Unlocking the full potential of private strategies with an active liquidity pool

09/15/2022

Carter Massengill

Private, closed-end investment funds offer some of the highest potential returns across the asset allocation spectrum, but building and maintaining a diversified portfolio of private investments presents some challenges.

We have previously shown that investors need a high degree of capital efficiency to achieve the internal rates of return (IRR) and multiples on invested capital (MOIC) expected from these strategies. While open-end vehicles can make initial investments quickly and keep capital fully invested across time, closed-end fund investors must address the problem of capital sitting idle between commitment and investment, and between distribution and reinvestment. In this article we describe how investors can benefit from a liquid, stable and return-focused liquidity strategy within a private investment portfolio.

The challenges of keeping private capital invested

Investors in the private markets face several key challenges when trying to minimize cash drag on what is intended to be the highest-returning allocation in the portfolio.

Substantial liquidity needs to be maintained across time to fund capital calls when they do occur. While investors can directly control the timing of their initial commitments to closed-end investments, they have limited visibility into the subsequent pace of capital calls. Studies have shown that aggregate capital calls for private equity funds follow a steadily declining pattern across the first five years after the initial commitment – approximately 30%, 20%, 18%, 12% then 10%. Dynamic market conditions, along with a GP’s ability to use subscription credit financing, may lead to the rapid acceleration or deceleration of capital calls at any time during the investment period.

The extended time horizon over which distributions can occur does not allow for effective balancing of inflows and outflows. At the end of the investment cycle, investors have almost no ability to forecast the timing of distributions, which can span multiple years and are subject to extensions of the fund’s maturity date at the GP’s discretion.

Aligning distributions with capital commitments is difficult, if not impossible. Additionally, research shows that distributions can be procyclical, clustering in periods of high public market valuations and liquidity, when the ability to profitably exit private investments reaches a peak. Attempting to predict these environments in advance is near impossible.

The benefits of establishing a shadow liquidity pool for private investments

As investors increase private market allocations, the operational burdens and costs of managing this process begin to build. Vintage year diversification can mitigate the potential gap between inflows and outflows, but cannot eliminate this problem. Idle capital remains a challenge for investors in the private markets because no perfect solution exists to efficiently recycle capital between funds.

Yet there is hope: A thoughtfully constructed and appropriately scaled liquidity strategy, designed to “shadow” a private market allocation, can maintain a pool of accessible capital while minimizing the return drag associated with holding excess cash.

Most asset allocations have ample liquidity across their public market equity and fixed income sleeves to fund capital calls and receive distributions – so why is a dedicated liquidity sleeve within the private market allocation even necessary? Consider a few reasons:

At the strategic asset allocation level, rebalancing between public and private investments is problematic. If public markets outperform and capital needs to be rebalanced towards private strategies, there will be concerns around the maintenance of vintage year diversification as well as finding highly rated managers to accept the capital. Conversely, if private markets outperform and capital needs to flow back to the public market strategies, investors will need to engage in costly and inefficient sales of private strategies to do so.

The volatility of the public markets can be misaligned with the timing of capital calls and distributions; this can result in capital calls accelerating in down markets, when private opportunities are presumably more attractive, and distributions peaking in strong markets, when exit opportunities are best. The net effect forces the public market portfolio to sell low and buy high – a strategy that is unlikely to benefit performance.

Public market portfolios already tend to carry the burden of managing external liquidity needs, such as benefit payments or operational support, which are not always predictable in terms of size and timing. Adding the need to fund private investment capital calls only increases operational challenges and allocation inefficiencies.

