Should I expect a market correction?

The S&P 500 has marched steadily higher from its March 23rd low against a backdrop of investor skepticism. In previous posts, we have discussed how this rally is being driven by three things – a slowdown in COVID-19 case growth, the aggressive fiscal & monetary policy response and an expectation that a v-shaped recovery in corporate profits will materialize. While we acknowledge that case growth has slowed and the policy response has been significant, we are not as confident that S&P 500 earnings per share will hit a new all-time high next year.

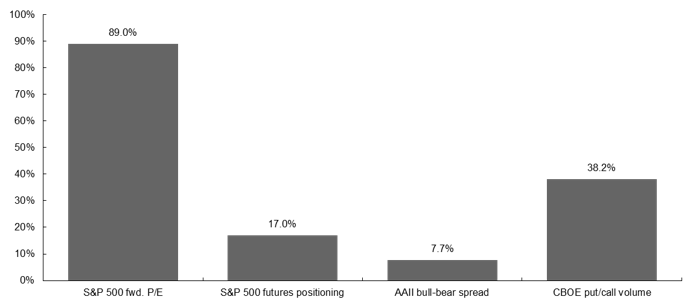

Importantly, however, if everyone is expecting a correction to materialize, can that end up delaying the inevitable? We often look for signs of excess or complacency to identify times when the market may have moved too far, too fast. However, we struggle to see too many signs of this at the current juncture. S&P 500 futures positioning remains net short, the AAII bull/bear survey is not showing signs of reckless optimism, and the put/call data is only starting to show signs of complacency. One could argue that valuations are stretched – and they would probably be right – but valuations don’t tell you much about near-term performance. The market doesn’t need a whole lot of good news, it just needs bad news to remain at bay.

That said, at some point, markets will pull back. This could be caused by any number of things: a reacceleration in case growth, any sign that policymakers are starting to reign in stimulus, or a failure on the part of the labor market to rebound in line with expectations. As long as these things do not materialize, equities will likely avoid retesting the March 23rd lows; at the same time, however, reaching a new all-time high in the near term seems unlikely.

Against this backdrop, volatility looks set to remain elevated; remember, it took over a year for the VIX to drop below 20 after peaking in November 2008. As such, we expect the market will be range bound going forward, but cyclical value could outperform growth as the data improves. As such, we maintain our preference for quality companies, but are increasingly comfortable taking a bit more risk.

Markets don’t look stretched outside of valuations

Percentile rank compared to history*

Source: AAII, CBOE, CFTC, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. * Percentiles are based on a 25- year period for the forward P/E ratio and AAII bull-bear spread. Percentiles are since 9/1/2000 for S&P 500 futures positioning and 9/27/1995 for CBOE put/call volume.

0903c02a828edfcb