- The global push towards sustainability continues to unite stakeholders, including consumers, businesses, policymakers, and investors. This unified approach is not only redefining market landscapes but also emphasizes the crucial role of sustainable practices in modern economies. Through the lens of ESG (Environmental, Social, and Governance) criteria, investors are increasingly prioritizing investments that present both ethical integrity and financial viability.

- ESG factors are now essential in identifying opportunities that support environmental and social progress, providing a comprehensive approach to managing risk and enhancing long-term investment returns.

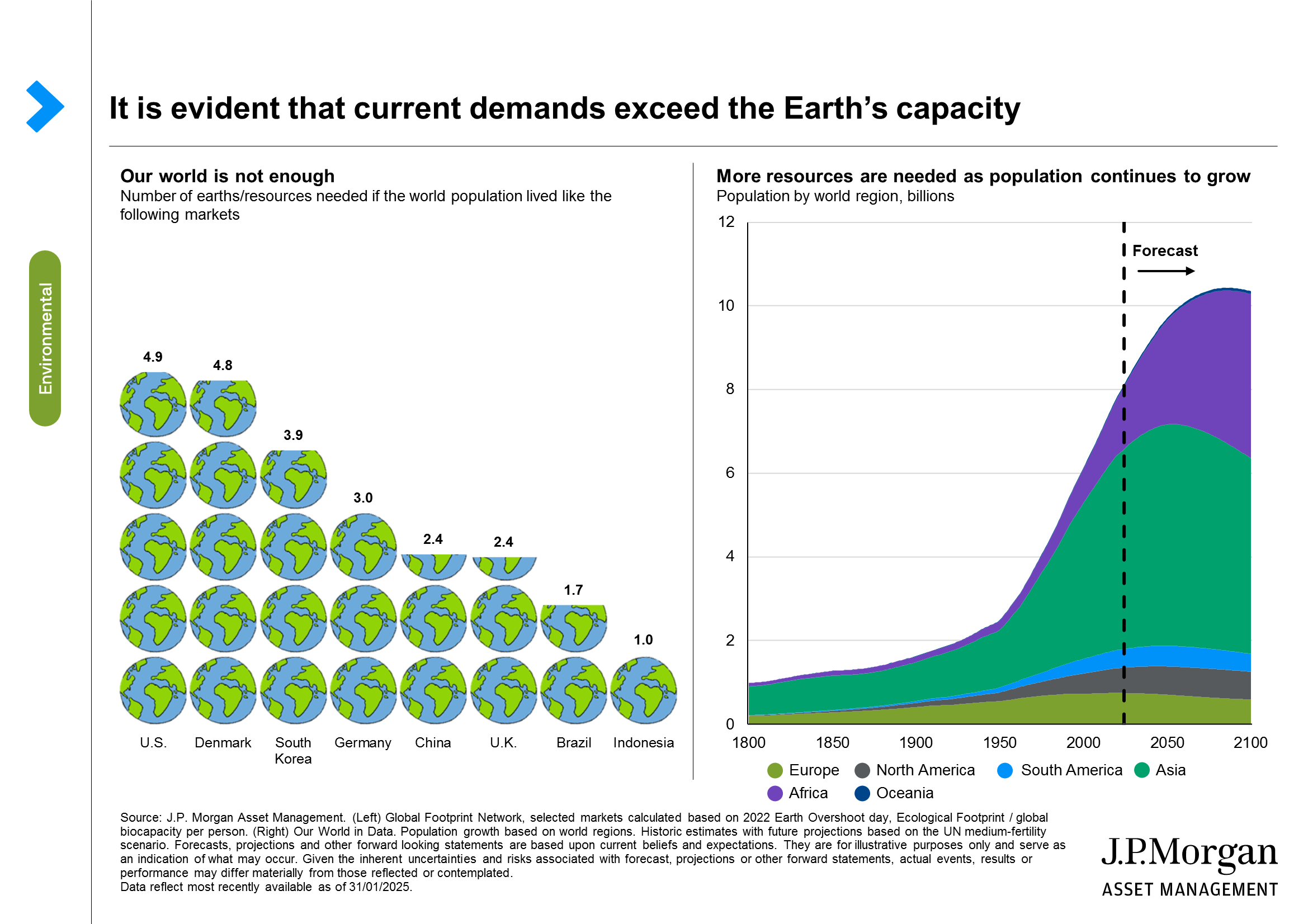

- The chart on the left reveals a concerning truth: if everyone in the world lived as people do in certain markets, we would need multiple Earths to sustain us. For example, the lifestyle in the U.S. would require five Earths, showing that we are living beyond our means. On the right, we shift our focus to the future population. As we prepare for our growing population, the pressure on resources only worsens.

