Bonds: ready for prime time

With starting yields across many fixed income sectors hovering near decade highs, it could be opportune to lock in elevated yields as central banks approach the end of their rate hike cycles.

JPMorgan Income Fund harvests high-conviction ideas across the bond universe, covering both traditional and extended sectors, delivering a wider source of income.

The global bond market has grown to about US$132 trillion1 and presents a wide range of income sources. With flexibility across sectors and geographies, the Fund endeavours to generate consistent yield under different market conditions.

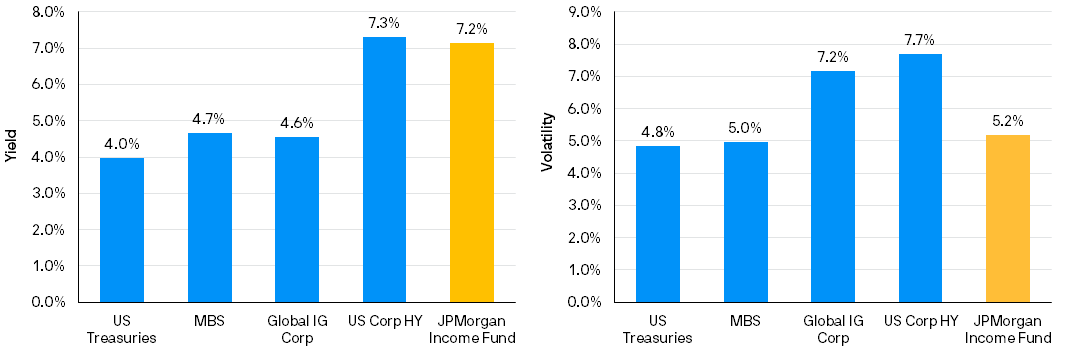

Seeking healthy yield with lower volatility than individual sectors2

^ The investment objective of the Fund is to provide income by investing primarily in debt securities. The Fund seeks to achieve its investment objectives stated in the offering document, there is no guarantee the objectives will be met.

* Diversification does not guarantee positive returns and does not eliminate risk of loss.

1 Source: J.P. Morgan Asset Management, Bank for International Settlements. Data reflect most recently available as of 30.06.2021.

2 Source: Barclays Live, J.P. Morgan Asset Management. MBS refers to mortgage-backed securities, Global IG Corp bonds refers to global investment-grade corporate bonds and US Corp HY refers to US corporate high-yield bonds. Volatility is realised annualised volatility based on monthly data since the inception of JPMorgan Income Fund. Indexes used are: Bloomberg Barclays Treasury Index, Bloomberg Barclays US MBS Index, Bloomberg Barclays Corporate Credit Index and Bloomberg Barclays US HY Index. The Fund seeks to achieve the stated objectives included in the offering documents. US Corporate High Yield is based on Yield to Worst. US Treasuries, Mortgage-Backed Securities (MBS) and Global Investment Grade (IG) Corporate is based on Yield to Maturity. JPMorgan Income Fund is based on Yield to Maturity of the underlying portfolio. Past performance is not necessarily a reliable indicator for current and future performance. Data as of 31.08.2024.

Past performance is not necessarily a reliable indicator for current and future performance. Past payout yields and payments do not represent future payout yields and payments. Positive distribution yield does not imply positive return. Dividend is not guaranteed. Please refer to further income disclosures on www.jpmorganam.com.sg.

Investments involve risks. Not all investments are suitable for all investors. Please seek financial advice before investing. Securities rated below investment grade are considered high-yield/below investment-grade. Although they might provide higher yields than higher-rated securities, they could carry risk.

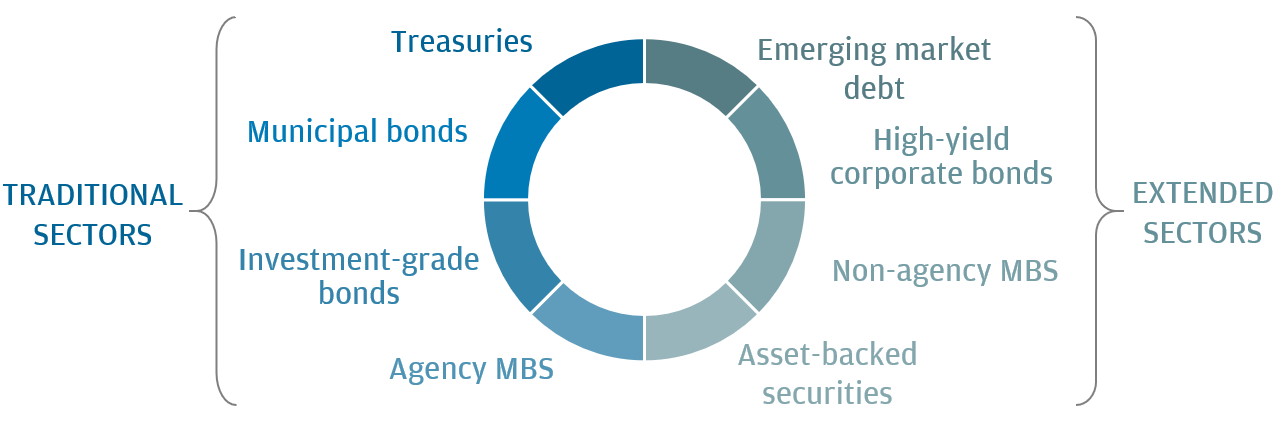

Striving to make portfolio income a viable outcome, the Fund seeks high-conviction ideas dynamically across both traditional and extended sectors to navigate changing market conditions.

