Dive into macro, market and portfolio themes

A changing environment demands that we reassess how we construct and diversify portfolios. Investors need the whole toolkit to extend, expand and enhance their portfolios.

Executive Summary

Smarter portfolios for a world in transition

A 60/40 asset allocation (60% equities, 40% bonds) is still a great starting point for portfolios. And we can build on it in many ways.

That’s because much of what defines the investing environment is in transition.

Consider:

- The economy is in transition as persistent disinflation transitions to two-way inflation risk.

- Policy is in transition as ultra easy monetary policy transitions to more traditional monetary policy and fiscal restraint shifts to fiscal activism.

- Technology is in transition as the potential of artificial intelligence begins to emerge.

- Climate is in transition from conventional energy to renewable energy.

Extend, expand and enhance the 60/40

To navigate a world in transition we recommend that investors build on the 60/40 portfolio and:

Extend – out of cash and delve deeper within core assets

We forecast that one dollar in cash could be worth only USD 1.04 in real terms in 10 years. In a 60/40 with a 25% alternatives allocation, it could be worth USD 1.62. (The principle applies across currencies.)

Expand – the opportunity set, especially with alternative assets

International developed equities can capture rerating and currency upside, real assets improve inflation resiliency.

Enhance – portfolio outcomes through active allocation and manager selection

As money is no longer free, markets will reward a more selective approach to asset purchases.

In this year’s Long-Term Capital Market Assumptions, forecasts across most assets offer attractive long-term returns. Investors can use the whole toolkit to extend, enhance and expand their portfolios.

Higher bond returns, lower equity returns

With high prevailing policy rates, our Global Aggregate bond forecast jumps 40bps to 5.1%. Our equity return forecasts fall in the wake of the 2023 rally, but not as far as might be expected. Our forecast for global equities dips 70bps to 7.8%. U.S. large cap declines from 7.9% to 7.0%.

Harnessing the power of private markets

The case for investing in private markets strengthens, especially given the inflation resilience that alternatives have demonstrated. Expected returns for core U.S. real estate rise 180bps to 7.5%. Forecasts for venture capital rise sharply and fall modestly for private equity (following equity market returns lower) and hedge funds.

Across many asset classes, the active alpha outlook improves. But make no mistake: Portfolio diversification will be a persistent challenge, especially when inflation risk is two-way and stock-bond correlation is no longer reliably negative. Staying invested beats hiding out in cash over virtually all time horizons. But investors will need to use all the tools available to build smarter portfolios for a world in transition.

The state’s role in the economy

How investors can assess the rise of industrial policy

The need is undeniable: Some of today’s most urgent challenges – notably, climate change, social strains and geopolitical tensions – likely require public sector as well as private sector commitment and capital.

That’s a key reason that industrial policy, and state intervention more broadly, are on the rise across the global economy. It’s the start of a new era, and a notable contrast to the laissez-faire of 1980-2008, especially in the U.S.

A framework for assessing the effectiveness of state intervention

We have crafted a framework for evaluating the effectiveness of state intervention, asking three key questions:

- Is the policy well-designed to address the defined problem?

- Can the policy lead to a sustainable end state?

- Are the necessary tools and/or political will in place to make the transition to that end state?

Industrial policies target a wide range of economic and noneconomic goals, with both short-term and long-term effects. We believe growing state intervention will present upside risks to inflation, upside risks to economic output in the short term, increased economic uncertainty and a higher cost of capital.

Investment implications

As we consider the investment implications of state intervention, we first note more uncertainty about the outlook for corporate margins from higher labor costs and potentially higher corporate taxes. This is counterbalanced somewhat by higher prices, increased consumer spending, and artificial intelligence (AI)-powered productivity gains.

The biggest beneficiaries of increased state intervention may lie in “real economy” sectors. Industrials are clear winners; utilities, energy, and parts of technology also stand to gain. Based on the real economy sectoral winners, regional markets tilted more heavily toward these type of companies may benefit the most. But investing based on sector exposure alone only goes so far; it will be key to consider the potential of thematic investing.