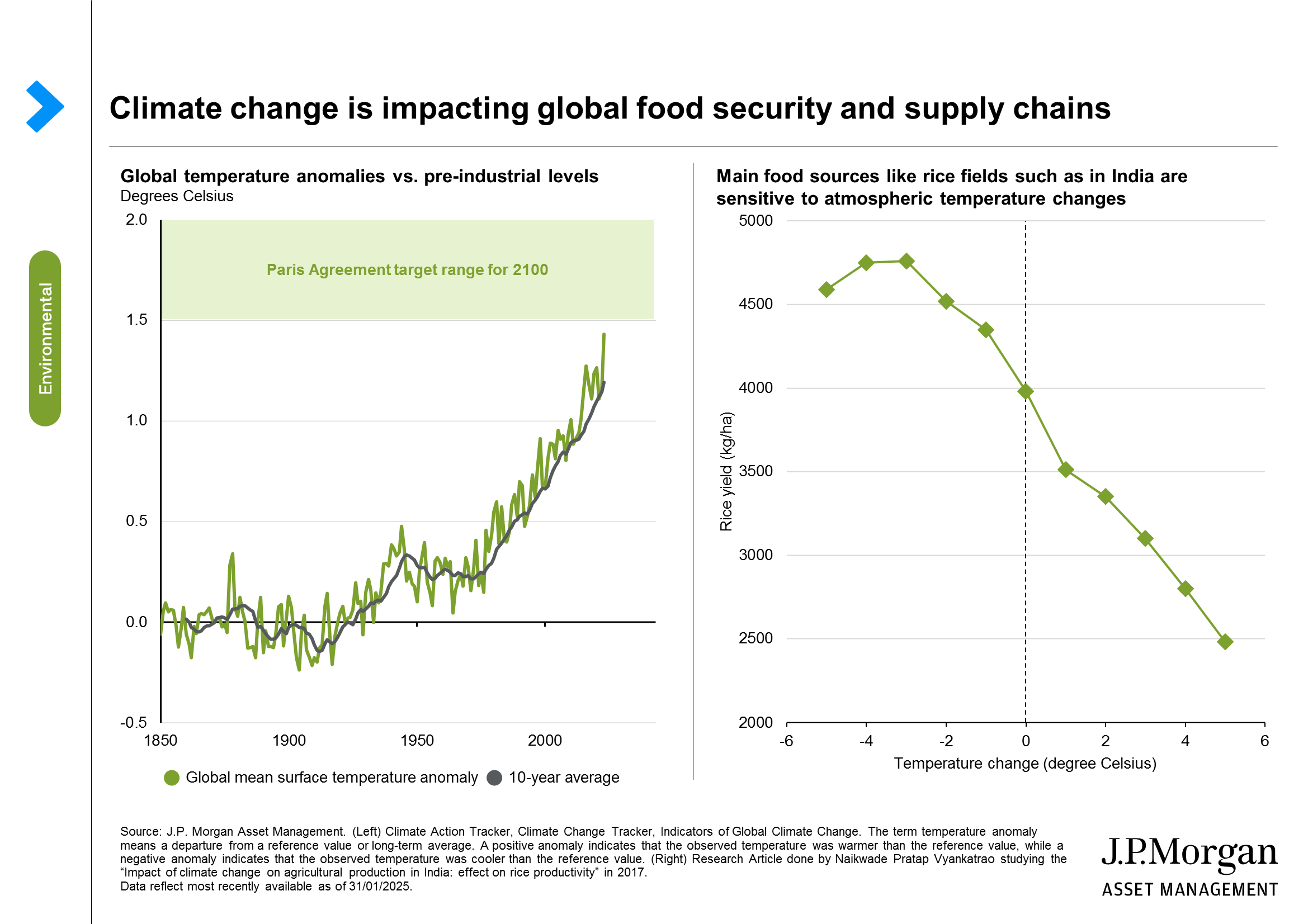

- The increase in greenhouse gas emissions has directly influenced global temperatures in both the ocean and on land. Sea levels, along with agricultural, marine, and terrestrial systems, are being impacted, compromising global food security. The case for protecting and restoring nature and biodiversity is clearly evident.

- There are interlinked global challenges, as our major food sources, like rice, are also showing a decline in production with the increase in temperature. A rice mapping research study conducted by New York University stated that by 2030, rice production must increase by an additional 25% to meet global population demand1.

- This highlights the direct impact of global warming on food security and underscores that climate mitigation must also involve agricultural adaptation to sustain global food supplies.

