Liability Driven Investing

OUR APPROACH TO LIABILITY DRIVEN INVESTING

A pioneer in asset-liability management for 40+ years, our LDI philosophy is focused on maximizing alpha by capturing inefficiencies through dynamic sector rotation and security selection within spread sectors. Our integrated team takes both a top-down and bottom-up approach to design a range of solutions to solve for a variety of pension challenges.

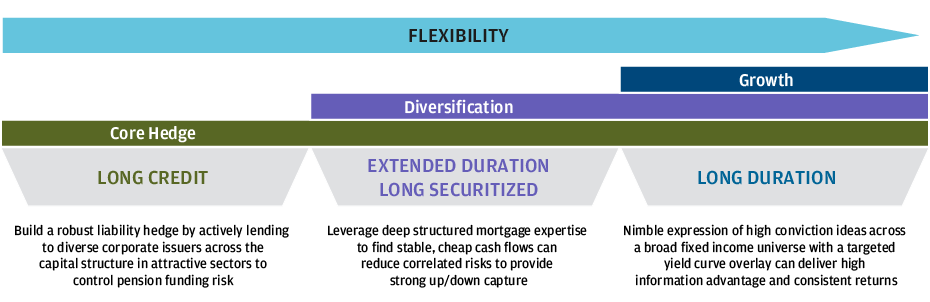

We offer a suite of solutions across the entire LDI spectrum to help investors solve a variety of pension challenges

[MUSIC PLAYING] Over the last decade, pension strategy has become increasingly focused on reducing risk and matching liabilities across time. The success of this model, known as liability driven investing, or LDI, has generated momentum to keep pushing further in the same direction, even as the risks in this approach are starting to become visible. Perhaps, a course correction is in order.

Bond heavy asset allocations are less able to earn their way past funding shocks. Portfolios concentrated in corporate credit are vulnerable to downgrades and defaults that don't reduce the liabilities they are hedging. And the use of treasuries as the sole diversifying asset class, locks in negative carry and low forward looking returns. Saving LDI from itself may be the next phase of pension asset allocation.

My name is Jared Gross, and I serve as the head of institutional portfolio strategy here at JP Morgan Asset Management. Joining me today is Justin Rucker, a senior fixed income portfolio manager who specializes in long duration and securitized strategies. Justin and I are going to spend the next few minutes describing a practical solution to the problem of concentrated hedge portfolios with limited diversification and low return prospects.

Fortunately for investors, this requires only two modest changes. First, that pensions bring back into their investment program an asset class that was once commonplace, securitized fixed income. And second, that they recognize a shift in the securitized market over the past decade that has allowed a new type of hedge asset to emerge.

The benefits of our approach include better diversification and reduced concentration risk, improved resiliency in a market sell off, and higher income in risk adjusted returns. So Justin, let me turn to you and ask, if securities investments are a natural fit for liability driven investment strategies, why haven't investors been using them all along?

Thanks, Jared. Going back 10 plus years ago, most pension assets invested in core fixed income, which had over a 30% securitized assets. So it's really not a new asset class. But unlike core mandates, LDI seeks to hedge very specific risks arising from the mark to market volatility of pension liabilities. So as LDI became more widely adopted, the traditional securitized market was really left behind, due to the undesirable attributes as a hedging tool, such as negative convexity and short to intermediate duration.

While there is no perfect hedge, the key attributes for an LDI portfolio are three-fold, high quality, long duration, and yield. Now traditionally, long corporates and long treasury bonds fit this profile. However, corporate credit quality has declined over the last several years with triple-b becoming the dominant rating. Interestingly, while LDI investors were focused elsewhere, the securitized markets evolved in ways that made it increasingly suitable for liability hedging.

As an example, developments and agency backed multi-family property financing created new classes of super high quality bonds with long durations and attractive risk adjusted yields. In the size of this asset pool is now well north of $100 billion. In addition to that, the long agency backed CMO market has an additional $200 billion outstanding.

