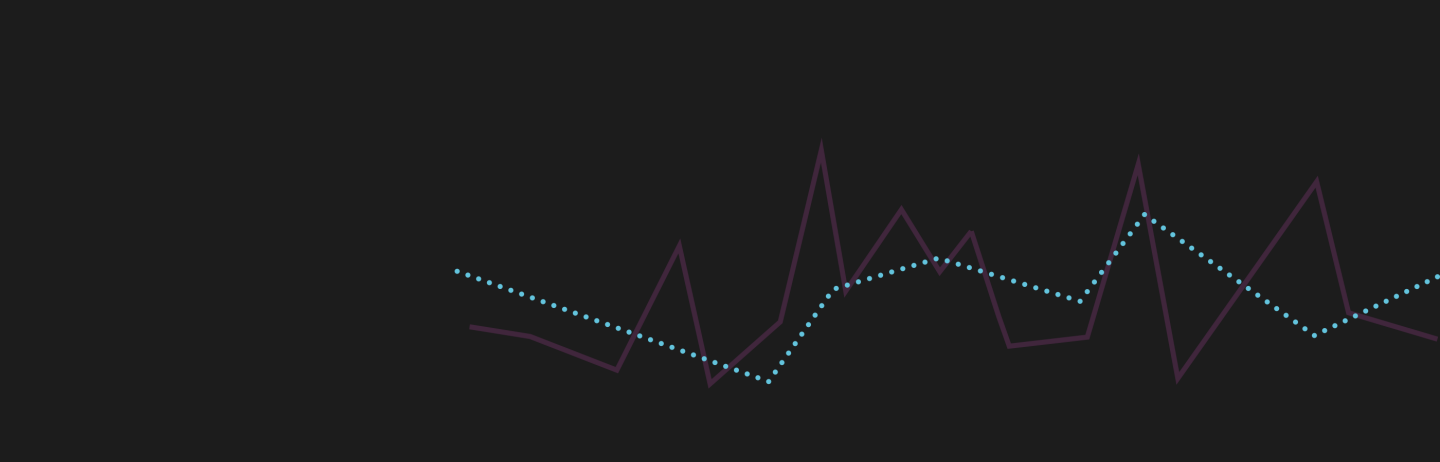

In our December, 2019 paper, “The Coming Pension Cambrian Explosion,” we discussed how the evolution of pension strategy against the backdrop of prevailing market conditions was setting the stage for an expansion beyond the traditional hedge portfolio opportunity set. A couple months later, to say “things are different” would be an understatement. With the benefit of hindsight, diversifying away from long corporates would have paid off during Q1 (Exhibit A). Bill Belichick, whose overarching ethos is simply “do your job”, would have been satisfied with the performance.

Exhibit A: Q1 Public Market Returns – Diversifiers Did Their Job

CML = Commercial Mortgage Loan

Source: J.P. Morgan Asset Management, Barclays Live, Morgan Markets, Bloomberg, BAML ICE

But with this outperformance in the rearview mirror, is it too late to diversify?

We think the answer is an unequivocal no!1 Through the COVID-19 crisis, the forces driving the benefits of hedge portfolio diversification have endured, if not strengthened. In the remainder of the piece we will revisit each of these catalysts, exploring how they been reshaped over the course of the year.

[1] To put this punctuation in proper context, it is my first published incidence of an exclamation point. I only use them sparingly and when I truly mean it!