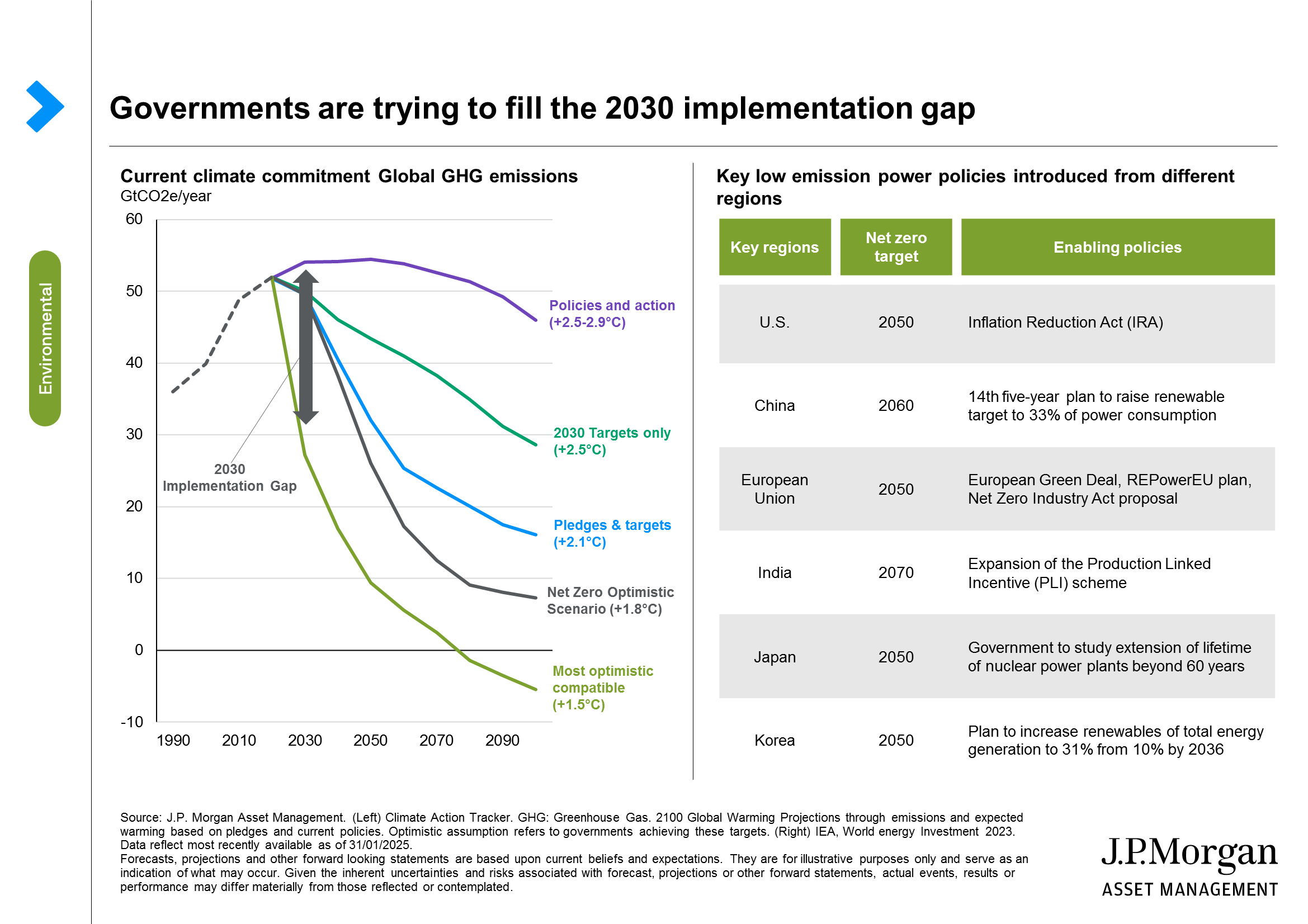

- The left graph highlights a concerning gap between our current climate policies and the necessary targets to keep global warming under control. Currently, the path we are on, in purple, points to a temperature increase that far exceeds safe limits, even with policies such as our 2030 target in place. The light green line represents the most optimistic scenario, while the grey line shows that even if we achieve our net-zero targets, we will still face moderate climate risks with a 1.8 degrees Celsius increase. This indicates that our current policies are insufficient and that we will likely need increased regulations and targeted strategies.

- Meanwhile, we see that governments around the world are trying to fill the 2030 implementation gap with various low-emission power policies in the U.S. and Europe. Similar incentives and programs are also being implemented in Asia.

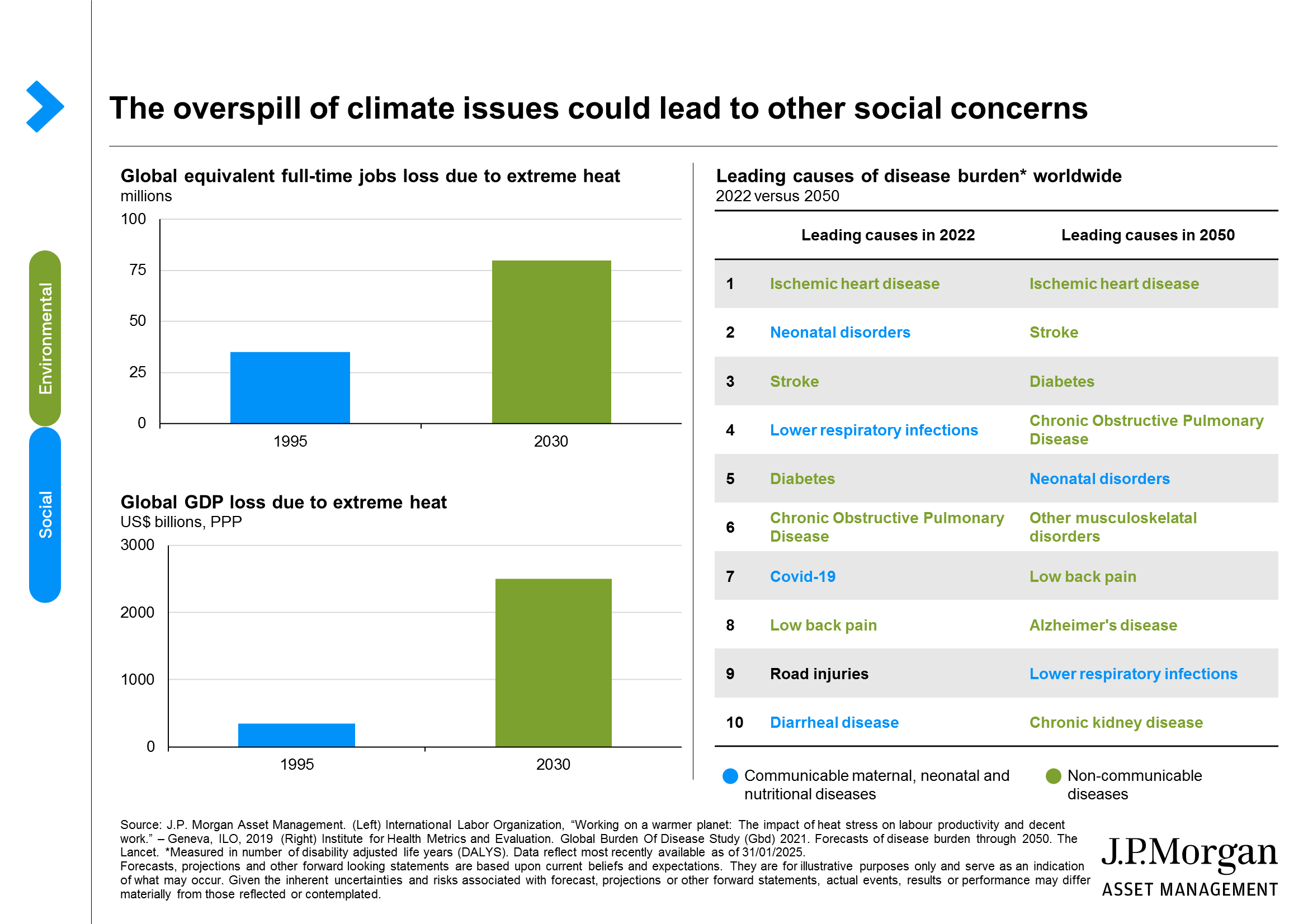

- The overspill of climate issues could also lead to other social concerns. ESG risks are all interconnected. For example, extreme heat will inevitably impact labor productivity globally. Estimates suggest that by 2030, when the global temperature is expected to have risen by about 1.3°C, the share of total working hours lost will rise to 2.2% — a productivity loss equivalent to 80 million full-time jobs and totaling US$2,400 billion in monetary terms2.