A wide spectrum of fixed income sectors3

^ The investment objective of the Fund is to provide income by investing primarily in debt securities. The Fund seeks to achieve its investment objectives stated in the offering document, there is no guarantee the objectives will be met.

3 Source: J.P. Morgan Asset Management. MBS refers to mortgage-backed securities. This information is provided for illustrative purposes only. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as Investment recommendation.

The investment objective of the Fund is to provide income by investing primarily in debt securities. Past performance is not indicative of future results. Dividend distributions, if any, are not guaranteed and are made at the manager’s discretion. Positive yield does not imply positive return. The Fund seeks to achieve its investment objectives stated in the offering documents, there can be no guarantee the objectives will be met. Investors should review the fund offering document(s) before investing.

Investments involve risks. Not all investments are suitable for all investors. Please seek financial advice before investing, Securities rated below investment grade are considered high-yield/ below investment-grade. Although they might provide higher yields than higher rated securities, they could carry risk.

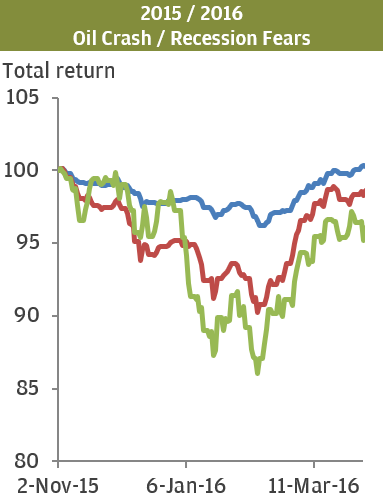

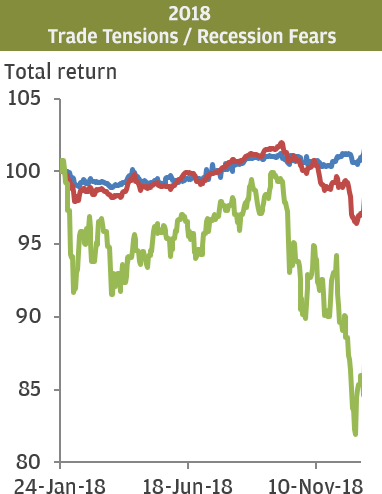

There are various types of bonds globally and they react differently as market conditions change. Diversification* by investing across multiple fixed income sectors could enable the Fund to stay resilient across different market conditions.

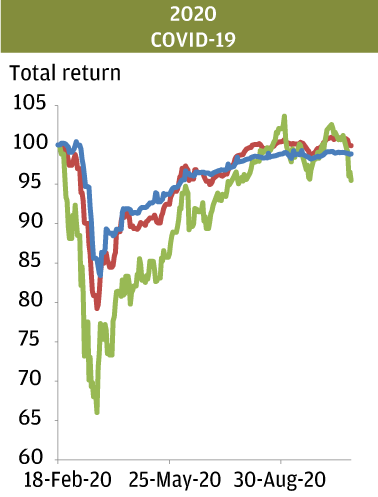

In times of uncertainty, the Fund had performed better compared with pure equities or pure high-yield bonds.

Seeking diversification* to achieve resilience amid volatility4

For full performance disclosures (including Charges Applied), please refer here.

^ The investment objective of the Fund is to provide income by investing primarily in debt securities. The Fund seeks to achieve its investment objectives stated in the offering document, there is no guarantee the objectives will be met.

* Diversification does not guarantee positive return or eliminate risk of loss.

4 Source: J.P. Morgan, Bloomberg. As at 31.10.2020.

The above is to illustrate the diversified fund portfolio vs a pure equity portfolio and High yield portfolio under specific market conditions. Benchmark for the Fund is Bloomberg Barclays US Aggregate Bond Index (Total Return Gross), please refer to the fund factsheet for performance summary.

Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not necessarily a reliable indicator for current and future performance.

Investments involve risks. Not all investments are suitable for all investors. Please seek financial advice before investing. Securities rated below investment grade are considered high- yield/ below investment-grade. Although they might provide higher yields than higher-rated securities, they could carry risk.

![]()

300+

Fixed income investment professionals5

Global research team with 70+ quantitative and fundamental research analysts

![]()

5

Locations worldwide

![]()

USD 783bn

Assets under management (AUM)6

Source: J.P. Morgan Asset Management as of 30.06.2024.

5. Includes portfolio managers, research analysts, traders and investment specialists with VP title and above.

6. AUM figures are representative of assets managed by the Global Fixed Income, Currency & Commodities group and include AUM managed on behalf of other J.P. Morgan Asset Management investment teams.

JPMorgan Income Fund is available at the following distributors: