We expect the growth of the AI market to continue as the breadth of applications expand, providing tailwinds to infrastructure, semiconductor and software companies.

The possible end to the U.S. hiking cycle and the peak in rates have historically benefited stocks with higher valuations. Typically, falling yields are constructive for growth-style equities, such as technology stocks, as investors assume higher future growth rates to offset potentially falling but still elevated discount rates.

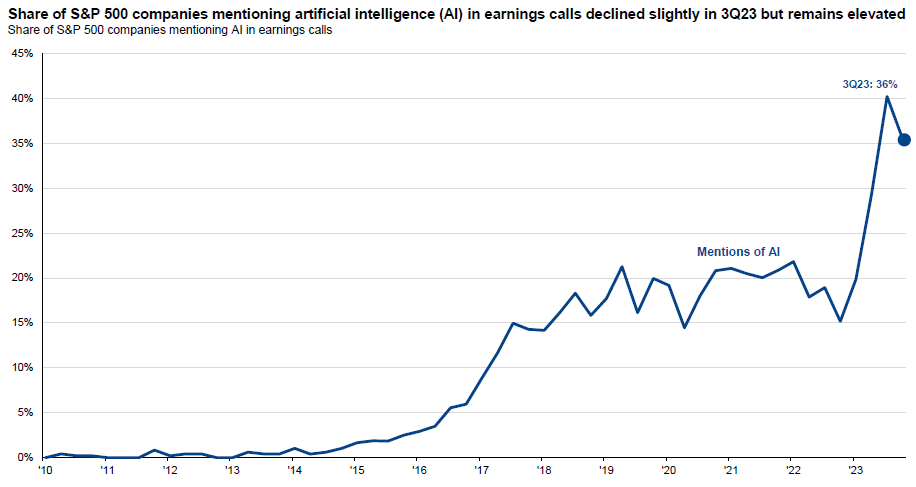

So far this year, enthusiasm over AI has fueled the outperformance in the tech sector. AI has accelerated the rate of technological advancement and has diffused across various sectors and the broader economy. Aside from the big tech firms, related computing infrastructure businesses that enable consumer and enterprise adoption also outperformed. We expect the growth of the AI market to continue as the breadth of applications expand, providing tailwinds to infrastructure, semiconductor and software companies.

Exhibit 10:

Source: J.P. Morgan Asset Management. Mentions of AI include the keywords: artificial intelligence (AI), deep learning, machine learning, chatGPT, LLM, and NLP. 3Q23 earnings season is still ongoing and so far 73.3% of S&P 500 market capitalization has reported.

Data reflect most recently available as of 01/11/23.

Meanwhile, the rebound in classic cloud consumption may also provide a favorable backdrop over the next several quarters. We remain excited about internet and semiconductors as well as the secular drivers in AI, automation and electrification.

Many investors question the sustainability of the narrow return contribution of large tech firms and their rich valuations, and some are concerned about the possibility of another tech bubble. While valuations of the dominant tech firms are high, they can be justified by strong long-term growth potential. Nevertheless, we remain mindful of the potential regulatory risks that could impact earnings potential.

In the event of an economic downturn, high-quality technology stocks could prove to be relatively resilient compared to other sectors, given their strong balance sheets and low correlation to the economic cycle as it pertains to earnings. In fact, fundamentals of large cap technology stocks have improved since the dot com bubble, with less leverage, more cash, higher profitability and better productivity.

Admittedly, persistent innovation and disruption imply an ever-evolving set of winners and losers from new technologies. The ultimate winners will likely be companies that innovate or adapt to leverage new technologies as they emerge. As market leadership shifts over time, being selective and picking businesses with high-quality growth remains key.

In sum, while developments in the AI space could continue to drive gains in the U.S. tech sector, its benefits will likely diffuse to a broader range of industries and companies.