Projections for stronger portfolios

Our assumptions see attractive real return potential, while differentiation across assets provides a richer hunting ground for active investors .

Topics

Matrices

Our expectations for returns, volatilities and correlations. Use our interactive version to download the excel in your chosen currency.

The assumptions are not designed to inform short term tactical allocation decisions. Our assumptions process is carefully calibrated and constructed to aid investors with strategic asset allocation or policy-level decisions over a 10- to 15-year investment horizon.

Download Excel and PDF matrices by currency

Assumptions

Examine our return projections by major asset class and the thinking behind the numbers.

Long-Term Capital Market Assumptions: Methodology Handbook

A companion volume to dive deeper into our LTCMAs’ building blocks

- Executive Summary

- Macroeconomic

- Public markets

- Private markets

- Volatility, Correlation and Portfolio Implications

EXECUTIVE SUMMARY

Shifting landscapes and silver linings

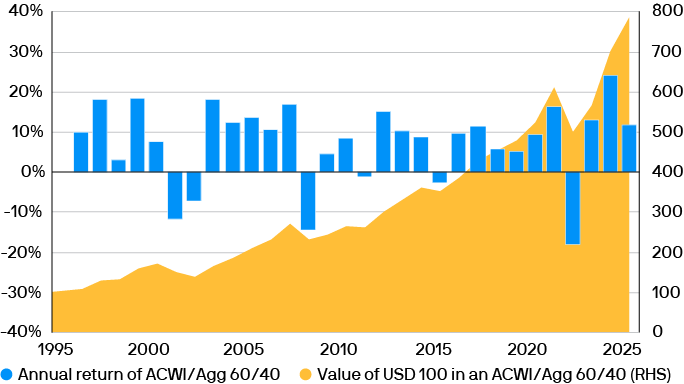

A steady exposure to stocks and bonds has stood the test of time over the last three decades

Growth of 60/40 over 30 years, and average returns through the period

Source: Bloomberg, J.P. Morgan Asset Management; data as of September 30, 2025.

MACROECONOMIC ASSUMPTIONS

Resilient growth and warmer inflation

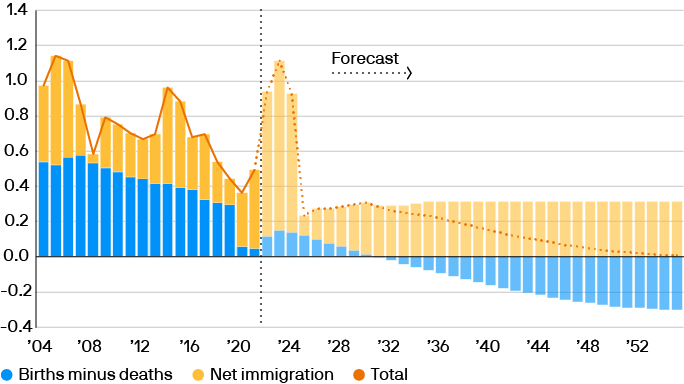

Tighter immigration policies appear set to pull U.S. labor force growth toward zero

Contributions to U.S. population growth (% change y/y)

Source: Congressional Budget Office, J.P. Morgan Asset Management; data as of September 30, 2025.

PUBLIC MARKET ASSUMPTIONS

Resilient profits, higher yields

Uncertainty about policymaking stability and safe-haven appeal has raised Treasuries’ term premium

Expected yield curve slope

Source: J.P. Morgan Asset Management; data as of September 30, 2025.

PRIVATE MARKETS AND ALTERNATIVE ASSET ASSUMPTIONS

Powerful market forces set capital in motion

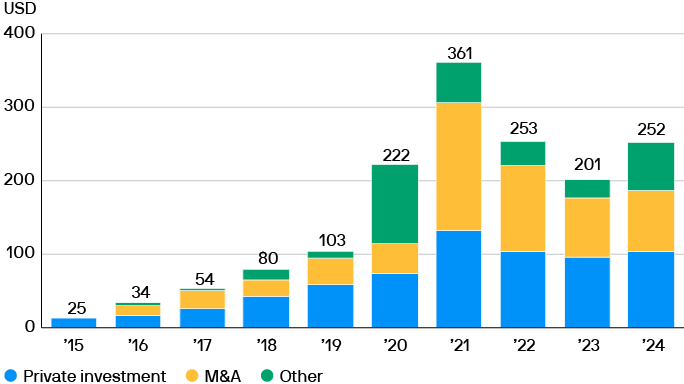

Globally, AI investment continues to drive significant deal flow

Global corporate investment in AI (by type), USD bn

Source: Stanford University Artificial Intelligence Index Report, J.P. Morgan Asset Management; data as of September 30, 2025.

Volatility, Correlation and Portfolio Implications

Changing portfolio construction in a shifting landscape

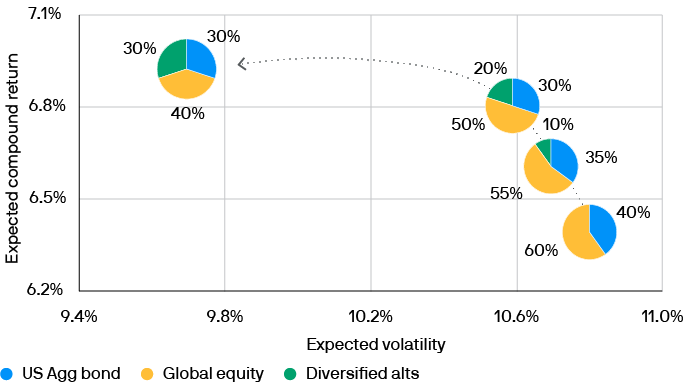

Portfolios that include alternatives can improve risk-adjusted returns, but the 60/40+ can vary

Projections for portfolio returns and volatility, based on 2026 LTCMA figures

Source: J.P. Morgan Asset Management; data as of September 30, 2025. Diversified alternatives allocation includes global real estate, global real assets, private credit, hedge funds and private equity.

Download this year's Long Term Capital Market Assumptions report