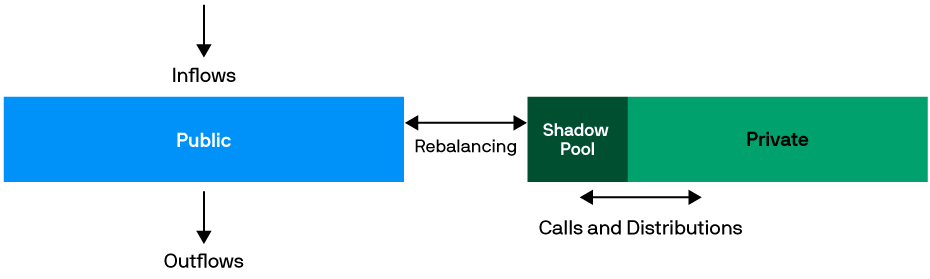

A dedicated shadow pool counterbalances these challenges: It can accept or distribute rebalancing flows without forcing capital into vintage years or managers that would otherwise be undesirable; it offers a better alternative to inefficient procyclical flows into and out of public market strategies during periods of volatility; and it enhances operational and allocation efficiency (Exhibit 1).

A dedicated shadow liquidity pool helps maintain optimal portfolio balance Exhibit 1: Utility of a shadow pool within private market allocations

Source: J.P. Morgan Asset Management. For illustrative purposes only.

Building a private liquidity pool

Conventional wisdom suggests that any liquidity buffer should be kept as small as possible, based on the assumption that it will require the use of stable, cash-like assets that generate returns far below the long-term strategic objectives of the plan.

But if a liquidity pool is able to offer returns closer to long-term strategic objectives, then the bias toward minimization is neutralized and the size of the dedicated liquidity pool can track the total value of uncalled commitments to private strategies, with some upside flexibility to absorb inflows and distributions across time and some downside flexibility to provide rebalancing capital.

New commitments can be fully funded in the liquidity pool until they are called. Should distributions from existing investments cause the liquidity pool to grow beyond this threshold, that capital can be rebalanced quickly and easily back to the public markets. Such an outcome is highly desirable: It would allow the natural rebalancing process between public and private markets to take place without costly withdrawals or secondary sales from private funds and would enhance the ability of allocators to be selective with respect to the strategies they choose to fund. Manager selection is of critical importance in private investing, and the timing of cash flows should not supersede informed judgement in this area.

Selecting the components

Investors should design a liquidity pool to remain relatively static over time; the most important task for investors is selecting attractive private investment opportunities, not constantly optimizing the pool.

The components of a shadow liquidity portfolio should be carefully selected to balance the key characteristics of liquidity, stability and return.

Liquidity is essential to meet capital calls on time and reinvest distributions as they arrive, operating at the highest level of capital efficiency. The use of ETFs maximizes liquidity while offering a wide range of useful investment options.

Stability is important to ensure that the market value of the liquidity pool stays within an acceptably narrow range across time. However, stability and return potential are inversely related and demand for liquidity is higher during market downturns, suggesting a bias to strategies with low downside capture.

Returns are needed to help combat the drag from idle capital, including cash. While it may not be possible to perfectly replicate private market returns in a liquid, public market equivalent, a liquidity pool that offers stable and moderately high returns will help increase overall IRRs and investment multiples across time.

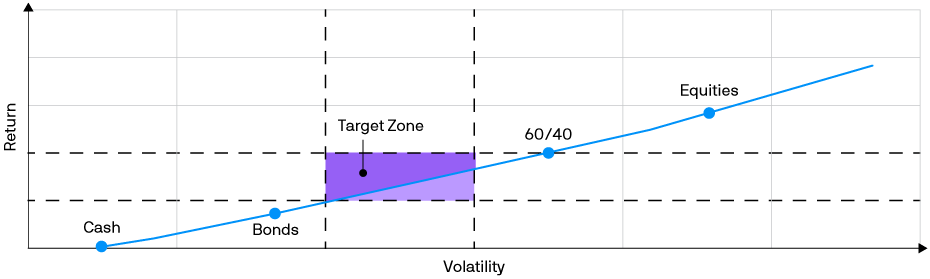

In practice, no single asset class can achieve all three objectives simultaneously. Liquidity is the easiest of the three to obtain as any strategy that is available in ETF form offers intra-day liquidity. Balancing stability and return in a single asset class is challenging (Exhibit 2), and choosing an option to achieve both objectives simultaneously is likely to do a mediocre job. A more effective approach is to blend a highly stable, active short duration fixed income strategy with a carefully selected return-generating strategy. With the growth of the active ETF market, investors now have the opportunity to incorporate liquid strategies that target specific risk and return objectives rather than simply gaining exposure to market risk.