New policy initiatives will require private capital as well as government funding. Among alternative assets, real assets look set to be the primary beneficiaries, especially infrastructure, real estate, transportation and timber investments. Private debt and private equity funds will likely provide critical capital for both the physical assets and the new businesses that will be part of the broader story of rising state intervention.

Expanding the diversification toolkit

A smarter portfolio to mitigate shocks in a less predictable world

Diversifiers are investments meant to help achieve more robust outcomes. Stocks, broadly speaking, struggle when economic growth contracts, so we diversify with bonds, which tend to do well when growth weakens.

Fixed income remains an indispensable portfolio diversifier, yet it has proved less successful against bouts of inflation, recent and past. There is more than one kind of shock in financial markets, as investors were reminded recently. The expanded diversification toolkit aims to help insulate portfolios from a range of different shocks.

Indeed, as 2024 LTCMA forecasts call for ongoing, elevated macroeconomic uncertainty, finding additional sources of risk diversification may be as important as finding sources of return.

We propose such dimensions of diversification to create enhanced balanced portfolios, identifying a basket of further diversifiers to broaden out and complement a standard 60/40 stock-bond portfolio for a wider range of environments. The basket includes:

- Actively managed equity

- Tactical asset allocation strategies

- Risk premia strategies

- Currency overlays

- Thematic investing

- Alternative assets – particularly real assets, hedge funds and private credit, which exhibit low correlation to traditional assets and the opportunity for downside resilience, enhanced returns and inflation protection

We identify these diversifiers by drawing on historical evidence; the knowledge that they each shine in different economic environments; and by running simulations using our robust asset allocation model to capture the effects of different possible regimes.

Testing a portfolio incorporating the full range of these potential diversifiers, we examine their performance in aggregate and provide an example of the new, smarter, more robust balanced portfolio.

The smarter portfolio provided a smoother ride in our simulations – especially helpful because its value comes when it is most needed. Long-term wealth creation is not only about generating more return but also avoiding wealth destruction.

The diversifiers in our basket have historically delivered positive returns, are not costly (like traditional portfolio hedges) and are fairly valued. Those qualities make the present moment a timely one for reshaping portfolios by expanding the diversification toolkit.

Portfolio implications

Smarter portfolios for a world in transition

All in all, it’s a hopeful outlook.

Our 2024 LTCMAs suggest a benign investing environment, with limited need to restructure asset allocations. We anticipate modestly lower returns on equities and stable returns on fixed income over our 10- to 15-year forecast horizon. That means overall returns on balanced portfolios should enable investors to reach their strategic objectives.

End of story? Not quite.

As investors allocate capital, they confront a macroeconomic and market environment that exhibits a high degree of short-term volatility. We believe investors are navigating a world in transition – most visibly from a world of persistent disinflation, accommodative monetary policy and fiscal restraint to one with two-way inflation risk, more traditional monetary policy and more active fiscal authorities.

Investors operating in a time of transition may wonder: Should they hold fast to a well-anchored long-term strategy, or adjust their allocations across time to reflect near term signals?

Long-term stability, short-term imbalances

In our view, some current market imbalances and trends could exert significant influence on returns and risk over a shorter horizon. Investors can adjust their portfolio strategy in the short term to take advantage of the opportunities – and manage the risks – inherent in those market imbalances.

The pivot to higher interest rates and the approaching conclusion of central bank hiking cycles suggest that bond portfolio duration should extend. The slow adjustment to higher financing costs will be felt across credit markets and alternative asset classes that employ leverage, implying a re-underwriting of exposure to key subsectors.

The fading of globalization, and the growing separation of China from trading partners in the developed world, may warrant an investment strategy that differentiates exposures within emerging markets. Finally, the pronounced concentration of U.S. equity markets may suggest a move away from passive market capitalization benchmarks and/or a shift from the U.S. in favor of global markets.

