Diversify your hedge: The benefits of more diversification in a liability-driven investment strategy

By Jared Gross, Head of Institutional Portfolio Strategy

IN BRIEF:

- The current environment has revealed some shortcomings of a traditional liability-driven investment (LDI) strategy.

- The reliance on concentrated portfolios of long-dated corporate bonds and Treasuries leaves future performance vulnerable to downgrade and default risk, with limited capacity for diversification and low potential returns overall.

- Adding diversifying assets to the LDI portfolio may allow plans to reduce credit risk concentration and improve returns, all while maintaining an effective hedging program.

- Long-duration securitized assets provide a valuable “third leg” for the LDI portfolio, offering higher returns than Treasuries, lower risk than corporate bonds and more effective rebalancing of portfolios across time.

LDI is not a diversified strategy—by design

Investors have long recognized that diversification of the strategic asset allocation is essential. However, when it comes to their hedge portfolios, they have been willing to accept concentrated risk on the asset side of the balance sheet because it hedges a concentrated risk on the liability side. If the key drivers of liability value are interest rates and credit spreads, then a portfolio concentrated in precisely those risk factors should be the most effective hedge.

But in giving up diversification with the intention of achieving a more precise hedge, have investors traded away something of great value to the portfolio? Quite possibly yes. In today’s environment, the degree of credit risk exposure in the LDI portfolio is high while the diversifying benefits of Treasuries are low. There is an opportunity to improve credit quality, increase returns and manage risk more effectively by adding high quality long-duration securitized assets to the hedge strategy.

How well do you really know your liabilities?

The most carefully designed hedge portfolio sits at the end of a long chain of risks stretching far into the future—only some of which are actually being hedged:

- The future benefit payments themselves are unknown at present.

- The actuarial techniques used to estimate future benefit payments make broad assumptions about behavioral, demographic and economic factors—including longevity—that may be imprecise.

- Discounting estimated future cash flows to a present value requires constructing yield curves that make compromises with respect to the corporate bond market.

- The market benchmarks chosen as proxies for the liabilities all pose challenges of real-world portfolio construction.

- The portfolios built to represent these benchmarks contain tracking errors, both voluntary (alpha seeking) and involuntary (downward credit migration).

In sum, seeking to minimize tracking error to a target that is itself uncertain may provide a false sense of security. But rather than ignoring the complexity of the relationship between the assets and liabilities, investors can take advantage of it by diversifying their portfolios. In doing so, they can meaningfully improve their portfolios in terms of credit quality, return potential and rebalancing flexibility, with very limited risk in terms of measured tracking error.

Cracks in the foundation?

As noted above, many liability-hedging portfolios are highly concentrated in long-maturity corporate bonds and, to a lesser extent, Treasuries. Since the global financial crisis, two powerful tailwinds have supported this strategy: First, a benign corporate credit environment with robust primary issuance, adequate secondary market liquidity and limited downgrade and default risk has supported corporate bond performance. Second, broadly declining interest rates have helped increase returns on otherwise low yielding Treasury holdings.

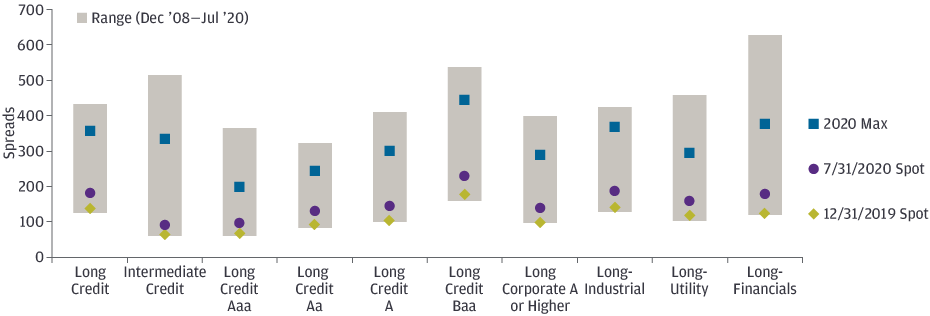

EXHIBIT 1A and 1B: Spreads are wider year-to-date but have retraced much of the widening

Exhibit 1A: Current spreads vs. long-term range

Exhibit 1B: U.S. 30-year Treasury yield, August 2000–August 2020

Source: J.P. Morgan Asset Management, Bloomberg, Barclays; data as of August 31, 2020.

Unsurprisingly, allocations to long-maturity corporate bonds and Treasuries have increased. Hedge portfolios have become a larger portion of plan assets and more concentrated in the long corporate sector. This raises concerns about the scale of the risk exposure and the lack of risk diversification, for two main reasons:

- Interest rates are at historic lows across the curve. While this has allowed the Treasury allocation to outperform, it also makes it less likely that future performance will be as positive. And to the extent that Treasuries are held for risk diversification purposes, their limited potential for future price gains makes them a less effective protector of portfolio value. One response might be to reduce Treasuries in favor of more corporate credit, effectively cashing in on recent outperformance and rebalancing back toward the more straightforward hedge asset. But rebalancing in this manner would serve to reduce portfolio diversification even further.

- Concentrated holdings in long-term corporate bonds bear key risks that are not embedded in the liability. Specifically, the exposure to loss of value and permanent capital impairment from downgrades and defaults could impact an investor’s portfolio with no corresponding decline in the value of the liability. The most common defense against this risk is to rely on active managers’ ability to identify credit risk early and steer the portfolio elsewhere. Beyond that, the alpha generation of active managers can help offset those losses that do occur.

