Week in review

- U.S. PCE index increased 2.8% YoY in November

- China 4Q GDP growth slowed to 4.5%

- China retail sales growth declined to 0.9% YoY in December

Week ahead

- U.S. PPI and Fed interest rate decision

- Japan Consumer Confidence

- China NBS Manufacturing PMI

Thought of the week

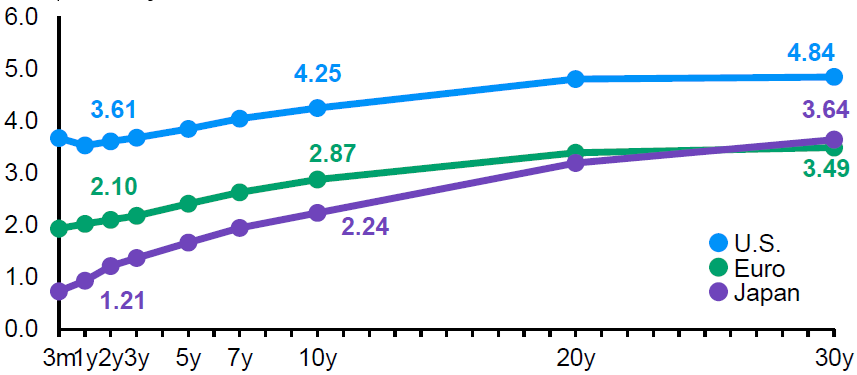

Japan's government bond market experienced a dramatic sell-off this week, with 10-year yields rising 19 basis points in two days and longer-dated bonds posting their biggest daily jump since 2003. The trigger was Prime Minister Takaichi's announcement of populist tax cut proposals ahead of the February 8th election, including suspending the consumption tax on food for two years and lowering gasoline taxes, all without a clear funding strategy. Markets are drawing uncomfortable parallels to the UK's 2022 bond market turmoil under former Prime Minister Liz Truss. While systemic risks appear contained given that Japanese banks maintain sufficient capital buffers and foreign ownership of JGBs remains limited, the sharp yield spike signals clear market concern about Japan's fiscal trajectory. Even in Japan's traditionally stable bond market, fiscal credibility matters, and continued volatility should be expected until the government clarifies how these tax cuts will be funded.

Treasury Yield Curves of the U.S., Japan and Europe

Yield, percentage

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 22/1/26.

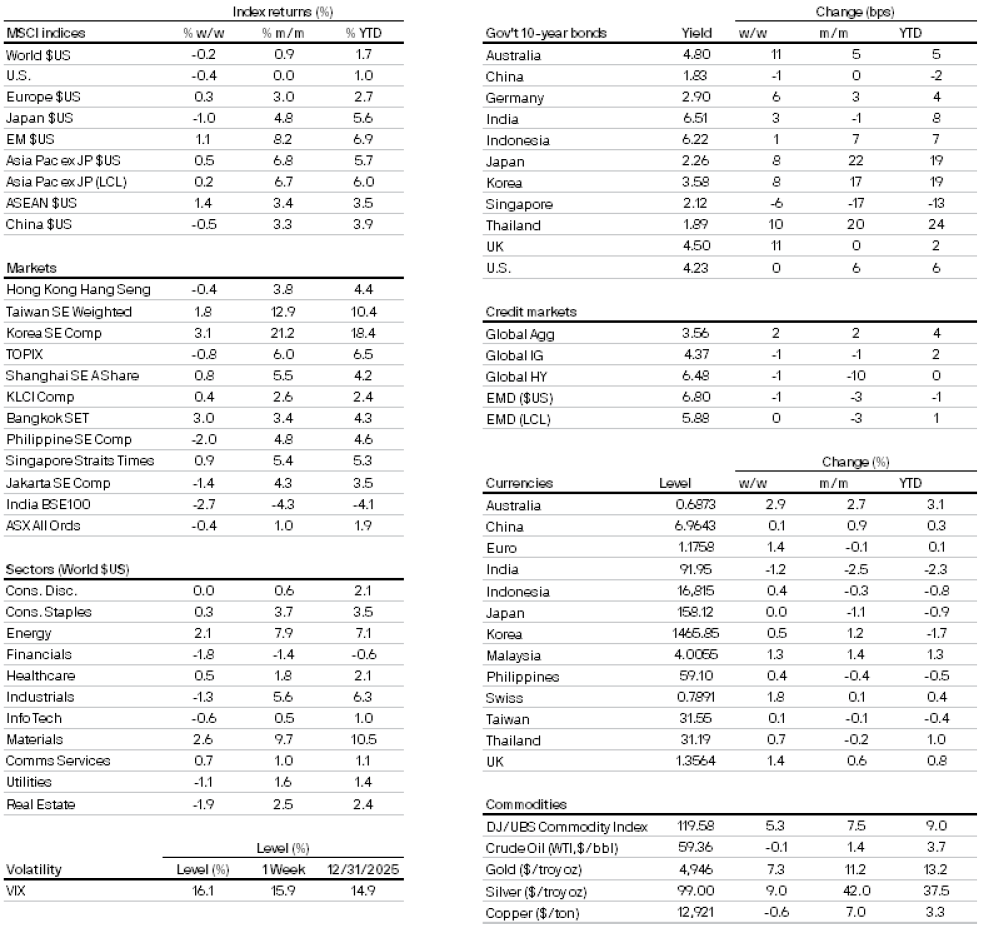

Market data

300a4900-f9d9-11e8-839f-fe2ee17e7f12

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.