Hedge Funds Outlook

With volatility rising, new opportunities emerge

12/01/2022

Jamie Kramer

Yazann Romahi

Shrenick Shah

Paul Zummo

Volatility will persist in 2022, giving rise to a shifting array of price dislocations and unexpected opportunities. After a year marked by rapid economic growth and positive market momentum, uncertainty has returned to markets, sparked by elevated – and possibly persistent – inflation, central banks’ resulting move to less accommodative monetary policy and renewed disruption from COVID-19.

Uncertainty may be the only certainty, but our hedge fund investors see significant opportunities for alpha generation as markets recalibrate for an ever more unpredictable future. Elevated levels of stock and factor dispersion, for example, are creating positive tailwinds for relative value and arbitrage strategies that focus on identifying price discrepancies among securities with similar characteristics. We also see strong growth and alpha opportunities in a diverse array of secular themes: innovation in biotechnology and cybersecurity, rising awareness of environmental sustainability, improving access to financial services (especially in emerging markets) and maturing corporate governance (particularly in Japan).

MARKET DISPERSION REFLECTS RISING VOLATILITY

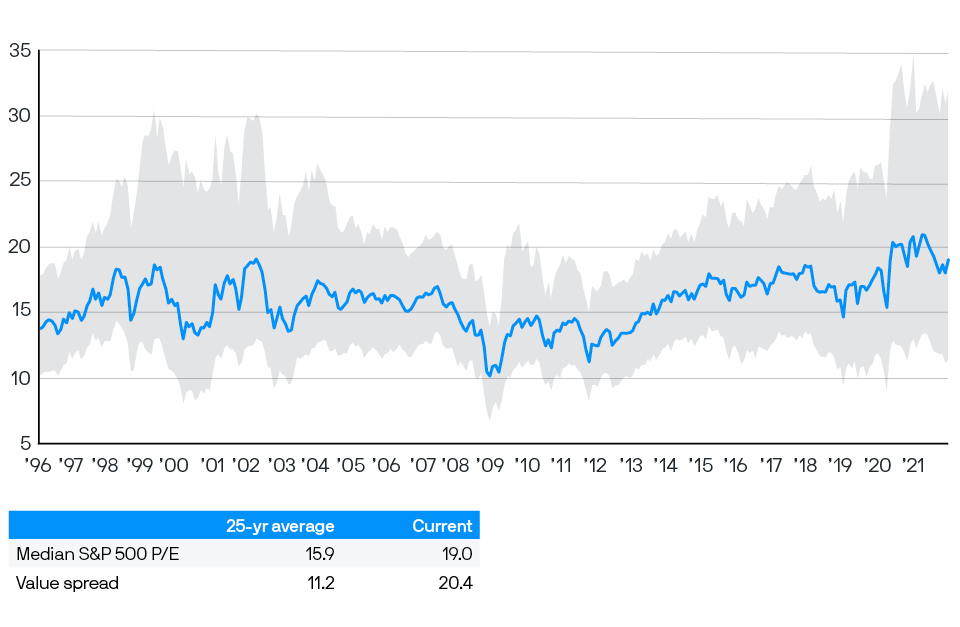

Although volatility has been more muted over the past year than it was in 2020, the VIX appears likely to settle in the top half of its pre-pandemic range of 10–20 in the coming 12 to 18 months, creating an attractive base for hedge fund strategies that benefit from elevated but not extreme volatility levels. Stock and factor dispersions are also historically high, creating significant trading opportunities. The level of valuation dispersion is approaching the range last seen in the dot-com bubble of 2001 (Exhibit 1).

Elevated volatility and high stock dispersion are creating favorable trading conditions for many hedge fund strategies in the current market

Exhibit 1: Median price-to-earnings ratio and valuation dispersion of stocks in the S&P 500 (January 1997–December 2021)

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management; data as of December 15, 2021.

Volatility in fixed income and currency markets has also begun to increase. Activity in mergers and acquisitions (M&A) was robust throughout 2021 and may continue as long as financing costs remain low in 2022. Although special-purpose acquisition company (SPAC) issuance declined in 2Q 2021, the sponsors of these investment trusts, which provide an efficient means for some companies to list shares, have started adjusting their terms as a way to incentivize greater participation in initial public offerings (IPOs).