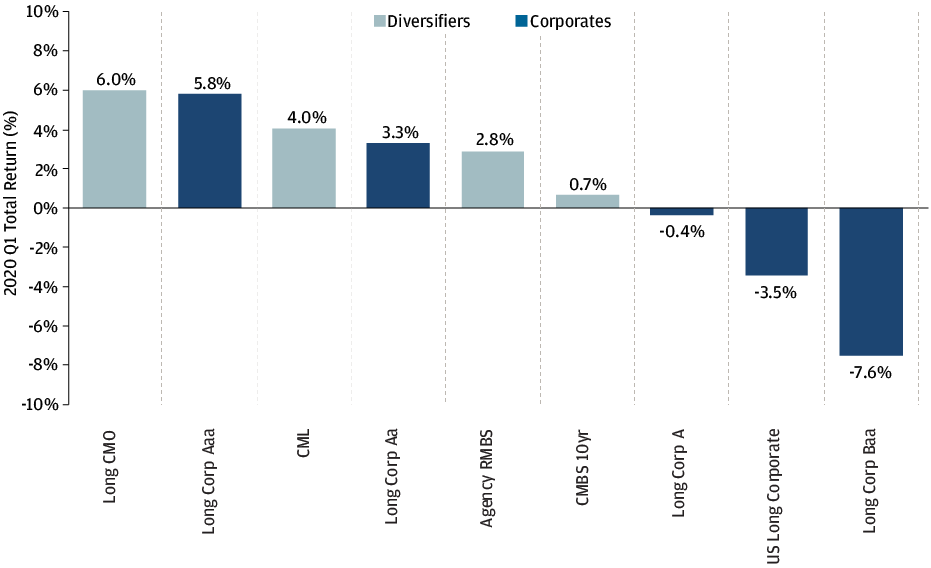

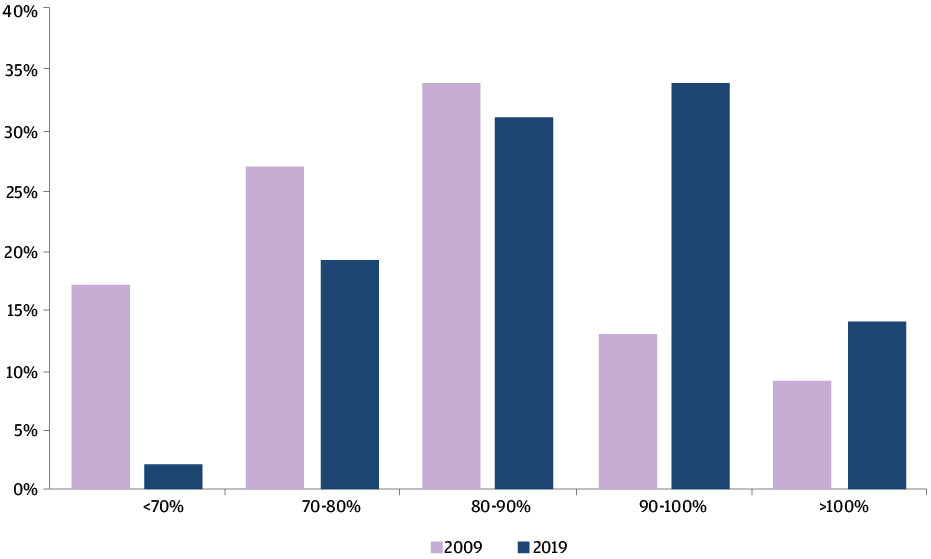

3 forces driving the benefits of hedge portfolio diversification

Hedge portfolios: larger & growingOver the last decade, hedge portfolios have grown larger as a function of funded status driven glidepath allocation shifts (Exhibit B) and a structural transformation away from “total return” and towards “liability aware” frameworks. In our recent paper “Into the Unknown” we estimated the largest plans experienced Q1 funded status drawdowns of anywhere between 5% and 15%. Subsequently, the S&P500 has rallied back more than 13% and funded status levels have rebounded, albeit not fully recovered. Without rebalancing, a 50% US Long Gov/Credit, 50% S&P500 would have almost reached 60/40 (Exhibit C). Given the relative performance of stocks and bonds, some plan sponsors have rebalanced back towards their strategic allocations while many are waiting patiently for opportunities to emerge, reallocating only as required to the outer edges of their strategic bands. A few sponsors have even re-risked, temporarily reversing their glidepaths to take advantage of perceived dislocations.

Despite these allocation shifts, we would be surprised to see any meaningful downsizing in hedge ratios and expect hedge portfolios to continue to increase in size. Given interest rate levels today, we don’t necessarily think adding duration provides great relative value, even on a surplus risk-adjusted basis. However, for those plan sponsors who have already constructed sizeable hedges, the benefits of a diversification strategy can be palpable.

Exhibit B: Top 100 Plans: GAAP Funded Status Distribution 2009 versus 2019

Source: JPMorgan, 10-K Filings, Capital IQ

Exhibit C: Allocation Drift of 50% US Long Gov/Credit, 50% S&P500 Portfolio

Source: JPMorgan, Bloomberg

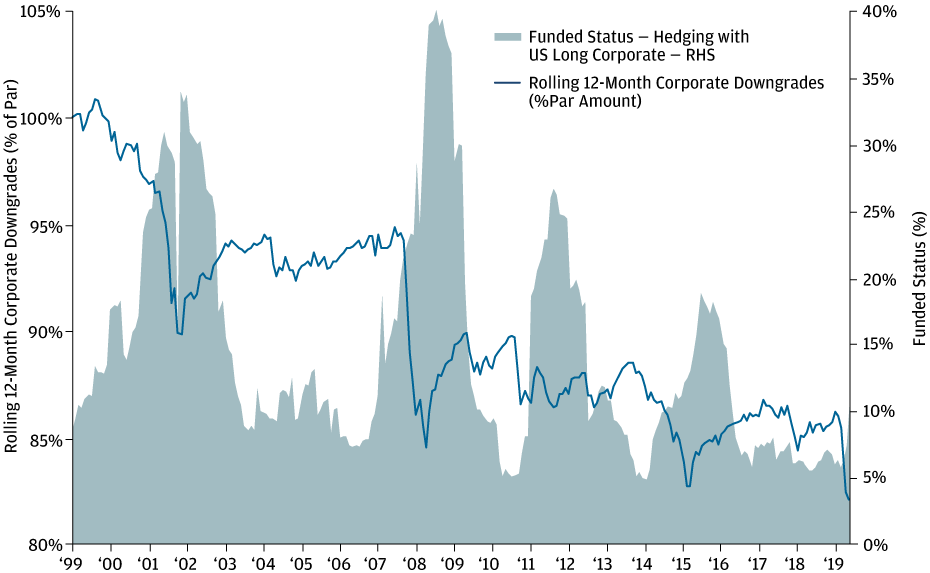

Over the last twenty years, a hypothetical pension plan hedged with a duration-matched corporates portfolio would have experienced funded status losses of between 25 and 75bps per annum due to the asymmetric impact of downgrades and defaults on the asset portfolio and liabilities. Exhibit D plots this hypothetical hedge portfolio performance versus rolling corporate downgrades. We can clearly see large gaps down in funded status coincide with an increase in downgrade volume.