- It is also estimated that between 2022 and 2050, the burden of non-communicable diseases, such as heart disease, stroke, and diabetes, is expected to rise globally. For some developing regions, pronounced increases in population growth will pose considerable challenges to already strained health systems.

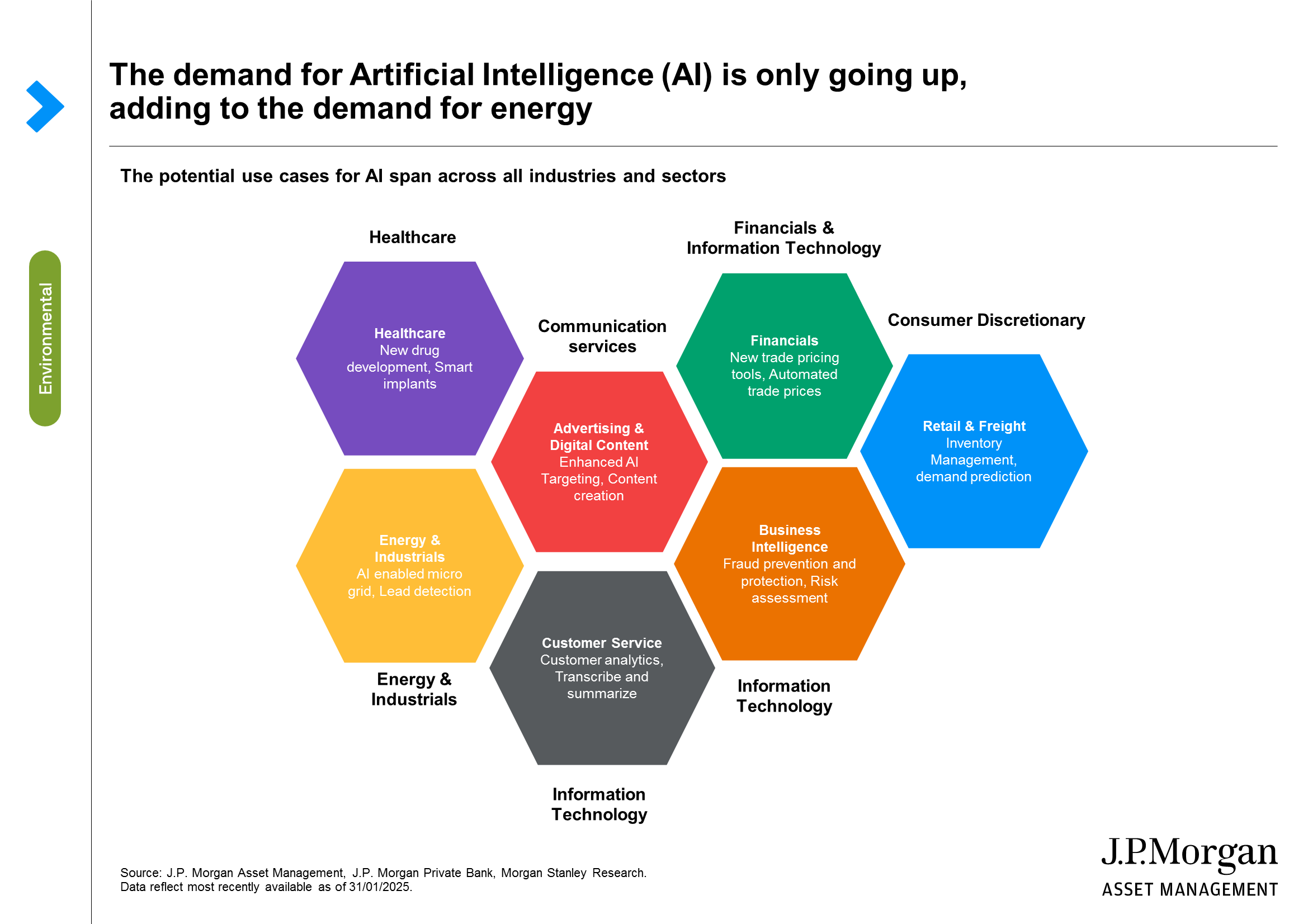

- The case for AI investment continues to grow and spans across all industries and sectors. Currently, there is over USD 200 billion in AI-driven capital expenditure expected, not just in technology but also in non-technology sectors. The trajectory of technology spending by major technology companies is projected to reach up to USD 1 trillion by 2032.

- This growth adds to the already increasing energy demand and highlights the need to improve efficiency across sectors. To put the energy demand into perspective, ChatGPT uses 6-10 times more power than traditional Google searches, and the latest version of ChatGPT uses 100 times more energy than its previous version. Meanwhile, data centers have only doubled in capacity during the same period.

- If we expect the adoption of AI across all sectors and industries, the trajectory of AI usage will not be sustainable unless new technology supports the energy demand. This means investments in better infrastructure, smarter energy grids, and, most importantly, renewables.

