In Brief

- Earnings are the main driver of stock market returns, but how earnings are used is also important.

- Historically, companies favored capital spending (capex), but more recently have shown a preference for dividends and buybacks.

- Companies with high buyback yields have outperformed this cycle, but the corresponding reduction in capex will matter in the long-run.

- The rise of the capital-lite business has implications for how investors should think about growth vs. value.

- Looking ahead, portfolios should balance shareholder returns and long-term growth.

Profits matter, but the devil is in the details

While multiple expansion was responsible for the majority of returns last year, over the long run, earnings growth tends to be the primary driver of stock market performance. As a result, equity investors spend a lot of their time looking for where earnings growth will be the strongest; what does not get as much attention is what happens to earnings after they are generated, and how this impacts future returns.

The clearest example of how earnings impact returns is through the shareholder channel – in other words, when a company returns cash through dividends or buybacks. However, there are other ways that earnings are used to create value over longer periods of time. For example, when companies reinvest in themselves by purchasing new equipment or providing employees with additional training, in theory this should increase productivity, and therefore earnings, over the long-run. Even paying down debt has a positive effect on profits, as doing so reduces interest costs and allows more cash to fall to the bottom line.

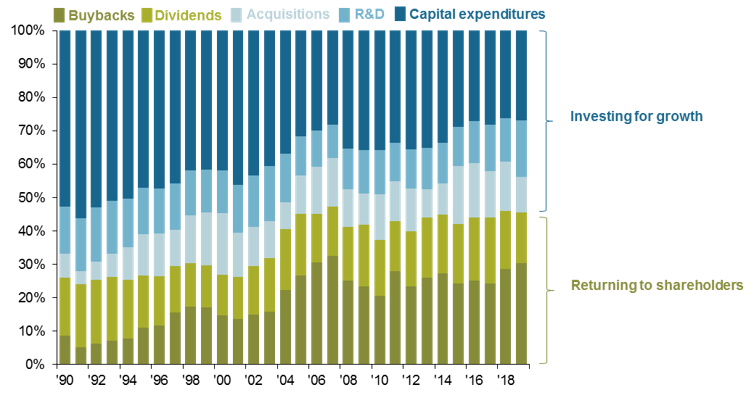

Historically, companies demonstrated a preference for investing back into the business in an effort to drive future growth. While this came at the expense of returning cash to shareholders through dividends and stock buybacks, as shown in Exhibit 1, this dynamic has begun to shift. At the current juncture, 45% of cash is being returned to shareholders through dividends and buybacks, compared to just 26% in 1990.

EXHIBIT 1: S&P 500 companies have seen a preference for shareholder return more recently

% of capital used for each outlay

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

0903c02a8280a9f4