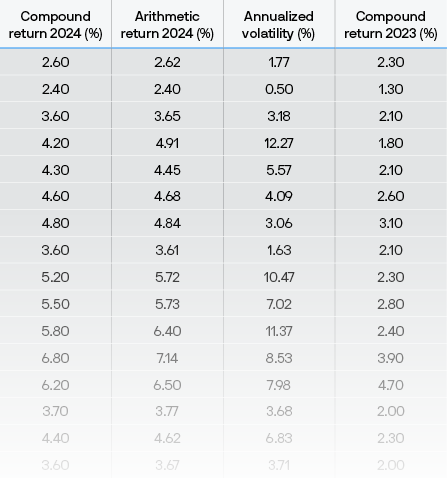

Matrices

Our expectations for returns, volatilities and correlations.

The assumptions are not designed to inform short term tactical allocation decisions. Our assumptions process is carefully calibrated and constructed to aid investors with strategic asset allocation or policy-level decisions over a 10- to 15-year investment horizon.

Our assumptions can be used to:

Develop or review a strategic asset allocation

Understand the risk and return trade-offs across and within asset classes and regions

Assess the risk characteristics of a strategic asset allocation

Review relative value allocation decisions

If you are looking for an asset class not listed in the published materials, please contact your J.P. Morgan representative.

Download matrix by currency

Assumptions

Examine our return projections by major asset class and the thinking behind the numbers.

- Macroeconomic

- Currency exchange rate

- Fixed income

- Equity

- Alternative assets

- Volatility and correlation

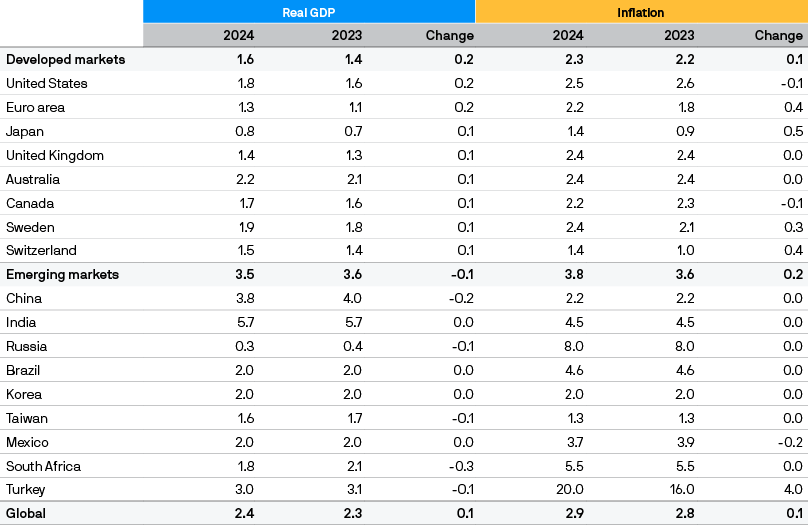

MACROECONOMIC ASSUMPTIONS

A world in transition: Changing tides of growth and inflation

Key points

- Improved labor force growth in the U.S., increased investment in the energy transition in Europe and the productivity-enhancing impacts of artificial intelligence (AI) technology combine to add to our forecast of developed market (DM) growth.

- Emerging market (EM) growth slips a little as China’s decades-long expansion continues to slow.

- DM inflation expectations remain higher than in the pre-pandemic era: Stronger wage growth in Europe and Japan modestly boosts their inflation forecasts, and a faster than expected decline in U.S. inflation allows us to slightly lower our long-term forecast.

- Our EM inflation outlook sees little change.

- Public investment to combat climate change and mitigate its social impacts could boost economic growth and productivity but should also be mildly inflationary.

- Accelerating investment spending on AI could provide a boost to productivity and be broadly deflationary. However, we recognize this with only a modest boost to our DM growth forecasts at this stage, as we continue to assess AI’s potential long-term impact.

Our 2024 assumptions anticipate mostly stable real GDP growth and higher – but not dramatically higher – inflation

Exhibit: 2024 Long-Term Capital Market Macroeconomic Assumptions (%, annual average)

Source: J.P. Morgan Asset Management; estimates as of September 30, 2023. Previous year’s real GDP forecasts shown include cyclical bonuses. Given depressed post-shock starting points, in last year’s edition we added cyclical bonuses to our 2021 trend growth projections. This year, our 2024 forecasting returns to trend rates alone. In comparing 2023 with 2024 trend rates here, we do not use last year’s rate-plus-cyclical-bonus figure but only the trend rate. Composite GDP and inflation numbers for DM, EM and global aggregates are calculated by assigning weights to individual economies that are proportional to projected nominal GDP over the forecast horizon. This updated methodology also results in revised aggregates for the 2023 LTCMAs, although individual economy forecasts remain unchanged from last year.