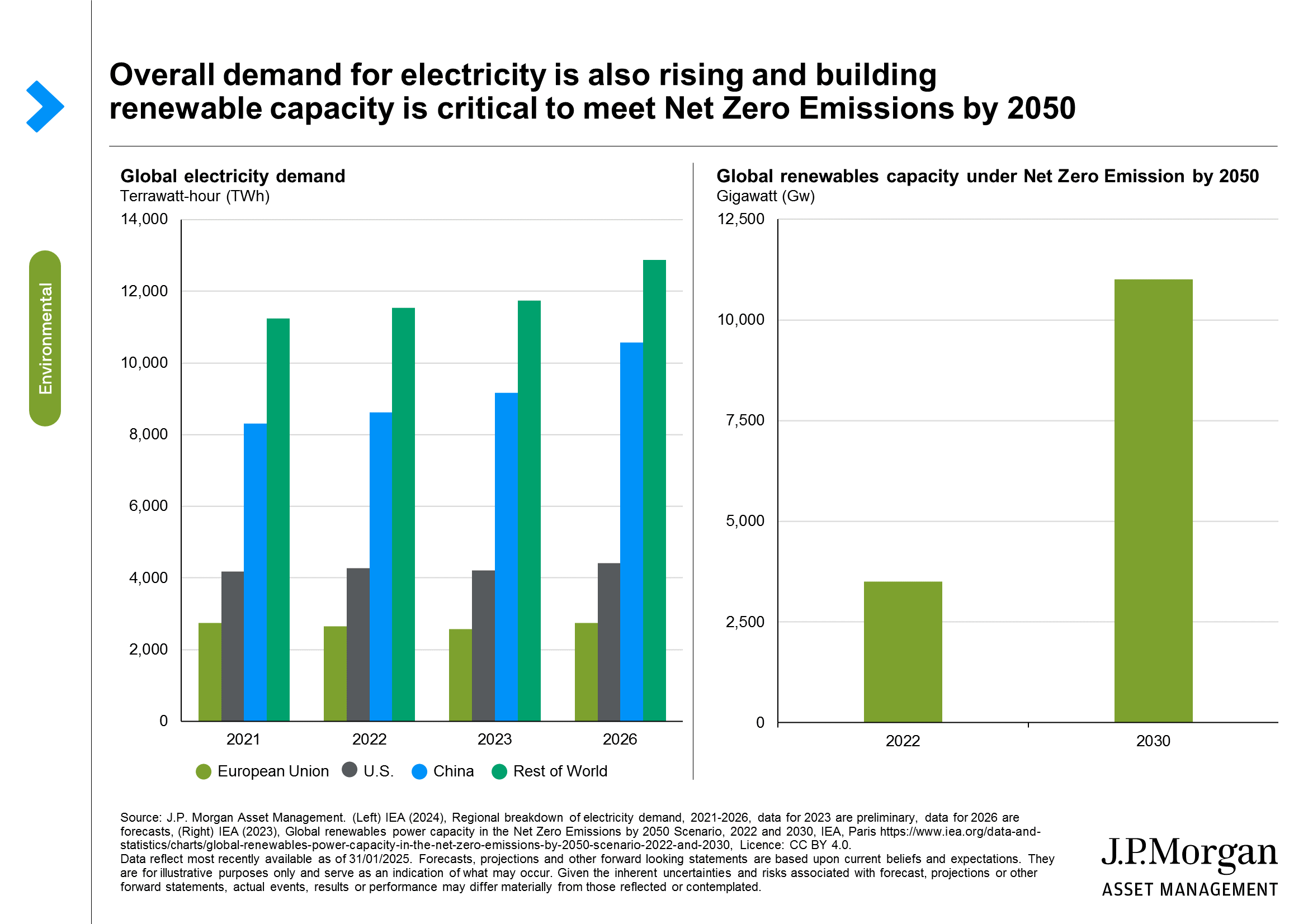

- The increasing demand for electricity is not solely a result of AI and technological advancements. Population growth, economic development, industrialization, urbanization, and the electrification of transportation all contribute to multiplying the demand for electricity.

- In particular, despite the expected slowdown in the Chinese economy, the expanding production of solar PV modules, electric vehicles, batteries, and the processing of related materials are all supporting electricity demand growth. Electricity demand growth in China continued at an estimated rate of 6.2% in 20253.

- Renewables are key to addressing electricity demand. As the IEA’s Net Zero Roadmap has outlined since 2021, achieving net-zero emissions from the energy sector by 2050 depends on the world’s ability to triple renewable energy capacity by 2030. In an ideal world, this would be when coal use declines, oil plateaus and renewables and natural gas grows substantially in 2050.

