Global markets have roiled in the face of COVID-19 and social distancing, and many investors are looking to “pick up the pieces,” eagerly hunting for the next big opportunity. Given the dramatic dislocations still present in markets, a number of potential candidates have presented themselves. With the Russell 2000 having significantly underperformed the S&P 500 year-to-date, it is tempting for investors to wonder: is now the time to invest in small cap stocks?

When assessing the viability of small caps at the current juncture, relative price performance is only one of the many necessary considerations. Instead, investors should focus on three key relative metrics: sector weights, earnings potential and financial health.

- Sector weights: Whereas the largest sector weighting in the S&P 500 is technology (just over 25%), tech plays a comparatively smaller role in the Russell 2000 (15%). Instead, small cap U.S. equities are dominated chiefly by Health Care (roughly 23%). Moreover, the Russell 2000 is much more heavily exposed to cyclical stocks, particularly Financials and REITs (16% and 7%, respectively) than the S&P 500 (11% and 3%, respectively).

While a tilt in favor of Health Care could be beneficial given the current health crisis, the underweight to technology and, perhaps more importantly, the overweight to highly sensitive sectors, put small cap stocks at a disadvantage as long as the pandemic persists.

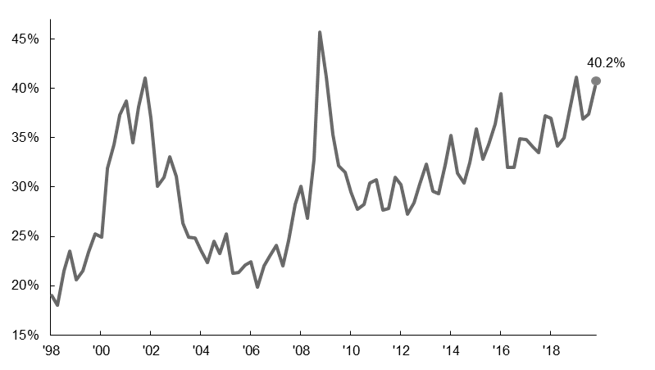

- Earnings potential: Small cap earnings quality is, generally speaking, low. As seen in the below chart, roughly 40% of the Russell 2000 currently has negative earnings, a trend that started in the aftermath of the financial crisis, with low interest rates providing support for otherwise unprofitable businesses.

Moreover, consensus estimates for 2020 small cap earnings growth are far worse than for large cap companies, and revisions have been more severe: Russell 2000 EPS is expected to contract by 43% in 2020, compared to 18% for the S&P 500; and small cap EPS growth has been revised down 52 percentage points year-to-date, compared to 27 percentage points for the S&P 500. This contraction in earnings estimates has put significant upward pressure on small cap valuations, which are now quite rich relative to history.

- Financial health: Small cap companies have a significantly greater debt burden than large cap companies. With a net debt-to-EBITDA ratio roughly three times the size of that for large cap stocks, the Russell 2000 is highly leveraged at a time when companies will likely be adding to their debt burden. Rising leverage, likely a broad outcome of the current crisis, will be felt acutely, particularly in small cap names.

Looking forward, elevated uncertainty suggests that the most prudent course of action is one of caution, rather than aggression. For this reason, it seems that quality above all else should be the focus of most investment portfolios; given the struggles outlined above, that focus should preclude an overweight to small cap stocks. Instead, investors must temper their expectations and remain patient. There will likely be a time for small caps to recover in the future, but now is not it.

Nearly half of Russell 2000 companies have negative earnings

% of Russell 2000 companies with negative earnings

Source: FactSet, FTSE Russell, J.P. Morgan Asset Management. Data are monthly and as of April 28, 2020.

0903c02a828aa072