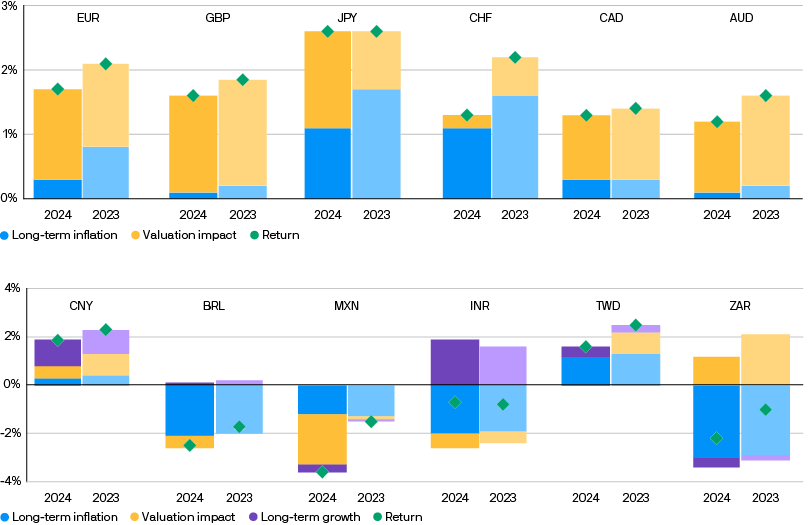

CURRENCY EXCHANGE RATE ASUMPTIONS

As U.S. and non-U.S. inflation assumptions converge, a smaller decline for the U.S. dollar

Key points

- Our 2023 currency exchange rate return assumptions are directionally little changed. We continue to believe that the USD will unwind its overvaluation over the Long-Term Capital Market Assumptions (LTCMA) time horizon.

- We reduce the magnitude of the USD decline from last year’s edition due to some reversal of the dollar’s 2022 strength and because our forward-looking inflation assumptions for the U.S. and non-U.S. developed economies have converged.

- We expect central banks will have to continue to prioritize meeting their inflation targets over maintaining currency competitiveness, allowing more currency pairs to converge closer to their fair value over our forecast horizon.

- A higher long-term European Union (EU) inflation forecast is consistent with a lower annual euro appreciation rate over our LTCMA horizon. The end of the era of negative rates, and reduced risks of an EU breakup, strengthen the probability that the euro converges toward its fair value, as investors are likely to raise their exposure to euro-denominated assets.

- Gradual but solid steps toward reflation of the Japanese economy lead us to raise our 2024 LTCMA growth and inflation forecast, which favors our forecast for an eventual yen appreciation.

- Limited inflation pressures reduce the impetus for the People’s Bank of China to refocus its policy away from currency competitiveness.

We expect DM currencies to appreciate and EM currencies to depreciate vs. the USD

Exhibit: LTCMA FX return drivers, major DM currencies vs. USD (top) and major EM currencies vs. USD (bottom)

Source: J.P. Morgan Asset Management; data and forecasts as of September 30, 2023. FV: fair value; EUR: euro; GBP: British pound; JPY: Japanese yen; CHF: Swiss franc; CAD: Canadian dollar; AUD: Australian dollar; CNY: Chinese renminbi; BRL: Brazilian real; MXN: Mexican peso; INR: Indian rupee; TWD: Taiwanese dollar; ZAR: South African rand.

FIXED INCOME ASSUMPTIONS

Fixed income returns remain attractive

Key points

- Our fixed income assumptions are heavily impacted by our expectation that other regions will follow U.S. inflation higher, on a sustainable basis.

- Our cycle-neutral cash rate assumptions rise across major developed markets, rising most for Europe and Japan. These increases reflect our expectation that rates rise more broadly to historically normal levels and that this normalization becomes more entrenched.