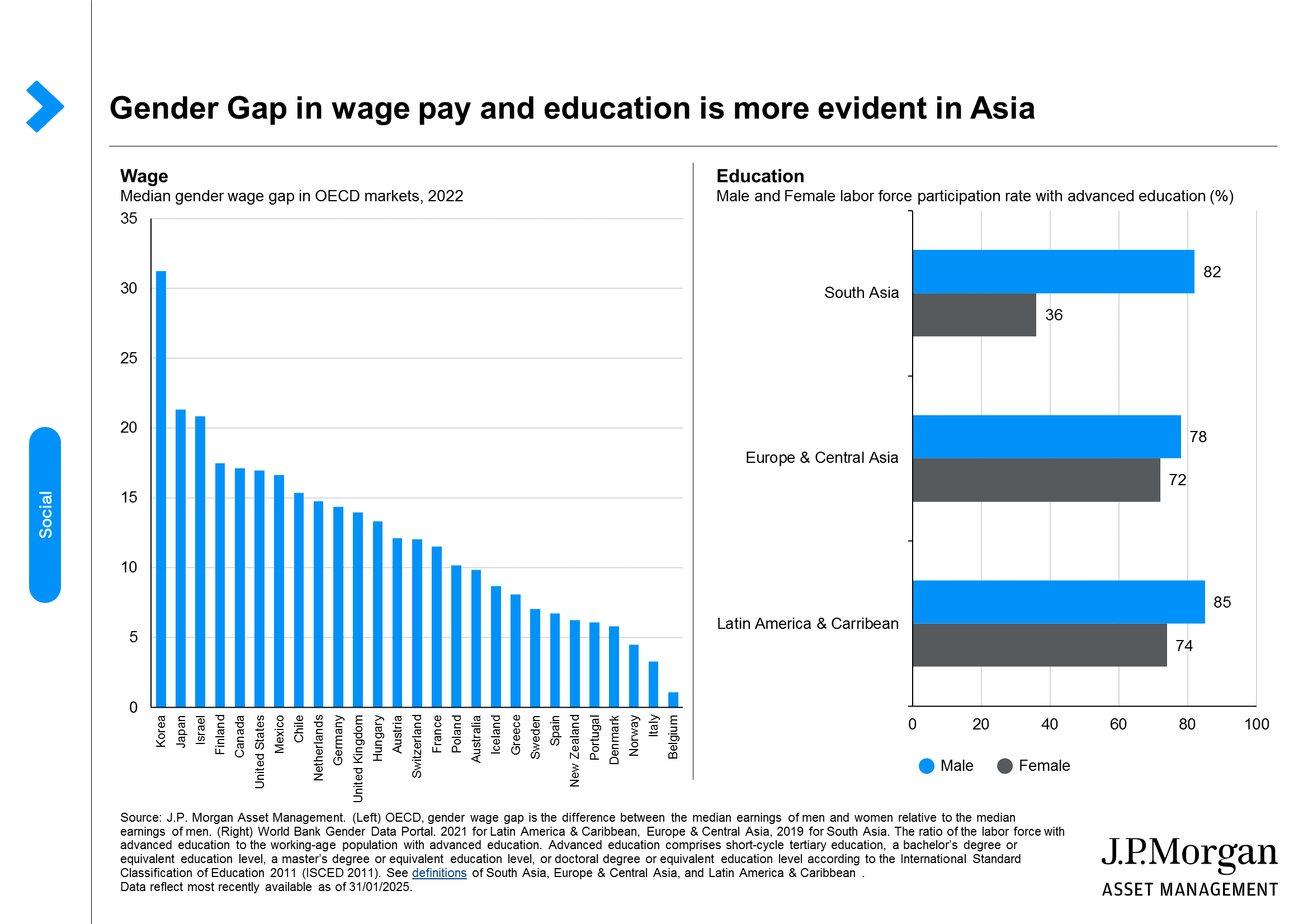

- Another social concern that remains prominent, even in developed markets, is the gender gap in wages and education. On average, higher educational attainment should lead to better labor market outcomes and higher earnings. However, these educational gains are not generally translating into labor market gains for women.

- Globally, the female labor force participation rate is 47%, compared to 72% for males. In South Asia, we see one of the lowest female labor force participation rates among women with advanced degrees, at only 36%. In contrast, the rate for men with advanced degrees is 82%. Unfortunately, this trend is similar in many other regions.

- In 2022, Korea's gender wage gap, defined as the median hourly wage difference between men and women, stood at 31.2%.

- Closing these gaps can be a central driver of inclusive economic growth. Markets could gain as much as a 20% increase in GDP per capita and a 14% increase in wealth, on average, if all gender employment gaps were closed4.