Exhibit D: Funded Status Slippage & Corporate Downgrades

Source: JPMorgan, BAML ICE, Bloomberg

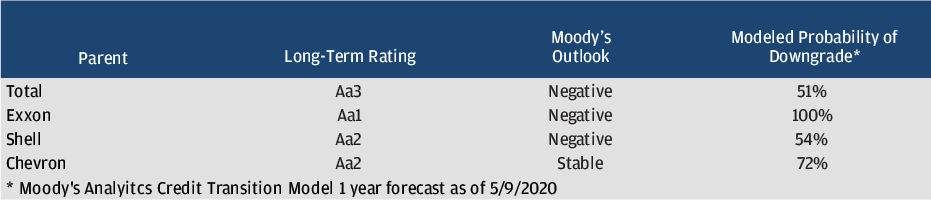

Already heavily concentrated among a limited number of issuers, high quality corporate indices currently exhibit elevated downgrade risk, increasing the threat of further funded status slippage. As of April 30th, the currently susceptible (Exhibit E) energy sector contributes about 25% of the total spread duration to the universe of Aa corporates used to construct liability discount curves. Should these issuers be downgraded below Aa1, they would fall out of the discount curve, causing a spike in liabilities, while concurrently detracting from hedge portfolio returns.

Exhibit E: Aa Corporate Energy Sector Issuers

Source Barclays, Moody’s, JPMorgan

* Moody’s Analytics Credit Transition Model 1 year forecast as of 5/9/2020.

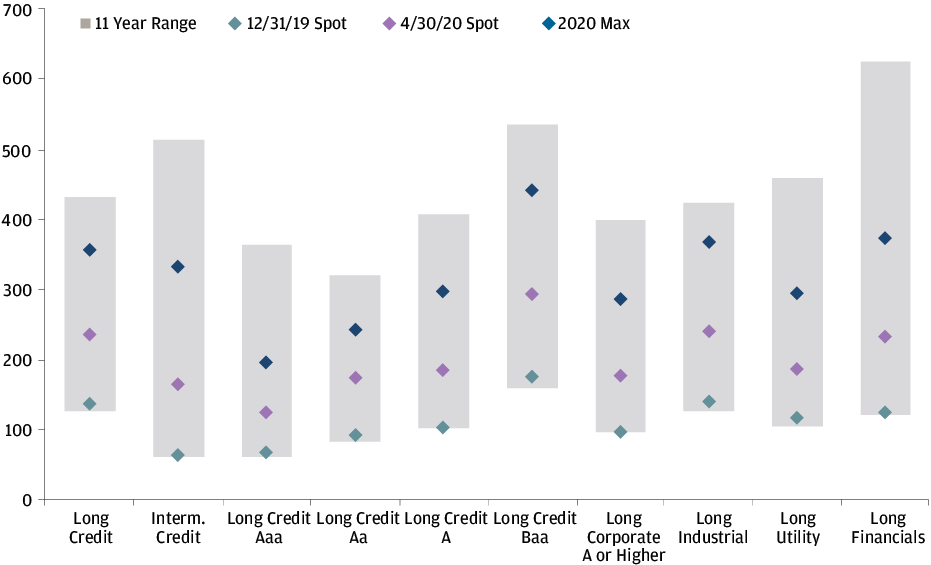

Coming into 2019 with long corporate spreads near all-time tights, there were widespread concerns about a deterioration in credit quality and increased leverage in investment grade corporates. While spreads are still higher year-to-date, they have retraced much of their widening (Exhibit F) and the areas of concern have only destabilized further.

Exhibit F: Investment Grade Credit Spread Ranges

Source: JPMorgan, Bloomberg

Debt levels have continued to increase with $150bn of net investment grade issuance in March and another $300bn in April. Investment grade net issuance through April 2020 is 3.6x the same 4-month period during 2019 and 1.6x times the entire 2019 annual net issuance. At the same time earnings expectations have plummeted. If you were worried about corporate leverage in 2019, you’re probably alarmed by now.

In Summary

Historical, and current, periods of market stress have borne out the benefits of a hedge portfolio diversification strategy. In our “The Coming Pension Cambrian Explosion” publication we estimated that over long periods of time, allocating 20-30% of a corporates hedge portfolio to credit diversifiers could minimize funded status volatility. While the optimal weights will vary with market conditions and market structure, we think the needs for such a strategy are particularly relevant today, with the current downgrade cycle and its impact on pension funded status looming in the foreground.

0903c02a828df57d