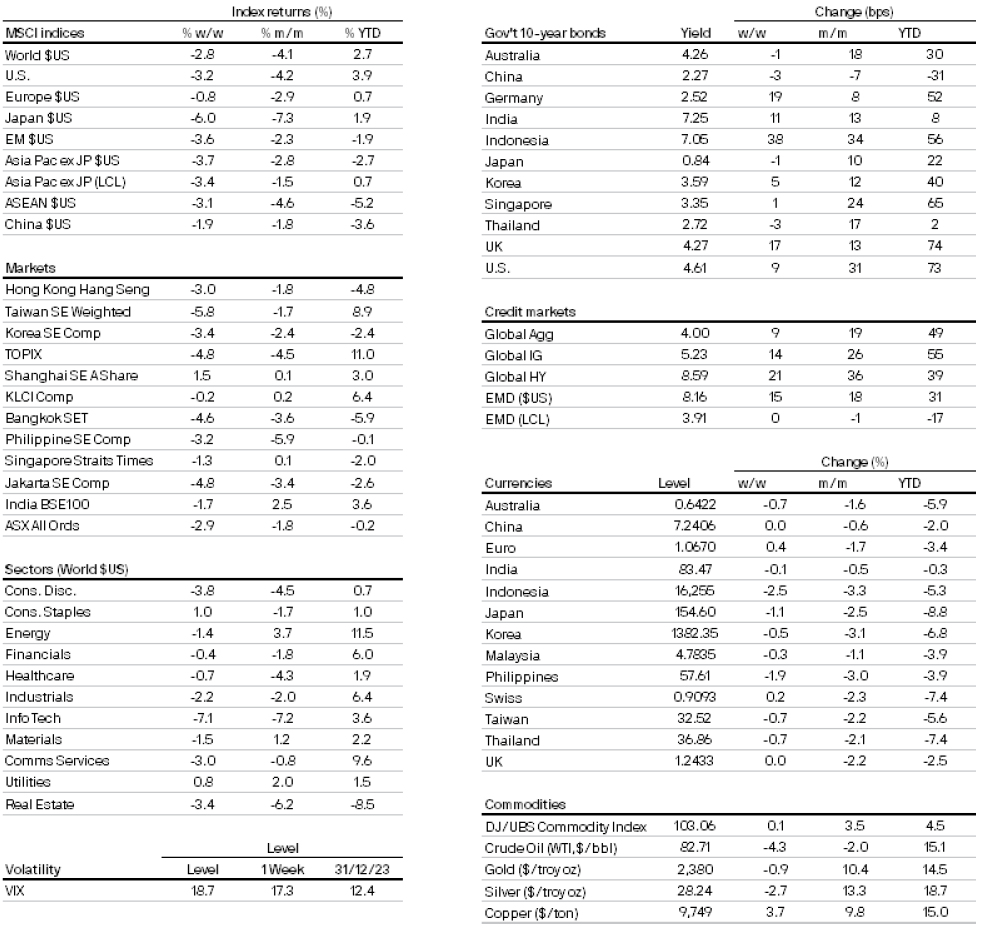

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.