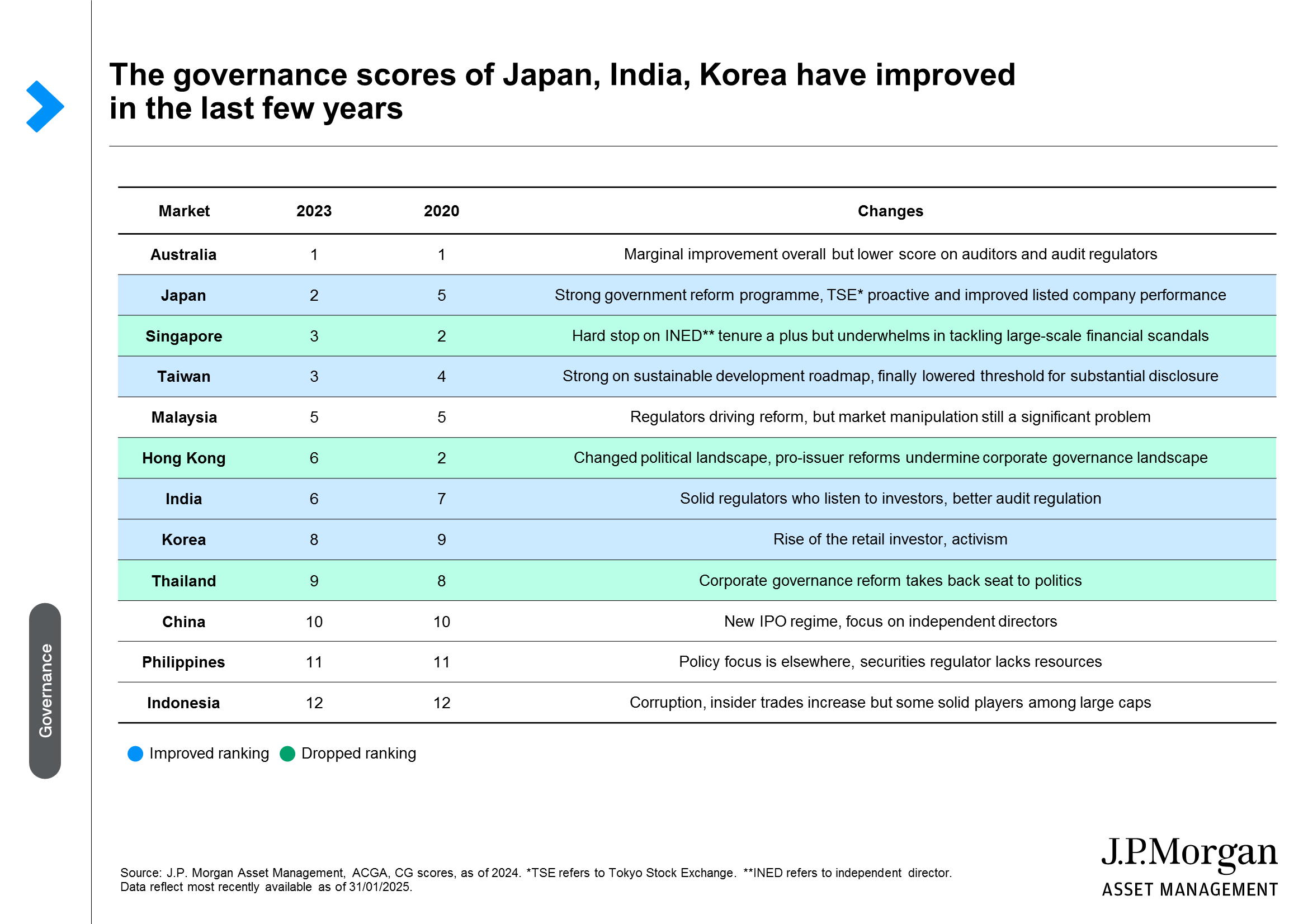

- The following table highlights the corporate governance (CG) scores for 12 markets in the APAC region.

- The biggest strides in performance came from Japan, India, and Korea, where there is clear government support for corporate governance, autonomy among securities regulators, and a healthy dose of investor activism and engagement.

- At the same time, Singapore, Hong Kong, and Thailand all moved down in ranking for mixed reasons, such as financial scandals and political instability in the regions.

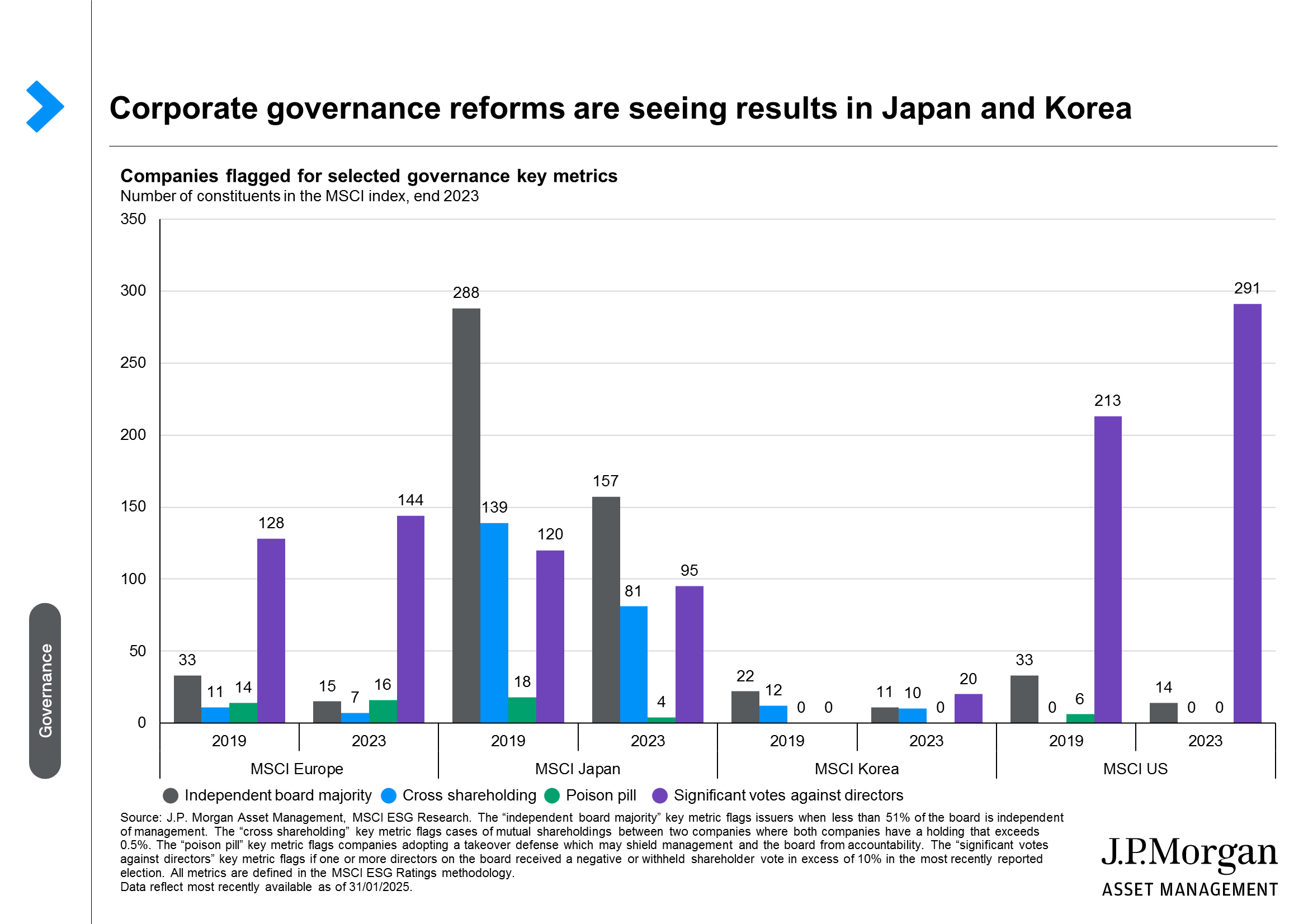

- Cross-shareholdings, which are rare in other developed markets such as Europe and the U.S., have historically been maintained by Japanese companies to support business relations. This practice has been criticized as an inefficient use of capital, with longstanding calls to unwind such arrangements. The aim of Japan’s Stewardship Code and Corporate Governance Code, established in 2014 and revised in 2018, has been to encourage alignment between shareholder and corporate interests and to promote board accountability. As a result, the number of constituents in the MSCI Japan Index flagged for cross-shareholdings significantly dropped, reflecting the progress made through the strong reform program. Simultaneously, the use of poison pills, often criticized by investors for limiting opportunities for shareholders to consider potentially favorable takeover bids, has notably declined.