But we recommend going further and introducing diversifying assets that deliver key hedging attributes while avoiding added portfolio concentration. To do so, investors will need to identify a source of high quality liquid fixed income, with yields in excess of Treasuries’, allowing pension funds to better manage risk and return in this environment.

The answer is hiding in plain sight...

It wasn’t so long ago that pension funds owned large allocations to mortgages and other securitized assets, mainly through core bond allocations benchmarked to the Barclays Aggregate Bond Index. This sector represents an exceptionally deep and liquid pool of high quality bonds, which ought to be a natural holding for large fixed income investors. However, there is one key problem: Mortgages and securitized assets generally exhibit low duration and negative convexity, which make them challenging to incorporate into a long-duration portfolio. Over the past decade, as pension plans have been migrating from traditional core benchmarks to long duration, they have turned their back on this asset class entirely.

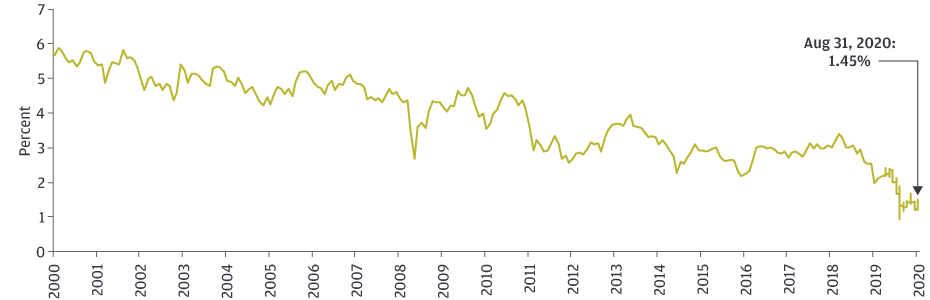

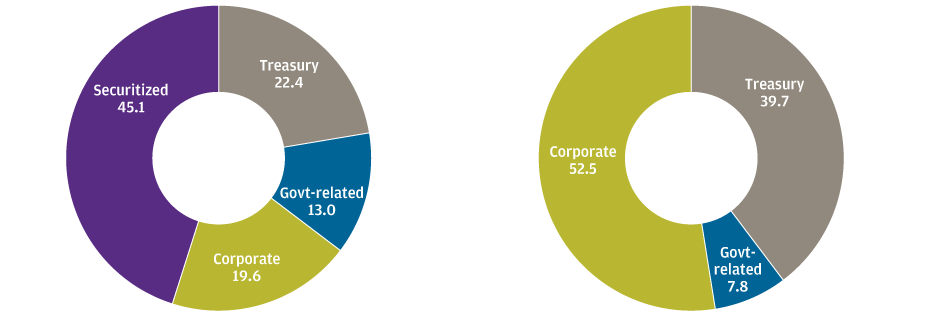

EXHIBIT 2: What happened to securitized allocations? As pension plans extended duration, they left behind a large portion of the U.S. fixed income market.

US Aggregate Index, December 2007; US Long Government/Credit Index, August 2020

Source: J.P. Morgan Asset Management, Barclays Live; data as of August 31, 2020. For illustrative purposes only.

This turn away from mortgages and securitized assets should be reconsidered.

Significant portions of the securitized asset class are long duration and could easily be considered part of the natural hedge portfolio opportunity set. In fact, many active long-duration portfolios already make use of these instruments as out-of-benchmark exposures that provide diversification and alpha potential relative to core holdings in credit and Treasuries. Using these assets as a stand-alone component of the LDI strategy is straightforward. The addition of interest rate derivatives, such as Treasury futures, would allow for the extension of duration to specific benchmark targets, facilitating the use of long securitized assets in broader hedge portfolios.

Adding a strategic holding in long securitized assets

Securitized assets improve the opportunity set for LDI hedge portfolio construction in three ways:

- They reduce reliance on corporate credit when risks are high and portfolios have grown concentrated. Much of the long securitized opportunity set consists of securities that feature credit support from government-sponsored enterprises, providing an AAA rating and effectively removing the risk of default.

- They offer a high quality, higher yielding alternative to Treasuries. Long securitized assets maintain a consistent yield spread advantage over Treasuries across time while providing similar portfolio diversification benefits.

- They could allow portfolios to rebalance more effectively during periods of volatility. The value of being able to rotate from a relatively rich asset to a relatively cheap one is widely understood. Within typical LDI portfolios, this flexibility can only be deployed in one dimension—between corporate bonds and Treasuries. The addition of long securitized assets as a third portfolio component can allow greater flexibility as market conditions change.

The benefits of diversification in an LDI strategy

The strategic risk management benefits of traditional liability-hedging strategies are significant, but the benchmarks and portfolios we select for this purpose are approximations of the liability, not the liability itself. Highly concentrated portfolios of long corporate bonds and Treasuries bear real-world risks that should be recognized. With the addition of long securitized portfolios, we have the opportunity to introduce a high quality, liquid asset class that provides key hedging characteristics while improving performance across time. As we look at the current market and consider where we may go from here, this flexibility should prove very valuable indeed.

Be the first to get the in-depth analyses for this series

Explore four themes that can lead to incremental benefits over the short-term and together can transform asset allocation over the long-term.