- Further out on the yield curve, interest rate normalization translates to higher 10-year yield assumptions. Our 10-year cycle-neutral assumptions rise more markedly for Europe and Japan, where our outlook is for higher trend inflation over the next 10 to 15 years.

- Central banks are more likely to be successful in meeting their policy objectives over the next decade than they were over the last 10–15 years, given the more historically typical inflation environment we forecast.

- Higher macroeconomic uncertainty and rising inflation risk theoretically elevate risk premia and steepen the slope of the yield curve, but in our view, rising government bond yields globally should revive demand for longer-term bonds from large investors underweight duration. We thus keep the yield curve slope largely unchanged, leading to a level shift in the yield curve in most economies.

- The rising cost of capital increases vulnerability in pockets of the credit markets, most notably in leveraged loans, a segment with higher exposure to refinancing risk. We raise the expected cycleneutral spread on the levered loan index and raise our U.S. high yield spread assumption.

- Our emerging market debt assumptions are little changed, with default rates consistent with historical averages.

Bond returns remain attractive

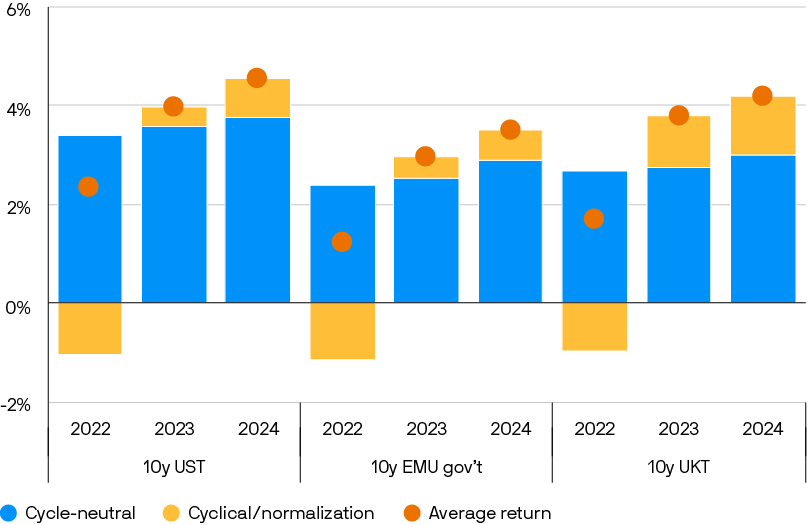

Exhibit: Cycle-neutral vs. cyclical returns for major government bond markets

Source: J.P. Morgan Asset Management; data as of September 30, 2023.

EQUITY ASSUMPTIONS

Valuation pressures, slightly lower forecast returns

Key points

- Long-term equity return expectations remain healthy, though they have moderated slightly from last year. As markets have rallied, cyclical headwinds have increased. Broadly, valuations function as a greater drag and margins function as less of a drag relative to last year.

- U.S. large cap return expectations decline from 7.9% to 7.0%, and U.S. small cap return expectations fall from 8.1% to 7.2%. Both moves reflect valuation pressures. We continue to forecast a reduced small cap premium relative to large cap, given relatively less favorable sector composition and profitability dynamics, and the continued trend of companies remaining private for longer.

- We expect non-U.S. equities to outperform U.S. equities. While we think U.S. stocks will deliver stronger earnings and revenue growth, developed non-U.S. equities offer more compelling valuations and higher dividend yields, contributing to modestly higher total return expectations. For USD-based investors, a weaker dollar should offer additional support for non-U.S. equities, although the anticipated magnitude of dollar weakness has moderated relative to last year.

- Emerging markets’ return premium to the developed markets continues to decline. As the transmission of economic growth into earnings growth has disappointed for several emerging markets, we take a more conservative approach in our revenue forecasts.

