Fixed income funds driven by global insight

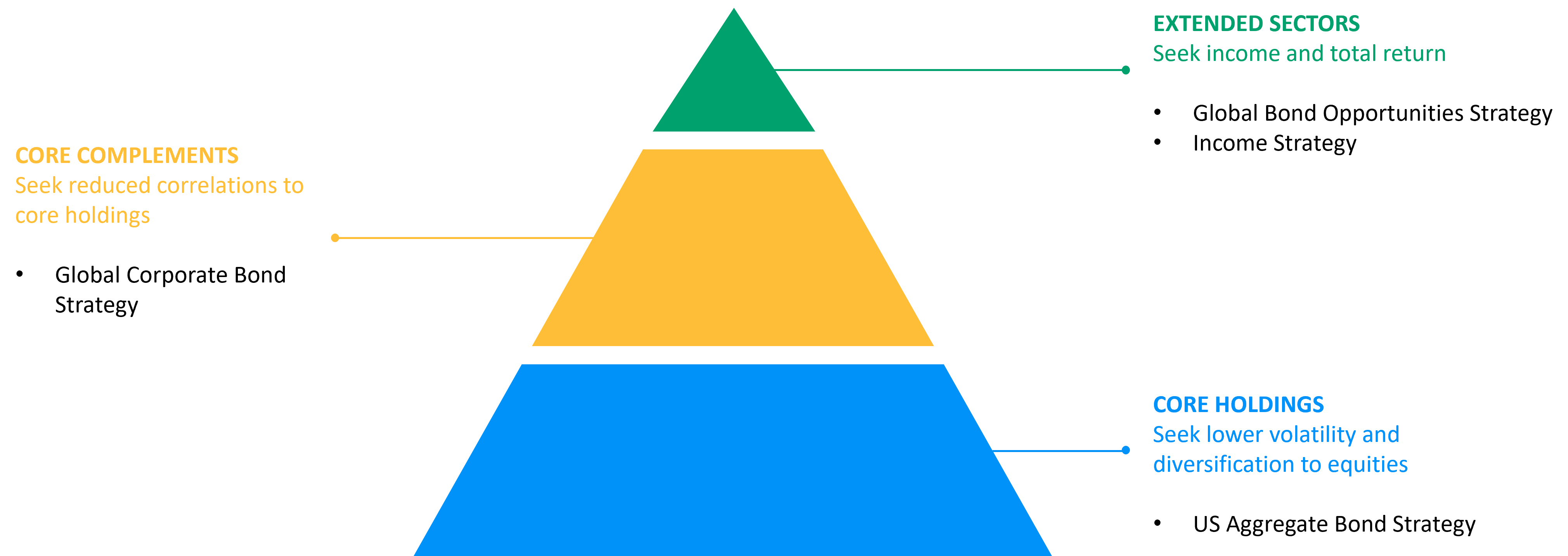

At J.P. Morgan Asset Management, our range of fixed income solutions spans the entire risk spectrum. Whether you are investing for income, looking to manage volatility or seeking a new source of return for portfolio diversification, our solutions provide the flexibility to help you achieve your goals.

As a leading active asset manager, we strive to deliver consistently attractive risk-adjusted returns from our fixed income portfolios, supported by a globally-integrated, research-driven investment approach.

Featured fixed income solutions

More fixed income solutions

J.P. Morgan Asset Management for fixed income

Benefit from the deep resources and rigorous research of a truly global fixed income manager, backed by a time-tested investment process where risk management1 is embedded at every level.

Awards & accolades

![]()

Asian Private Banker Asset Management Awards for Excellence 20245

House of the Year – Overall

Best Fund Provider - Global Bond

Best Fund Provider - Global Equity

Best Fund Provider - US Equity

AsianInvestor Asset Management Awards 20246

Asia Fund House of the Year - International

Fund House of the Year – Singapore

![]()

Refinitiv Lipper Fund Awards Singapore 20237

Best Fund over 5 years - Bond Global USD - JPM Income Fund A (acc) – USD

Best Fund over 5 years - Bond USD Hield Yield – JPM US High Yield Plus Bond A (mth) – USD

Best Fund over 5 years - Equity China – JPM China A-Share Opportunities A (acc) - RMB

Fixed income insights

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yields are not guaranteed. Positive yield does not imply positive return. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

* In actively managed assets deemed by J.P. Morgan Asset Management to be ESG integrated under our governance process, we systematically assess financially material ESG factors amongst other factors in our investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not change a strategy’s investment objective, exclude specific types of companies or constrain a strategy’s investable universe.

1. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

2. Source: J.P. Morgan Asset Management. As of 31.12.2024. Includes portfolio managers, research analysts, traders and investment specialists with VP title and above.

3. Source: J.P. Morgan Asset Management. As of 31.12.2024.

4. Source: J. P. Morgan Asset Management. Data as of 31.12.2024. AUM figures are representative of assets managed by the Global Fixed Income, Currency & Commodities group and include AUM managed on behalf of other J.P. Morgan Asset Management investment teams.

5. Asian Private Banker Asset Management Awards for Excellence are issued by Asian Private Banker in the year specified, reflecting product performance, business performance, service competency, branding and marketing as at the previous calendar year end.

6. The 2024 AsianInvestor Asset Management Awards are issued by AsianInvestor in the year specified, reflecting performance as at the previous calendar year end.

7. The Lipper Fund Awards Singapore 2019-2023 are issued by Lipper of Refinitiv in the year specified, reflecting performance as at the previous calendar year end.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investments involve risks. Investments are not similar or comparable to deposits. Past performance is not indicative of current or future performance and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Fund’s net asset value may likely have high volatility due to its investment policies or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class. Investors should make their own investigation or evaluation or seek independent advice prior to making any investment. Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details at https://am.jpmorgan.com/sg/en/asset-management/per/. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with https://am.jpmorgan.com/sg/en/asset-management/per/privacy-statement/. Issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.