WHY INCOME INVESTING MATTERS?

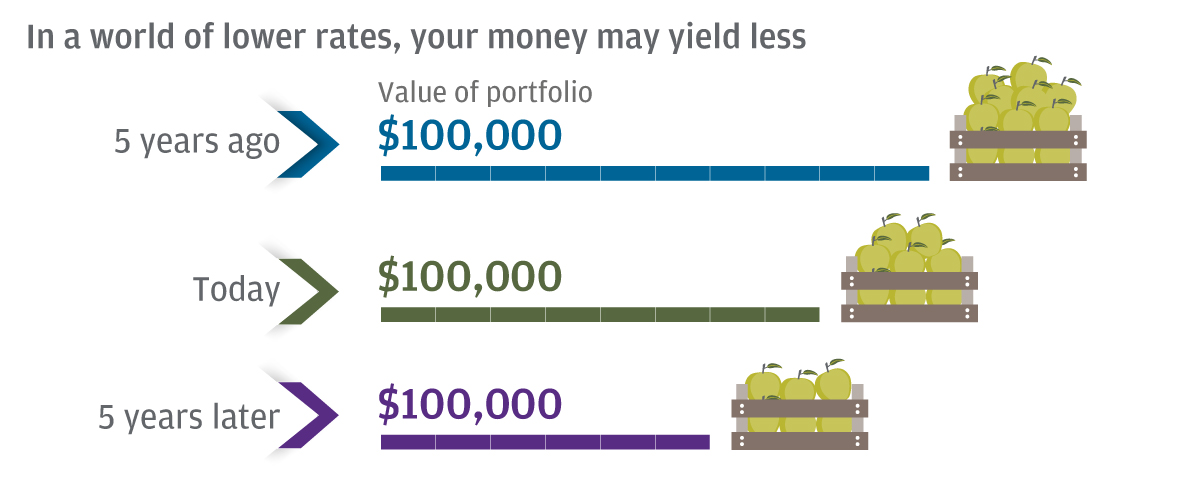

A world of lower ratesA world of lower rates

- Market uncertainties have reinforced the dovish bias for central banks. With lower interest rates, traditional income sources have come under pressure.

Market uncertainties persist

- The road to full recovery is likely to be long. Investors are increasingly looking for alternative ways to broaden the sources of income for their portfolios.

HOW DO WE HARVEST INCOME OPPORTUNITIES?

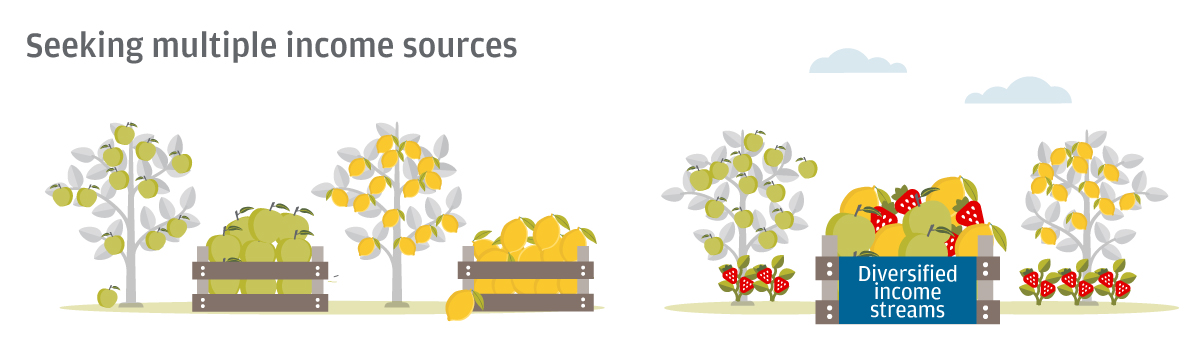

Seeking multiple income sourcesSeeking multiple income sources

- Market volatility and lower yields are expected to stay. By differentiating and investing via a flexible approach, investors can harvest income from different sources across different asset classes and regions.

Seeking diversification

- Asset class performance varies under different market conditions. A diversified portfolio is better positioned to manage risks while paving the way for consistent performance.

Returns, income or yields are not guaranteed. Value of investments or income accruing from them may rise or fall.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

This information is generic, not tailored to any specific individual circumstances and should not be construed as investment advice. Risk management does not imply elimination of risks. Investments involve risks and are not similar or comparable to deposits, not all investments are suitable for all investors. Please seek financial advice and make independent evaluation before investing.