When you know the facts, you’re one step closer to your retirement goals.

JPMorgan SmartRetirement® is built to withstand a range of market cycles and conditions. Two decades of research and the behavioral data of millions of participants fuel our investment decisions, which helps more people cross the retirement finish line.

RESEARCH FUELS OUR INVESTMENT DECISIONS

Two decades of research and the behavioral data of millions of participants fuel our investment decisions, which helps more people cross the retirement finish line.

FACT: 10% of participants over age 59 ½ withdraw, on average 55% of their assets

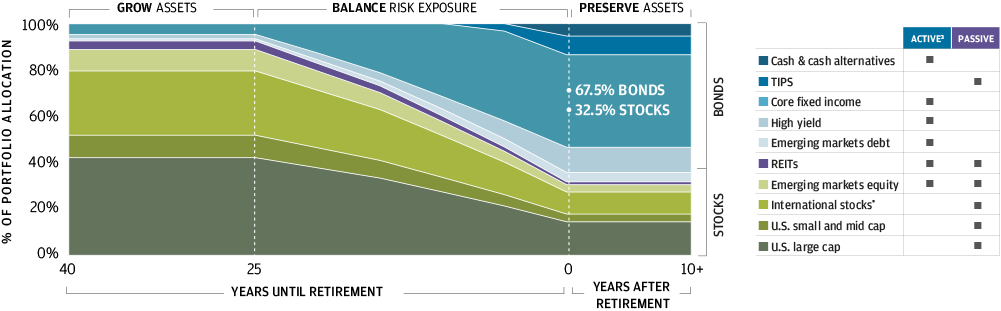

We maintain a lower risk profile near retirement to protect against market volatility

FACT: 72% of participants are no longer in the plan 3 years into retirement

Our glide path is static at and post retirement to account for high levels of cash flow volatility

FACT: 19% of participants borrow on average, of 20% of their 401(k)

Our volatility controls helps manage the amplifying impact borrowing has on individuals’ long-term success

Our balanced approach to risk management focuses on growth early-on, then shifts to savings retention before and during retirement