- Learning from Japan, South Korea introduced a “corporate value-up program” in 2024 to encourage companies to assess their relatively low valuations, offering tax incentives and benefits for companies taking measures aimed at increasing their corporate value. Overall, the number of Korean companies flagged for cross-shareholdings is also trending down. At the same time, there has been an increase in significant votes against directors, which may indicate that investors are being more cautious about the quality of board members, as the independence of boards has reached a majority in most large companies.

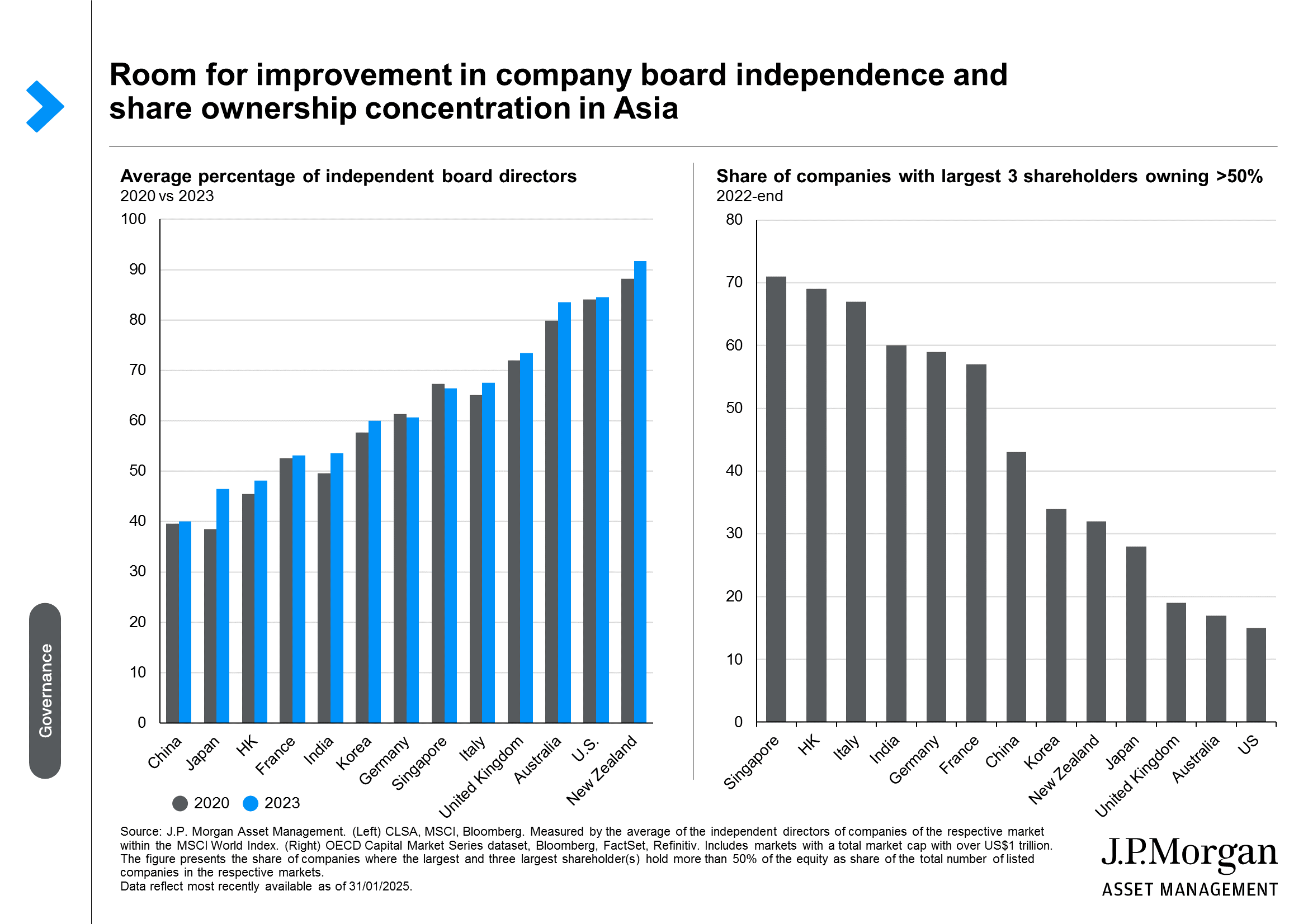

- There is a significant focus on the independence of boards and the effectiveness of their oversight functions. This includes ensuring that boards are not overly influenced by controlling shareholders or management, which can lead to conflicts of interest and poor governance practices.

- While board independence is a global issue, it is particularly pronounced in Asia due to the prevalence of family-owned businesses and conglomerates, where controlling shareholders often have significant influence over board decisions. In contrast, Western markets, especially in the U.S. and Europe, have more stringent regulations and practices to ensure board independence.

1Source: Naikwade Pratap Vyankatrao, "Impact of Climate Change on Agricultural Production in India: Effect on Rice Productivity," October 2017.

2Source: International Labour Organization, "Working on a Warmer Planet: The Impact of Heat Stress on Labour Productivity and Decent Work," July 2019.

3Source: IEA, Electricity Mid-Year Update, July 2024.

4Source: World Bank.

09j9252701095942

EXPLORE MORE