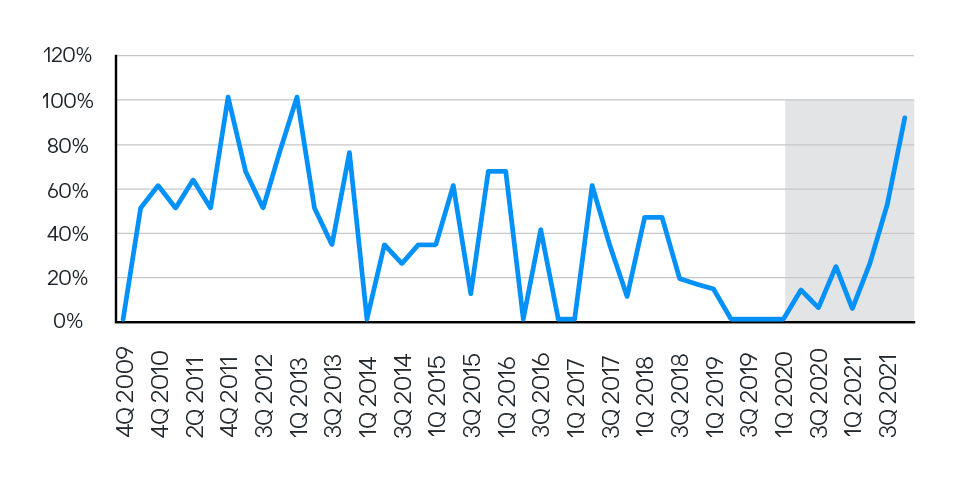

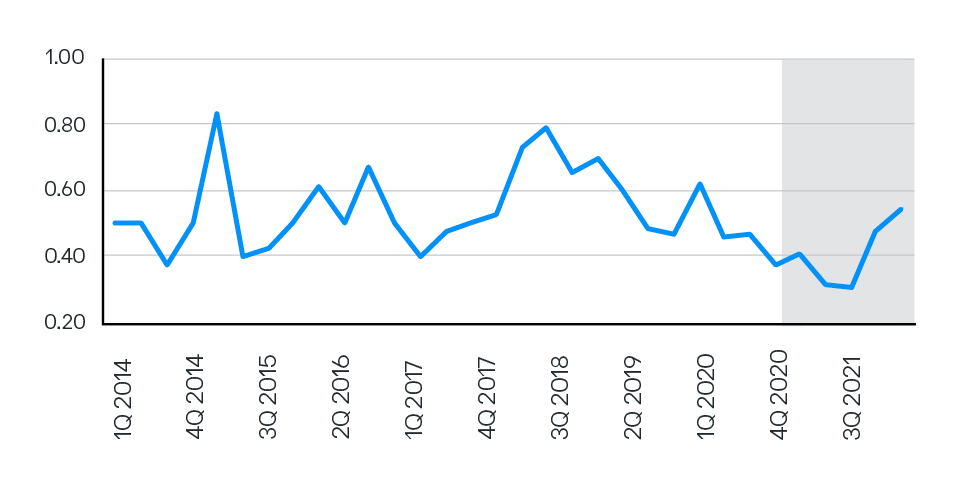

The power shift from sponsor to investor in the context of the SPAC investment dynamic creates more attractive opportunities, and by December 2021 we had already begun to see a pickup in SPAC IPO volume. Sponsors had begun routinely overfunding trusts by adding money on top of the gross proceeds raised for the SPAC and offering higher warrant coverage. The first trend effectively guaranteed that investors that redeemed shares would receive a return on their investment; the second enabled investors to get more warrants per share that they could exercise (Exhibits 2A and 2B).

Two recent trends in SPAC financing – the overfunding of trusts and extension of higher warrant coverage – have shifted greater investment benefits to SPAC owners

Exhibit 2A: Percentage of overfunded SPAC IPOs

Exhibit 2B: Industry-wide trend of rising warrant coverage (per unit)

Source: SPACInsider and J.P. Morgan Asset Management.