So the timing is now right for pensions to re-enter the securitized market. Traditional LDI assets are not compensating investors for the risks that they're taking. And the availability of long duration securitized bonds presents an attractive alternative.

So let's spend a moment on the fundamentals. We know that a pension asset should offer three broad attributes, quality, duration, and yield. How do long duration securitized bonds deliver on these key characteristics?

So let's start with quality. These are securities backed by high quality assets, typically multi-family residential properties that participate in various GSE credit facilities, such as the Fannie Mae Dus program. As a result, they are principally guaranteed an effectively default remote.

Next is duration. Traditional MBS pass through securities have short, unstable duration, which is exactly what a liability hedge doesn't need. The types of deals we seek in the long securitized space contain strong pre-payment in yield maintenance provisions that provide very stable duration. This is precisely what is needed for pension hedging.

Finally, yield, long duration high quality securitized bonds can offer attractive risk adjusted yields to high quality corporates and to long treasuries, particularly in times of credit volatility. It is critical to understand that is it in times of credit volatility when long securitized assets show the value of their high quality. And finally, the tracking error that emerges during a credit sell off is a direct benefit to investors preserving capital that can be used for benefit payments or re-deployed back into the corporate credit at more attractive entry points.

So keeping these attributes in mind, how would you build out a long securitized portfolio today?

We have found over the years that a combination of these high quality long duration bonds, coupled with a smaller diversified allocation to securitized credit bonds, such as ABS, CMBS and non-agency, can provide these desired attributes. Now, the bulk of the portfolio would be in long high quality bonds, such as agency CMBS and agency CMO securities, which provide long and stable duration, positive convexity, and those attractive risk adjusted yields. Now to gain some additional yield and diversification, smaller physicians and well-structured non-agency mortgages, asset backed securities, and other shorter duration higher yielding instruments would be added.

And finally, to achieve a specific duration target, Treasury Futures can be added along with a small amount of cash collateral. So collectively, this portfolio would offer AA quality with a duration of 15 to 16 years in a yield that tracks closely to high quality corporate bonds. Its potential as a liability hedging asset should be clear.

I'll conclude by spending a moment addressing how an investor should think about introducing and managing an allocation to long securitized bonds. Beyond understanding the basic benefits of the asset class as a diversifying component of hedge portfolios, there are usually three main questions that come up. First, how much long securitized makes sense in an LDI program? Second, do I need a dedicated strategy, or should I just give existing managers discretion? And third, should I focus exclusively on long securitized bonds or the broader sector?

So let me take each of these in turn. Research suggests that the optimal level of long securitized, relative to long corporates is approximately 20%. Interestingly, this seems to be backed up by an examination of the general account holdings of insurance companies in the annuity underwriting business, who hold a very similar percentage in securitized assets. Across time, it is likely that the percentage will change somewhat as the markets move and various components of the hedge portfolio become more or less attractive on a relative basis.

The purpose of a dedicated long security strategy is to create structural diversification within the hedge portfolio, not simply to increase tactical flexibility for managers operating against more traditional benchmarks. A dedicated sleeve, alongside corporate credit and treasuries serves as the third leg of the stool in a diversified hedge portfolio. Further, very few managers have the specialized expertise to successfully implement a long securitized portfolio.

Finally, the specific characteristics of these assets are the key to their success. Because they have all of the essential attributes of a liability hedge, quality, duration, and yield, long securitized bonds can serve as a core component of the hedge portfolio. Attempting to achieve the same result with the full securitized asset class won't be as effective.

Such an approach would require aggressive duration hedging and whatever alpha might be generated would be given back from lower yields and higher tracking error. So as pension hedging continues to grow, the need to reevaluate and evolve LDI implementation becomes increasingly important. The time to diversify hedge portfolios is now, when both corporate bonds and treasuries are rich and the benefits of flexibility are high.

Now is the time for diversification in hedge portfolios

We highlight how the power of diversification and reduced concentration risk can help make for more resilient portfolios.

EXPLORE OUR INSIGHTS

For more information, please email us or contact your J.P. Morgan client advisor.

0903c02a8286df39