Listen to On the Minds of Investors

The balance sheet of the U.S. Federal Reserve (Fed) has increased by 2.9 trillion USD since the start of March, meaning that in just over eleven weeks it has grown more than it did in the five years following the Financial Crisis. Such a dramatic loosening of monetary policy has led investors to worry about the potential for inflation in the years ahead. History is littered with examples of countries who have turned to the printing press during times of distress and the end result is typically inflation or even hyper-inflation. However, this time around expansionary monetary policy may not result in runaway inflation.

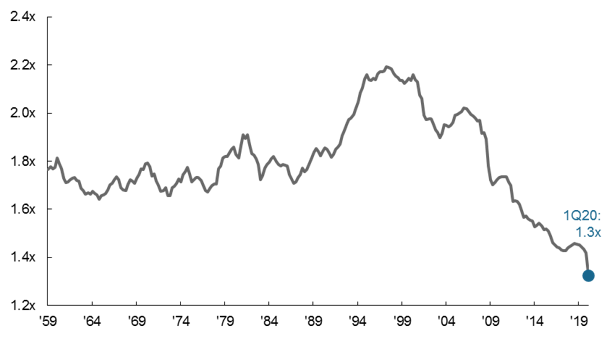

Historically, an increase in the money supply leads to higher levels of inflation, but investors should remember that supply is only one driver of overall prices. Another important component is the speed at which money moves around the system – often referred to as the velocity of money. As we highlight in the below chart, the velocity of money is at record low levels. The sluggish speed at which money moves through the economy means that the money supply can increase significantly without necessarily causing high levels of inflation.

Economists don’t have a clear explanation as to why the velocity of money has been falling so sharply, instead attributing it to a range of factors including but not limited to:

- Aging demographic profiles: Older individuals save and spend in a different way compared to younger people.

- Banking regulation: Tougher capital requirements mean that banks need to keep more cash on hand to meet regulations. This limits the speed at which money moves through the system.

- Conservative fiscal mindset: Post the Financial Crisis, economic agents are adopting a fiscally cautious approach dampening the demand for loans and slowing the speed at which cash moves through the system as individuals opt to save rather than spend.

- Rising inequality: Wealthier individuals tend to save and invest excess money rather than spend it. As inequality levels rise this can slow the speed at which money moves through the economy.

While these drivers may be diverse, they are similar in that they are all quite structural in nature and are unlikely to disappear overnight. This means that the money supply may be able to rise quite dramatically without triggering dramatic increases in inflation. With that being said, investors are right to watch inflation carefully. A shift in inflation can have a profound impact across asset classes.

Velocity of money

Quarterly, nominal GDP/money supply (m2)

Source: BEA, FactSet, Federal Reserve System, J.P. Morgan Asset Management. Data are as of May 19, 2020.

0903c02a828e8866