Balancing return and stability is critical when building a liquidity pool Exhibit 2: Historical risk and return characteristics of various assets

Source: J.P. Morgan Asset Management, Digital Portfolio Insights. For illustrative purposes only.

Part 1: The stability anchor

A general rule in investing is that stability and return are mutually exclusive. However, certain strategies may tilt in an investor’s favor. One useful example is short-term fixed income, where the trade-off between increasing yield and increasing volatility is highly favorable. An actively managed short-term fixed income ETF strategy can provide a stable anchor in a liquidity pool while offering more yield than conservative money market options.

Within a larger and more permanent liquidity pool, there may be value in layering multiple fixed income components that extend further out the yield curve and incorporate diversified credit sectors to generate higher returns across time. In particular, short-core or short-core-plus approaches are worth considering as they can add more yield with limited volatility.

Part 2: The return engine

The primary purpose of the return engine is to generate a high level of performance, but to do so with lower risk characteristics than the public market investments elsewhere in the portfolio. Any such strategy will create volatility that must be managed, and part of the solution depends on the mix of low-risk and high-risk strategies. But simply blending a volatile asset class, such as equities, with a low-volatility cash strategy only moves overall risk and return downwards in a linear fashion; it cannot improve overall efficiency.

Blending stocks and bonds – in a 60% stock/40% bond strategy – might offer some increased efficiency vs. stocks and cash, but we shy away from this approach for several reasons. First, this strategy can exhibit levels of volatility in excess of what an investor would want for this particular purpose, therefore requiring both a stability anchor and a bond allocation within the return engine – which would limit returns. Second, the strategy would not be materially different than the broader public market allocation in the portfolio.

Instead, identifying a more sophisticated return engine that incorporates risk reduction on its own would reduce the need to rely solely on the stability anchor for volatility management. Greater weight could then be placed on the return engine and stronger performance might be achieved for the same amount of risk.

We have identified a long-established and widely used equity investment strategy known as “call overwriting” as a particularly compelling option for this purpose. In this strategy, a diversified equity portfolio systematically sells out-of-the-money call options to generate cash premiums. This transforms some of the intrinsic volatility of equities into a modestly lower yet more stable return stream. In moderately positive, flat or down markets this approach can outperform traditional equity portfolios with lower volatility; in a strongly positive environment, it will slightly underperform but with lower volatility. The strategy is well suited to the task at hand, and importantly, it can be found in ETF form, which preserves the maximum level of liquidity.

Backtesting blends

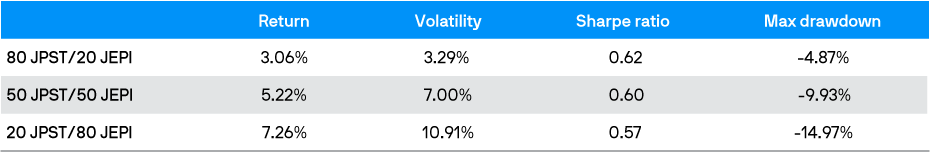

To take this concept for a test drive in the real world, we compared the performance of a series of ETF liquidity portfolios over the period 2019 to 2022. While this is not a particularly long time period, it was an extremely volatile one and therefore a rigorous testing ground for potential liquidity pools. The allocations were selected to cap the maximum drawdown at a fixed level of 5%, 10% or 15%.

In each test, the stability anchor was a short-term fixed income ETF (ticker: JPST). Targeting a duration of less than one year, JPST primarily invests in a diversified portfolio of short-term, investment grade fixed- and floating-rate corporate and structured debt while actively managing credit and duration exposure. For the return engine, we used a call writing strategy (ticker: JEPI). JEPI is an actively managed strategy that generates income and lower volatility returns through a combination of selling options and investing in selective, higher quality names from the S&P 500. Exhibit 3 shows the risk and return characteristics from blends of these two strategies.

