Looking ahead, Asian high dividend stocks remain relevant even as global growth momentum slows.

Asian earnings remain highly correlated with export growth. Despite the challenging backdrop for exports in 2023, green shoots of recovery have emerged in Asian exports that should provide a foundation for earnings growth in 2024. Moreover, Asian economies with strong local demand, solid tourism recovery and ability to capitalize on AI demand could bolster earnings growth.

From a valuations perspective, Asian equities are trading at relatively attractive levels. In particular, from a price-to-book (P/B) perspective, most regions are trading more than one standard deviation1 below their 15-year averages. Historically, at current P/B levels, Asian equities tend to clock positive returns over the next 12 months. Earnings expectations have also been revised downwards significantly since the beginning of year, largely driven by South Korea and Taiwan.

Despite the rise in equity volatility in the past few weeks, high dividend stocks in Asia have been outperforming. While the MSCI Asia Pacific ex-Japan Index has declined by 0.1% while S&P 500 rose by 1.9%, since the end of June, the MSCI Asia Pacific ex-Japan High Dividend Yield index has outperformed both indices, returning 3.4%.

Looking ahead, Asian high dividend stocks remain relevant even as global growth momentum slows. First, Asia corporates are supported by robust balance sheets and lower debt levels relative to their historical average, which bodes well for dividends in addition to providing a shelter from deteriorating economic conditions. Second, valuations are undemanding compared to developed markets. Moreover, from a macro perspective, Asian economies are likely to enjoy a healthy growth differential relative to the U.S. in 2024, and the region’s monetary policy continues to be supportive on a comparative basis.

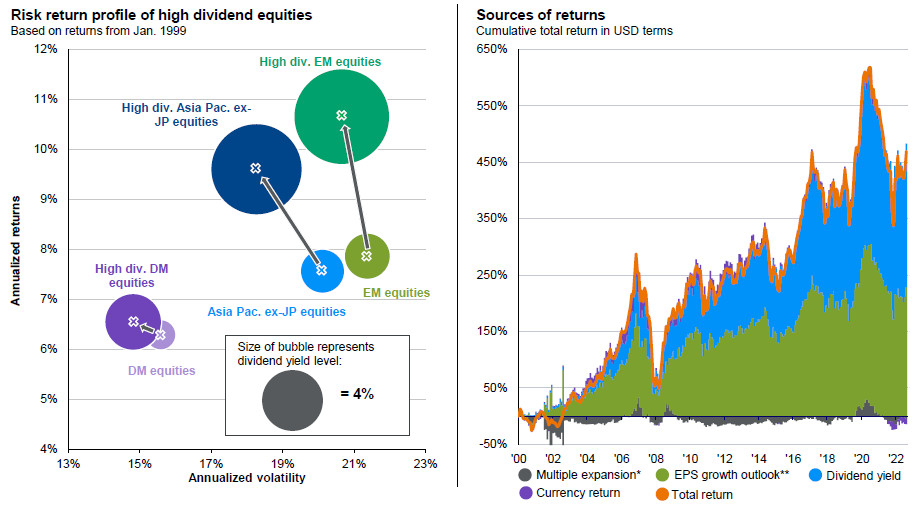

Dividends have, in the past, played a critical role in Asian equity returns. From 2000 to the end of September this year, Asia Pacific ex-Japan and Japan dividends contributed more than 60% and 65%, respectively, to total returns, compared to 44% in the U.S. In addition, the MSCI Asia Pacific ex-Japan High Dividend Index tends to provide a better risk-adjusted return relative to the broader MSCI Asia Pacific ex-Japan Index as shown in Exhibit 6. Given the macroeconomic uncertainties and the likely decline in cash rates over the next 6 to 12 months, it will be increasingly essential to find complementary pairing of fundamental resilience and stable dividends to preserve and enhance the total return of a portfolio.

Exhibit 6:

Source: FactSet, J.P. Morgan Asset Management. *Multiple expansion is based on the forward price-to-earnings ratio. **Earnings per share (EPS) growth outlook is based on next 12-month aggregate (NTMA) earnings estimates. Past performance is not indicative of current or future results. High div. DM equities is represented by MSCI World High Dividend Yield index, DM equities is represented by MSCI World index, High div. Asia Pacific ex-JP equities is represented by MSCI AC Asia Pacific ex-Japan High Dividend Yield index, Asia Pac. ex-JP equities is represented by MSCI AC Asia Pacific ex-Japan index, High div. EM equities is represented by MSCI Emerging Market High Dividend Yield index, EM equities is represented by MSCI Emerging Market Index.

Guide to the Markets – Asia. Data reflect most recently available as of 30/09/23.

Other than Asia high dividend stocks, Japanese stocks have risen 28% year-to-date (TOPIX, as of 16/11/2023), outperforming the U.S. and Europe. Although Japanese stocks have historically displayed a strong correlation with the global economic cycle, active management can help shift focus toward domestic factors to drive returns. These factors include the Tokyo Stock Exchange (TSE) governance reforms (which prompted companies to shift retained earnings into growth investments, wages and higher shareholder returns), Japan’s stronger economic recovery and resilient domestic demand as it emerges from deflation. Coupled with the revamped Nippon (Japan) Individual Savings Account scheme starting in January 2024—a tax exemption program for small investments—these domestic tailwinds should help drive retail investor flows and support sustained outperformance by Japanese stocks going forward.

However, stock selection is key when investing in Japanese equities. The economic recovery is likely to benefit companies that are predominantly exposed to domestic or tourist demand. Meanwhile, the TSE’s push to boost shareholder value is focused mainly on value stocks. Yet, there are plenty of companies with strong technical and innovation intellectual capital that have constructive long-term earnings potential. Hence, pointing the sail in the right direction can help investors capture enduring opportunities.