Valuations tailwinds subside, but equity return forecasts remain compelling

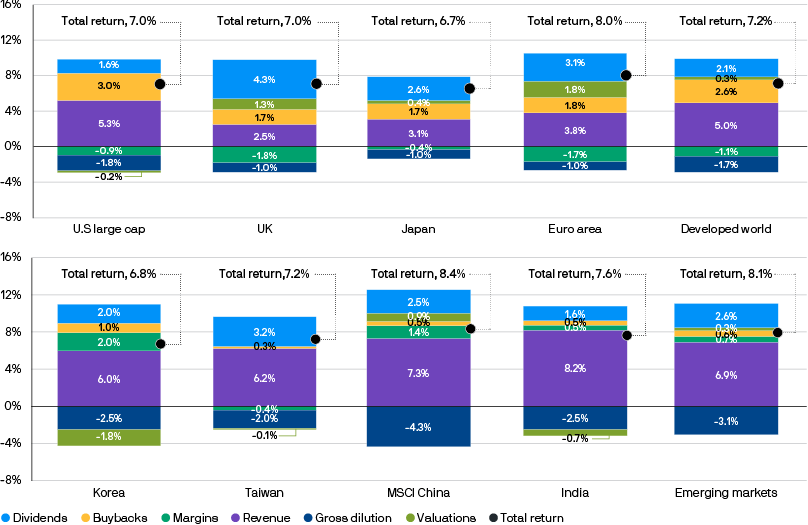

Exhibit: Selected developed market (top) and emerging market (bottom) equity long-term return assumptions and building blocks, in local currency terms

Source: J.P. Morgan Asset Management; data as of September 30, 2023. Please note that figures may not sum up due to rounding. MSCI China is treated as an asset whose local currency is CNY.

ALTERNATIVE ASSET ASSUMPTIONS

Rewarding a renewed focus on diversification, inflation resilience – and alpha

Key points

Although near-term challenges persist – notably, normalizing interest rates in the context of elevated inflation – alternatives continue to offer powerful tools that support portfolio diversification, inflation hedging and resilient performance.

- We expect real assets will continue to deliver resilient returns, inflation sensitivity and diversification over our 10- to 15-year investment horizon. Real estate equity benefits from substantial repricing, while real estate debt – represented by a new category, commercial mortgage loans – experiences higher yield. We expect other real assets, such as infrastructure, transport and timber, will provide stable returns, and we anticipate that returns for commodities will outpace inflation. Although leverage is less accretive in this environment, inflation resilience and sustainability considerations may also support the valuation of real assets.

- Our return assumptions for financial alternative assets and strategies continue to be defined by superior returns vs. public markets and significant diversification benefits. We expect to see high absolute returns for private equity and venture capital, high cash returns for direct lending and increasingly efficient, broadly stable returns for diversified hedge funds. Across private markets, however, historically large amounts of dry powder have yet to be deployed, which tempers our outlook for alpha across some of these investment classes.

- Our 2024 long-term return projections for a traditional 60/40 stock-bond portfolio experience a slight decline compared with our 2023 forecast. As a result, we expect to see investments in alternatives play a more significant role in portfolio allocations by providing potentially attractive returns and diversification benefits. In core alternatives with high dispersion of returns across asset types, active management will play a critical role in realizing value; in noncore alternatives, manager selection will be key to realizing alpha.

Across all alternative sectors and strategies, future performance may exhibit wider dispersion of returns

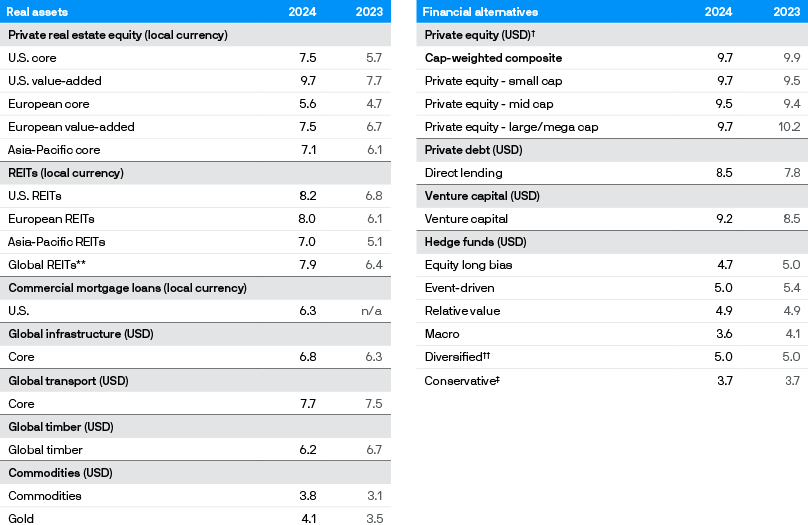

Exhibit: Selected alternative strategies – return assumptions (levered,* net of fees, %)

Source: J.P. Morgan Asset Management; estimates as of September 30, 2022, and September 30, 2023.

