Hello. My name is Gabriela Santos, and I'm a Global Market Strategist here at JP Morgan Asset Management. Welcome to On the Minds of Investors. Today's topic is, what will the reopening of the economy look like?

Now over the past two months, investors have digested this COVID-19 shock, the fast spread of the virus around the world, all the social distancing measures implemented, and the resulting economic and earnings recession. Now investors are looking to the future, specifically to how global economies can reopen.

And really, optimism in this regard has been driving stocks off their lows and credit spreads off their highs over the past couple of weeks. And indeed, here there has been some good news.

The curve of new cases has begun to decline in Italy, Spain, Germany, and has begun to plateau in the US. However, this decline in the growth rate of new cases is not the end of the story. Instead, it's the beginning of a new chapter. And this new chapter will be long and complicated as the health care issue is going to remain the main protagonist, driving each twist and turn.

And this is really because there's still no vaccine or successful treatment available, so it's impossible to go back to normal life overnight without causing another spike in cases. So turning the economy back on, it's not going to be like a light switch. It'll be more like a dimmer, a slow, gradual process with differences in brightness between countries and sectors.

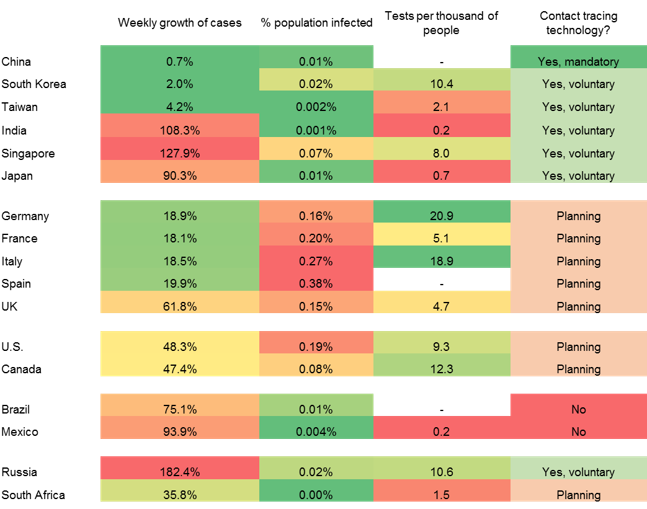

So in order for an economy to turn back on and for confidence to return in a sustainable way, it'll be very important to have a health care plan in place. So in addition to a slowdown in new cases, it'll be crucial for countries to have sufficient testing capacity as well as broad capabilities to track infected individuals and trace their contact with others.

And when we look globally, we see big differences in where countries are in this new chapter. Now, some countries in Asia like China, Korea, and Taiwan stand out as being particularly well positioned. They have very low growth rates of new cases at this point, a small percentage of the population infected, testing capacity, and contact tracing programs in place. Germany also looks well positioned, especially with regards to its testing capabilities. Now, the US looks to be lagging a bit behind these countries with regards to the start of reopening and also with the testing and contact tracing programs.

Now, looking at Asia's experience with the reopening, we can see that even in well-prepared countries, the reopening needs to happen gradually. So for example, China is now open, but life has not fully returned to normal. Factories have reopened, so bringing its manufacturing PMI above 50 in March.

However, services activity still remains far below normal with China services PMI rising during the month, but still remaining at a low 43. This suggests that services will be more gradually reopened within countries, especially discretionary retail, restaurants, leisure, hotels, and air travel.

Now, EM Asia also looks particularly well positioned in this regard because these sectors only represent 2.7% of its equity market versus 5.9% in the US. Now, once a vaccine is readily distributed in 2021, the true economic and earnings recovery will begin. Until then, the story will still be difficult, suggesting that investors should remain cautious, focusing on quality in portfolios.

While this usually leads investors to focus very heavily on the US, I think at this point, Asia in particular deserves a closer look, given its better positioning in the health care issue, its earlier recovery, and its sectoral composition.

This content has been produced for information purposes only, and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the recipient.

The material was prepared without regard to specific objectives, financial situation, or needs of any particular receiver. Any research in this asset has been obtained and may be acted upon by JP Morgan Asset Management for its own purpose.

The results of research are being made available as additional information and do not necessarily reflect the views of JP Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends, or investment techniques and strategies expressed are those of JP Morgan Asset Management unless otherwise stated as of the date of production. They are considered to be reliable at that time, but no warranty as to the accuracy and reliability or completeness in respect of any error or omission is accepted. They may be subject to change without reference or notification to you.

JP Morgan Asset Management is the brand for the Asset Management business of JPMorgan Chase & Co. and its affiliates worldwide. JPMorgan Distribution Services Incorporated, copyright 2020, JPMorgan Chase & Co.

Over the past two months investors have digested the COVID-19 shock: the fast spread of the virus around the world, the social distancing measures implemented and the resulting economic and earnings recession. Investors are now looking to the future, specifically to how global economies can reopen. Optimism in this regard has been driving stocks off their lows and credit spreads off their highs over the past couple of weeks.

Indeed, there has been good news: the curve of new cases has begun to decline in Italy, Spain and Germany, while beginning to plateau in the U.S. However, this decline in the growth rate of new cases is not the end of the story; instead, it is the beginning of a new chapter. This new chapter will be long and complicated, as the health care issue remains the main protagonist driving each twist and turn.

Given that there is no vaccine or successful treatment available yet, it will be impossible to go back to normal life overnight without causing another spike in new cases. Turning the global economy back on will not be like a light switch, it will be more like a dimmer: a slow, gradual process with differences in brightness between countries and sectors.

In order for an economy to turn back on and for confidence to return in a sustainable way, it will be paramount to have a health care plan in place. In addition to a slowdown in new cases, it will be crucial for countries to have sufficient testing capacity for its population, as well as broad capabilities to track infected individuals and trace their contact with others.

Looking globally, we can see a big difference in where countries are in this new chapter. Some countries in Asia, like China, Korea and Taiwan stand out as being particularly well positioned: with very low growth rates of cases, a small percentage of the population infected, testing capacity and contact tracing programs in place. Germany also looks well positioned, especially with regards to its testing capabilities. The U.S. looks to be lagging a bit behind these countries, with regards to the start of reopening and also with testing and contact tracing programs.

Looking at Asia’s experience with reopening, we see that even in well prepared countries, the reopening needs to occur gradually. China is now “open”, yet life has not fully returned to normal. Factories have reopened, bringing its manufacturing PMI above 50 in March. However, services activity still remains far below normal, with China’s services PMI rising during the month, but still remaining at a low 43. This suggests that services will be more gradually reopened within countries, especially discretionary retail, restaurants, leisure, hotels and air travel. EM Asia also looks particularly well positioned in this regard, with these sectors only representing 2.7% of its equity market versus 5.9% in the U.S.

Once a vaccine is readily distributed in 2021, the true economic and earnings recovery will begin. Until then, the story will still be difficult, suggesting that investors should remain cautious, focusing on quality in portfolios. While this usually leads investors to focus more heavily on the U.S., Asia in particular deserves a closer look, given its better positioning in the health care issue, its earlier recovery, and its sectoral composition.

Readiness to reopen economies varies significantly by country

Source: John Hopkins University, Our World in Data, J.P. Morgan Asset Management. Testing data are as of most recently available. Data are as of April 15, 2020.

0903c02a8288be34