INFLATION AS A HEADWIND – OR A TRADING OPPORTUNITY

The specter of rising inflation, which hit a 30-year high in November 2021 in the U.S., is forcing a reckoning among asset owners: They are actively engaged in sector rotation with the prospect of inflation remaining higher for longer than many policymakers initially predicted. Although inflation poses a challenge for investors in the next 12 to 18 months, hedge fund managers, particularly those pursuing relative value strategies, could thrive. In an inflationary and rising rate environment, trading conditions become choppy and uncertain, and spreads widen, providing relative value strategies, among others, with more trading opportunities.

We see global macro managers, whose strategies often perform well in volatile periods, repositioning portfolios to take advantage of near-term opportunities in currencies, commodities and rates. Our hedge fund experts have also observed some openings to take a view on inflation as a theme in long-short equities as rising inflation exerts pressure on growth-oriented longer-duration names (whose valuations are more sensitive to rising rates) and provides more support for shorter-duration value-oriented stocks.

BREAKING AWAY FROM MARKET BETA

Relative value strategies are likely to benefit from high and persistent stock dispersion in 2022. We consider these strategies to be among the most protective in a rising rate environment, as they provide performance upside with low to mid single-digit volatility and are largely uncorrelated to equity and fixed income.

The relative value theme is also evident across a number of different substrategies, including convertible bond arbitrage and short-term statistical arbitrage. Managers in the latter space can turn over their books quite quickly (in less than 30 days) and exploit higher levels of volatility, which often create tradable micro-dislocations.

We consider equity capital market (ECM) strategies, which facilitate short-term trading in IPOs, block trades and flow-driven investments, as another form of relative value. Some hedge fund managers are buying IPO risk from investment banks (which are no longer able to hold it), hedging that risk and then liquidating it efficiently in the marketplace.

SECULAR THEMES: INNOVATION, SUSTAINABILITY AND GOVERNANCE

Although inflation is creating headwinds for some of the structural themes that we have been pursuing over the past year, a few of these sectors will be more resilient than others. Biotechnology is a theme that we continue to back, although it is arguably somewhat dislocated now – especially in smaller mid-cap names – given the prospect of rate increases in mid-2022. We believe it should continue to do well over the coming three-year period.

We are also strongly committed to the theme of sustainability, with a particular focus on carbon neutrality as a driver of corporate performance. We have begun building this data into our factor-based trading models because companies that are focused on achieving carbon neutrality will attract greater investment flows than industry laggards and may be better positioned to develop solutions for the coming transition to a greener economy. Positive fund flows, coupled with consumer demand and trends in regulation and technological innovation, make this idea our highest conviction position in sustainable investing.

This theme has also percolated through our macro funds, where we are investing in select companies that choose to reflect sustainable ideas, including sustainable electricity generation and energy efficiency in transport and building construction.

In long-short equity and activist strategies, we’ve been focused on corporate governance in Japan, which is edging forward. We have been concentrating on it for the past year and continue to believe that progress will be made as activist managers apply pressure, although the process moves very slowly.

One of the newest themes that we’ve begun to implement concerns technology solutions around cybersecurity, which is likely to prove extremely resilient, even in an inflationary world, because it’s a compelling structural growth story based on the rapid expansion of cloud computing. Investment flows continue to increase dramatically to the sector as the risks of data breaches get higher and higher, creating a opportunities for selective exposure to high growth companies.

Our macro funds are also engaging with this theme by investing directly in cloud computing providers, as well as software companies delivering services to firms moving to cloud-based business architecture as part of their ongoing digital transformation.

CONCLUSION

Hedge fund investors willing to pursue diverse and uncorrelated strategies are likely to find opportunities in a shifting array of near-term market dislocations and longer-term secular trends in 2022. The coming year, which appears destined to usher in a more nuanced period of change, holds the potential for significantly greater market volatility – a key enabler for hedge funds seeking to generate alpha. Beyond their ability to turn volatility into opportunity, hedge funds may also provide downside protection and strategic diversification in an era of pandemic-induced unease, making them a critical component of a well-diversified portfolio.