As economists continue to revise down their 2020 GDP estimates, a lot of clients have been asking us about the potential impact on earnings. While there are still questions surrounding when the recession will officially begin, this is something we will only know with hindsight. More importantly, there seems to be agreement that 2Q20 will see a sharp drawdown in GDP before the economy normalizes into the end of the year.

So what does this mean for earnings? As we have written in recent months, earnings growth decelerated for the better part of 2019 on the back of falling profit margins. Coming into this year, we expected that earnings growth would shake out in the low single-digits, an estimate well below that of consensus. With the rapid growth of COVID-19 and significant decline in energy prices, we now expect that earnings will contract for 2020 as a whole. However, given the unique nature of this particular recession, gauging how much earnings will fall is a bit of a challenging exercise.

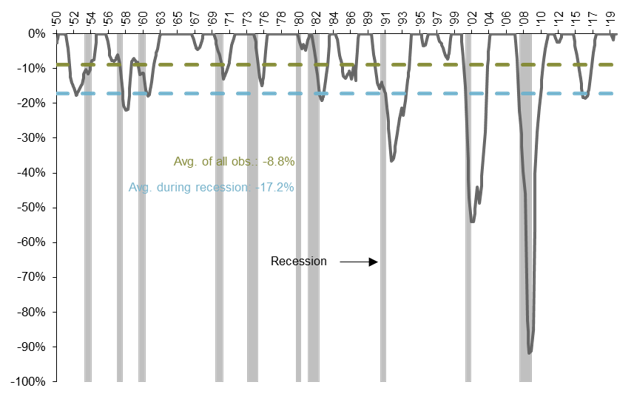

The chart below looks at drawdowns in S&P 500 earnings per share (EPS), as reported by Robert Shiller, since 1950. As you can see, not every earnings recession was accompanied by an economic recession, but every economic recession was accompanied by an earnings recession. Furthermore, the average decline in S&P 500 EPS during economic recession was -17.2%. Our own models currently point to a drawdown in earnings of -15.2%, well below current consensus estimates and generally in line with the historical experience.

That said, markets are forward looking. As the clouds begin to break, the market will start to price in a “virus-free” run-rate for earnings. At that point, equities should resume their upward ascent. Given this outlook, we are focused on quality companies in the short/medium term. This leads us to sectors like consumer staples, technology and health care; more broadly, we like companies with low leverage, solid margins, and some sort of pricing power. Longer-term, however, investors should use valuation as a guide. Financials and energy both look cheap, and along with the other cyclical sectors, will likely lead the rebound when it does eventually occur. Because this event is transitory, the prudent investor will view it as a buying opportunity, while understanding that volatility is unlikely to subside anytime soon.

Earnings tend to contract by about -20% during economic recessions

% DRAWDOWN FROM PREVIOUS PEAK

Source: Robert Shiller, FactSet, J.P. Morgan Asset Management.

0903c02a8284e041