ETFs can be blended to achieve desired risk/return targets Exhibit 3: Historical performance of JPMorgan Equity Premium Income (JEPI) and JPMorgan Ultra-Short Income ETF (JPST)

Source: J.P. Morgan Asset Management, Digital Portfolio Insights. Data is from September 1, 2019 - July 31, 2022. JEPIX, the mutual fund equivalent of JEPI, was used for historical performance.

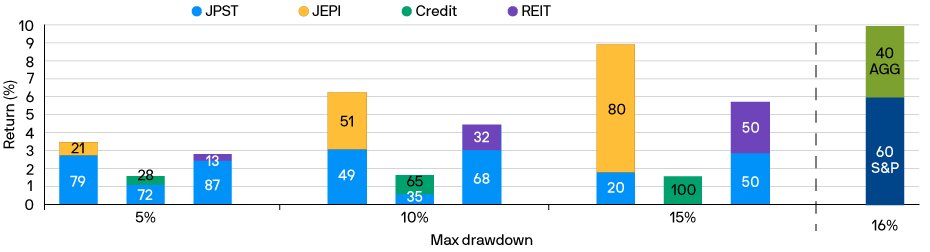

We also tested investment grade credit and real estate indexes as potential return engines because private credit and private real estate investors might see some value in “matching” the beta in the liquidity pool to something fundamentally more similar in their private strategies. For general comparison purposes, we also included a 60% stock/40% bond portfolio to represent the broader public market asset allocation (Exhibit 4).

A few takeaways emerged from this analysis:

An investor can build a liquidity portfolio that delivers returns well in excess of cash with moderate volatility and limited drawdown. Staying entirely within the highly liquid domain of ETFs, the level of returns is sufficiently high to support a structurally larger liquidity pool while also helping the overall private allocation achieve its long-term return objectives.

The trade-off between higher returns and maximum drawdown is appropriately balanced for this purpose. While stability may be seen as synonymous with absolute volatility, we think that maximum drawdown is actually a better metric to use when placing boundaries around risk tolerance. We used 5%, 10% and 15% drawdown to approximate low, medium and high risk tolerance. In this case, an investor using one of the 10% downside capture blends would have confidence that the liquidity pool would not drop below 90% of its initial value at any point in time. The significantly higher returns available are adequate compensation for this level of risk.

The idea of using direct public market equivalents, such as credit or real estate, to align the risks of the private funds and liquidity portfolio appears to be of limited value. A strategy using a volatility monetizing equity program, such as call overwriting, delivers higher returns for the same level of downside risk than an equivalent credit or real estate allocation scaled to the same level of drawdown risk.

Volatility monetizing equity programs offer better risk-adjusted returns relative to other public market equivalents Exhibit 4: Blends of J.P Morgan Ultra-Short Income ETF (JPST), J.P. Morgan Equity Premium Income (JEPI), Investment Grade Credit Index, and MSCI US REIT.

Source: J.P. Morgan Asset Management, Digital Portfolio Insights. Data is from September 1, 2019 - July 31, 2022. JEPIX, the mutual fund equivalent of JEPI, was used for historical performance.

Conclusion

The operational challenges posed by illiquid private investments are well understood. However, many investors seek to overcome these challenges in ways that are likely to be ineffective: trying to avoid mismatched capital calls and distributions with a steady pace of annual commitments or using cash-like liquidity vehicles that cannot be sized correctly without creating too large a drag on performance.

Our approach solves these problems with greater efficiency while helping investors stay true to their strategic objectives. Creating a shadow liquidity pool that offers liquidity, stability and returns will allow investors to manage cash flows without return drag, sidestep rebalancing challenges and ultimately make it easier to achieve the return targets for which private investments were chosen.