When it comes to investing in equities, one of the most frequently asked questions is whether we prefer value or growth. We generally think about equity markets as being divided between cyclical and defensive sectors, but understand that many investors still adhere to the style box when building portfolios. The key question, therefore, is under what circumstances will one style outperform the other?

Over the course of this business cycle, growth has handily outperformed value. But can we draw any conclusions as to why by looking at a larger data set? One of the reasons investors cite for the outperformance of growth as a style is that the economic backdrop has been relatively muted. This is true - the quarterly annualized average GDP growth rate over the course of this cycle has been 2.3%, versus an average of 2.8%, over the past 50 years.

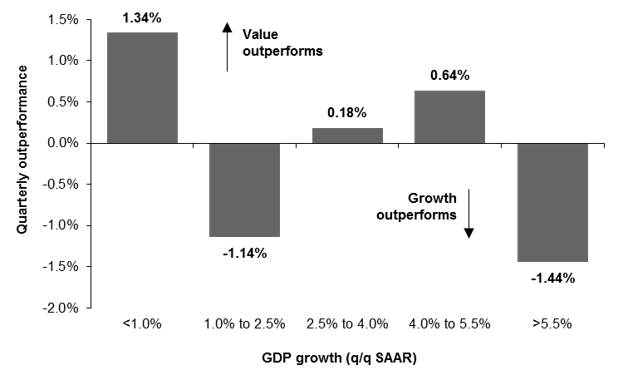

However, does this theory about the outperformance of growth hold when you look over longer periods of time? The answer is yes. As shown in the chart below, growth has tended to outperform value in two types of environments since 1978 - when economic growth is between 1% and 2.5% (much like the environment we have been in during this expansion), as well as in very high growth environments (>5.5%). The rest of the time, value tends to outperform.

So looking ahead, what do we expect? To start, and as highlighted in Long Term Capital Market Assumptions, we expect U.S. economic growth to average around 2% over the next 10-15 years. This backdrop should generally be supportive of growth, relative to value. Furthermore, there seems to be structural tailwinds supporting the growth style, and specifically in the technology sector. As the labor market continues to tighten and the number of available workers dwindles, companies will have to rely on technology and automation to increase productivity. As highlighted in our recent paper on the uses of corporate cash, companies have been increasing spending on research and development in an effort to do exactly that, providing additional support for the “growthier” parts of the equity market.

That said, a bit of caution is warranted - investors have gravitated to the growth style given the ability of these companies to grow earnings and revenues against a sluggish economic backdrop. In the process, this has pushed the valuation of certain companies to all-time highs. If those businesses fail to deliver the sales and earnings that investors are expecting, prices will decline accordingly. As such, security selection will be increasingly important as investors allocate to this part of the equity market.

Growth tends to outperform in lackluster economic environments

QUARTERLY, 12/31/78 - PRESENT

Source: FactSet, FTSE Russell, J.P. Morgan Asset Management. Growth is represented by the Russell 1000 Growth Index and Value is represented by the Russell 1000 Value Index.

0903c02a82805d2f