* All return assumptions incorporate leverage, except for commodities, where it does not apply.

** The global composite is built assuming the following weights: roughly 70% U.S., 10% Europe and 20% Asia-Pacific.

† The private equity composite is AUM-weighted: 65% large cap and mega cap, 25% mid cap and 10% small cap. Capitalization size categories refer to the size of the asset pool, which has a direct correlation to the size of companies acquired, except in the case of mega cap.

†† The Diversified assumption represents the projected return for multi-strategy hedge funds.

‡ The Conservative assumption represents the projected return for multi-strategy hedge funds that seek to achieve consistent returns and low overall portfolio volatility by primarily investing in lower volatility strategies such as equity market neutral and fixed income arbitrage. The 2024 Conservative assumption uses a 0.70 beta to Diversified.

VOLATILITY AND CORRELATION ASSUMPTIONS

Settling into higher bond volatility and unstable stock-bond correlation

Key points

- For a second year, our assumptions forecast more elevated bond volatility and less negative stock-bond correlation.

- We expect macroeconomic volatility to return and central bank policies to normalize – bringing back bond returns but also bond volatility.

- Correlations between equities and bonds are likely to remain volatile in the short term, lessening the efficacy of core fixed income in smoothing risk asset returns. Over the long term, bonds’ diversification role in portfolios is weakened but remains relevant in downside scenarios.

- Year-over-year, our risk assumptions are little changed across asset classes after shifting significantly last year. We see last year’s forecasted risk dynamics continuing.

- We lower our Sharpe ratio forecasts for most fixed income and equities as return assumptions fall and cash rate assumptions rise. Sharpe ratios are little changed for most alternative assets, except for real estate, where Sharpe ratios improve, given a meaningfully improved return outlook.

- The record pace of central bank rate hikes is stressing select parts of the economy, such as private commercial real estate. We take a deep dive into the changing sectoral composition of the real estate market and its potential impact on our real estate volatility forecast. The changes impact our volatility forecasts only minimally, but affect the asset class’s economic and factor exposures.

Much of the change we expected is playing out in higher fixed income volatility

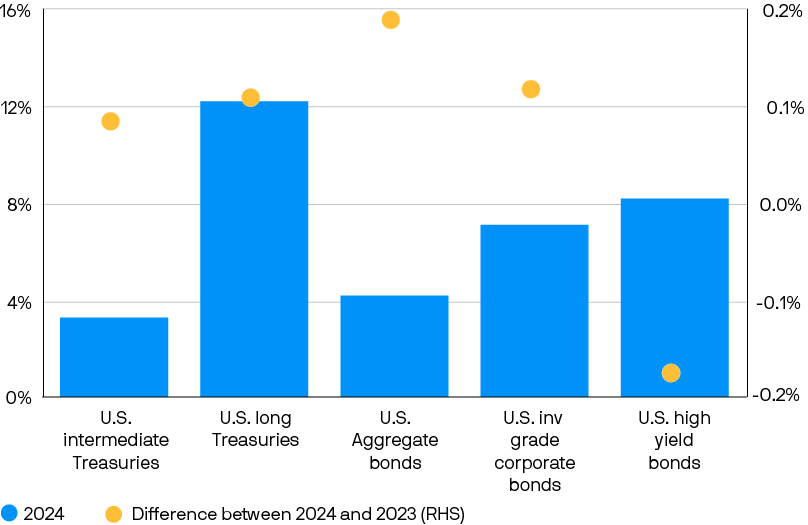

Exhibit: LTCMA fixed income volatility forecasts, 2024 vs. 2023

Source: J.P. Morgan Asset Management; data as of September 30, 2023.

Download this year's Long Term Capital Market Assumptions report