NAIC spring national meeting capital framework discussion

Capital framework discussion from the NAIC Spring 2019 National Meeting.

04/17/2019

Dean Crabtree

Wheatley Garner

On April 6-9, we attended the NAIC Spring National Meeting in Orlando, FL to stay informed for you on important regulatory issues that are affecting the insurance industry today. Summarized in this document are the most relevant sessions and discussions from the meeting.

Investment related risk-based capital updates

Referral of the Comprehensive Fund Proposal to the Capital Adequacy Task Force

In 2017, the NAIC1 SVO2 released proposed guidance changes to clarify eligibility of fund investments to receive NAIC Designations (see updates related to the adoption of the Comprehensive Fund Proposal here ). The SVO explained that many funds are excluded from designation eligibility but are structurally identical to those permitted under the Purposes & Procedures Manual (P&P Manual) and the Accounting Practices and Procedures Manual (AP&P Manual). The goal of the proposal was to ensure consistent treatment for investments that involved funds that invest in bond portfolios.

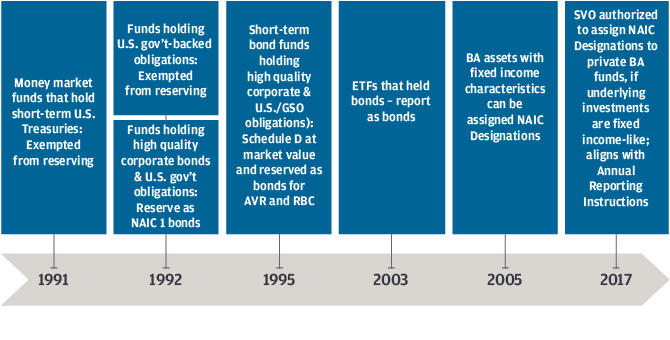

Since 1991, The Valuation of Securities Task Force (VOSTF) has permitted more appropriate treatment to funds that invest in bonds and possess other defined characteristics (Exhibit 1).

EXHIBIT 1:

Significant efforts have also been made to align guidance in the P&P Manual and the AP&P Manual for fund investments, including NAIC designation-related guidance for mutual funds, money market funds, ETFs and non-SEC registered Schedule BA funds.

With its adoption, the Comprehensive Fund Proposal combines guidance for all fund investments into a new section in the P&P Manual. The proposal will expand existing policy to funds issued by an investment company that is a closed end fund or a unit investment trust type registered with and regulated by the U.S. SEC. The policy that fund investments are not eligible for filing exemption is also extended to the new fund procedures and to private (Schedule BA) funds.

VOSTF has referred to the Capital Adequacy Task Force (CADTF) a recommendation that it conduct a comprehensive review of all funds that can be assigned NAIC Designations by the SVO and consider how those NAIC Designations should be included into the RBC calculation; specifically, for the CADTF to consider what RBC changes they would like to make. CADTF, as a result, has directed NAIC staff to do an analysis of the fund universe subject to this guidance to assess industry impact and recommend next steps.

Investment Risk-Based Capital

The Investment Risk-Based Capital Working Group (IRBCWG) did not meet during the Spring National Meeting. During their most recent meeting back in the Fall of last year, the IRBCWG discussed the American Academy of Actuaries’ Joint Property & Casualty and Health Bond Factors Analysis report and comment letters received from interested parties that touched on the proposed expansion and updates to the decades-old bond factors for health and P&C companies. There is currently a regulatory call scheduled for regulators and interested parties on May 16th to further discuss the bond proposal and to gain further insight into the path towards implementation.

1 NAIC – National Association of Insurance Commissioners

2 SVO – Security Valuation Office

Source: NAIC Memorandum: Referral to the Capital Adequacy Task Force - Comprehensive Fund Proposal

0903c02a8257aa1b