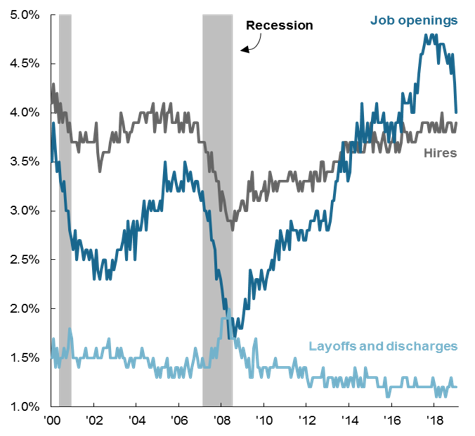

The latest job openings figures in the December JOLTS report makes for a concerning read. Job openings declined by 5.4% m/m and were down 14% y/y, its largest annual decline since 2009 with the slowdown widespread across sectors. As we highlight in this week’s chart, a decline in openings has occurred during the last two U.S. recessions. However, investors should be wary of the figures for a number of reasons:

- The data on job openings only goes back to 2000. While an interesting indicator for the previous two U.S. recessions, its lack of history limits its reliability in forecasting future recessions.

- The labor market is often a lagging indicator of economic conditions. While economic growth slowed in 2019, cuts by the U.S. Federal Reserve, as well as a cooling of trade tensions, has helped stabilize the economy heading into 2020. Therefore, the labor market may be playing catch-up and does not yet reflect the recent improvements.

- The recent changes may be a bi-product of disgruntled employers. With the unemployment rate at 3.6%, the U.S. labor market is at its tightest level in over 50 years. Disgruntled employers, unable to find workers with the necessary skills and tired of the expensive and time-consuming process of advertising openings, may have opted to pull the opening altogether.

Taken at face value, the fall in job openings is concerning and warrants careful monitoring. However, limited data, changes in the economic backdrop and disgruntled employers may be offsetting factors that explain the fall in job openings.

Hires, job openings and layoffs and discharges

SHARE OF TOTAL NONFARM EMPLOYMENT, SEASONALLY ADJUSTED, PERCENT

Source: FactSet, U.S BLS, J.P Morgan Asset Management. Data are as of 12 February 2020.

0903c02a82805d2f