Global high yield markets have been hit particularly hard by the recent volatility, as the coronavirus has spread globally. This risk off sentiment has really damaged this very sensitive part of the asset world.

The collapse in oil prices, combined with quarantines and lockdowns, have particularly damaged the global high yield universe. Spreads have now widened to roughly 1,000 basis points, and that's some of the highest that we've seen since the financial crisis.

In the last few weeks, the conversation has really turned from one of, say, upgrades and spreads, which is what we talk about in the good times, to one of downgrades and defaults, which has really occurred in the darker days.

Over the next few weeks, I think the big question on the top of a lot of investors' minds is what we see from downgrades, defaults, and subsequent recovery rates. Within the downgrade space, we estimate that there may be nearly 500 billion of investment grade debt eligible for downgrade in the coming few quarters.

These fallen angels, as the industry term for them goes, present a challenge for high yield managers who have to absorb those downgraded issues into their index. Defaults is also a concern as well. Two big sectors within the high yield universe are consumer cyclicals and energy, that have been right in the crosshairs of the virus challenges.

But we also need to remember that in the event of a default, you often don't lose your entire principal. Recovery rate is an important component in that equation. Again, there is some troubling news. Recovery rates for 2019 were at just 25%. Their long run average is closer to 45%. And this 25% figure for last calendar year was a record low level.

But despite all this doom and gloom, I think investors need to think about the long term. Spread levels at this juncture typically point to pretty strong returns, an average of around 18% to 20% over the next 12 months from current spread levels.

But things may get worse before they get better, as we start to understand the full scale of damage that the virus has done and we understand the challenges on the downgrade and default-scape better in the coming couple of weeks.

This content has been produced for information purposes only. And as such, the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto.

Reliance upon information in this material is at the sole discretion of the recipient. The material was prepared without regard to specific objectives, financial situation, or needs of any particular receiver.

Any research in this asset has been obtained and may have been acted upon by JP Morgan Asset Management for its own purpose. The results of such research are being made available as additional information, and do not necessarily reflect the views of JP Morgan Asset Management.

Any forecasts, figures, opinions, statements of financial market trends, or investment techniques and strategies expressed are those of JP Morgan Asset Management, unless otherwise stated, as of the date of production. They are considered to be reliable at that time, but no warranty as to the accuracy and reliability or completeness in respect of any error or omission is accepted.

They may be subject to change without reference or notification to you. JP Morgan Asset Management is the brand for the asset management business of JPMorgan Chase and Company and its affiliates worldwide. JP Morgan distribution Services Inc. Copyright 2018, JPMorgan Chase and Company.

Global high yield markets have been rocked by recent volatility, with risk-off sentiment, in the face of the spread of COVID-19, compounded by a collapse in oil prices driving the asset class down -16% year-to-date. But these miserable returns should not come as too much of a surprise to investors, as the asset class can be quite capricious. During good times, the discussion tends to be centered on spreads and rating upgrades; during tough times, the conversation tone sours.

High yield spreads have now widened to roughly 1,000bps, the highest level since the Global Financial Crisis. As a result, the conversation has now shifted, with investors paying attention to three key variables:

- Downgrades: High yield managers will have to absorb “fallen angels” into their benchmarks. “Fallen angels” are downgraded issuances that were previously trading with an investment grade rating. Forecasts suggest as much as 500bn USD of issuance might be downgraded to junk by the end of 2020, a record high, if achieved.

- Defaults: As an economy enters recession, defaults often begin to rise. Unfortunately, the composition of the global high yield market makes it especially vulnerable to the current state of affairs. Consumer-cyclicals and energy, two sectors that have come under pressure in recent weeks, make up 15% and 6% of the market, respectively.

- Recovery rates: In the event of a default, not all of the principal debt is always lost and investors can sometimes recoup some losses. However, recovery rates have been trending lower in recent years. In 2019, U.S. recovery rates were at just 25%, versus a 25-year average of 45%. This is a record low level.

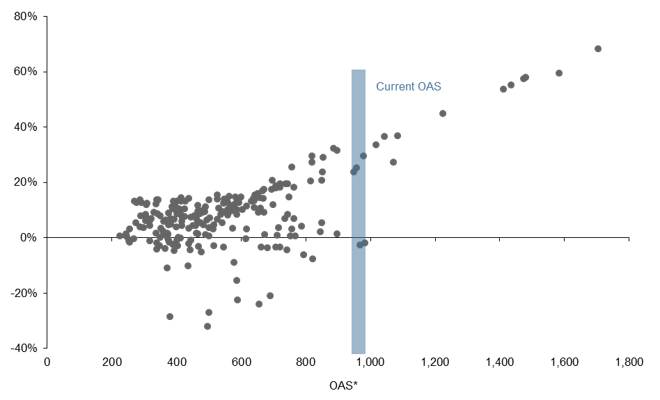

But despite all of these headwinds, there may still be some opportunity for patient, risk-tolerant and long-term investors. The chart below looks at starting spreads and subsequent 12-month returns over the last 30 years. While there are a few instances where spreads have continued to widen from current levels, the average return has been approximately 18% over the subsequent 12-months. As a result, for the right investor, today’s objectively complicated credit market may be an excellent source of future portfolio growth.

Global High Yield OAS versus subsequent 12-month return

Source: Bloomberg, Barclays, FactSet, J.P. Morgan Asset Management. Index is Bloomberg Barclays Global High Yield. *OAS is Option Adjusted Spread Data are as of April 7, 2020.

0903c02a82876029