China: Should we be worried about local government implicit debt?

Recently, China’s local government made headlines on the implicit debt issue, but we believe the issue is manageable and that systemic risk is unlikely.

07/06/2023

Andrea Yang

Douglas Ng

China’s total local government implicit debt—including Local Government Financing Vehicle (LGFV) bonds, LGFV bank loans and other LGFV interest bearing debts—is estimated to be between CNY50-60trn, and our estimate is close to the upper end. Along with the policy-guided real estate sector reshuffle in the past two years, fiscal revenue from land sales entered a yoy contraction in August 2021 and has remained in deep contraction through the first five months of this year. As LGFV highly relies on local fiscal supports which mainly comes from land sales, now, China’s LGFV solvency issue is catching increasing attention. In this blog, we explore the evolution of the LGFV issue, the potential impact and the government’s response.

Idiosyncratic risk is possible while systemic risk is unlikely

After the 2008 Global Financial Crisis, a visible increase of local government implicit debt was observed; this came with a strong central government intention to boost GDP via infrastructure investment and via the housing market. Having said that, a large portion of the debt is built up under the investment-led growth guidance and is sort of quasi-central government debt.

Now that central authorities have been pushing for the transition from investment-led growth to consumption-led growth in the past few years, the dependence on local government implicit debt has been decreasing, as evidenced by the moderating new debt increases since 2017.

That said, going forward, the local government will continue to undertake primary responsibility over public services/utilities, job creation and social stability with limited access to fiscal revenue. If any idiosyncratic risk turns into systemic risk, it will most likely shut down all potential financing channels for the local government, which is the last thing central government wants to see.

Central government response

From 2015 on we have experienced three rounds of local government debt replacement:

2015-2018: three years program, replacing implicit debt with explicit debt of ~CNY12trn;

2019: replacing implicit debt with bank loans, published number showing that the amount should be smaller than CNY1trn;

- 2020-2022: replacing implicit debt with newly introduced LG (Local Government) refinancing debt of ~CNY1trn.

Since the beginning of this year, we have seen increasing concerns and efforts from the central government to address the local debt issue: (1) with support from State Council and the MOF (Ministry of Finance), a LGFV in Guizhou province is now able to extend its bank loan by 20 years with interest payment only in the first 10 years; (2) the NAFR (National Administration of Financial Regulation, formerly known as the CBIRC: China Banking and Insurance Regulatory Commission) required local banks to support the LGFV debt restructure in the Shandong province; (3) the central government repeatedly stated the requirement to strictly curb any new local government implicit debt while smoothly resolving the existing debt issue.

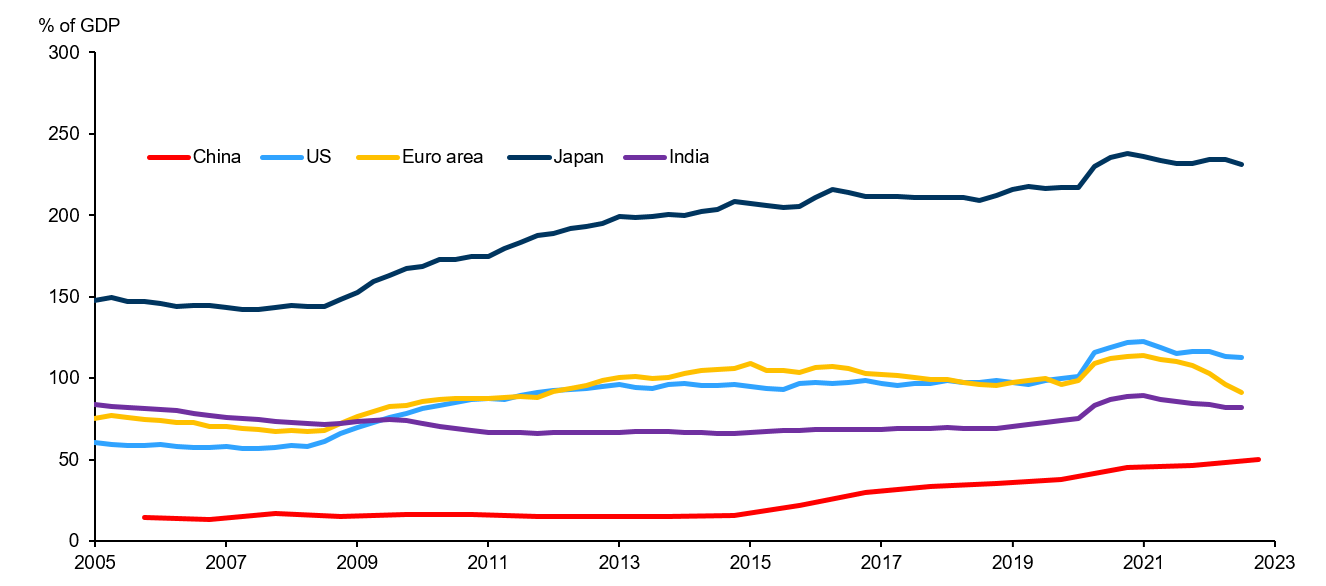

Based on our estimate, outstanding central government debt + explicit local government debt accounts for ~50% of GDP by Q1 this year, much lower than most large DM (Developing Market) and EM (Emerging Market) economies, implying there is still room to replace implicit debt with explicit debt. That said, we are less likely to see a program similar to that implemented from 2015-2018, as the central government wants to dampen any hope, from the local government, of a large scale bailout and boosting up new debt again. As the provincial government already built up a system to closely monitor the local implicit debt repayment schedule, we think the central government is able and more willing to deal with the local debt issue case by case.

Government debt-to-GDP

Source: BIS, WIND, JPMAM Estimate as of 28 June 2023.

There is an estimated CNY4trn of LGFV bonds maturing in 2023 and about CNY3trn maturing in 2024 (about 3% of GDP). In the short term, we are likely to see: (1) more issuance of LG re-financing bonds to replace parts of LGFV bonds1; (2) more financial institutions will participate in LGFV debt roll-over and restructuring given lower funding costs; (3) a selling of existing assets to make up the gap from sliding land sales.

In the long term, the central government will continue to push forward—striping off the shadow financing function of LGFV for the local government and promoting LGFVs gradually increasing commercial businesses—to increase operating cash flow. With this, regional divergence may become more prominent as LGFVs in developed regions are better equipped to manage the transition than LGFVs in less developed regions.

Potential impact to local financial conditions and bond holders

While we see a low probability of systemic risk, we expect decreasing land sales to affect the fiscal condition of areas with a less developed economy, resulting in tighter financial conditions for some local governments. Headline risks, such as last-minute payments, from these regions could surface occasionally, and, as a result, their LGFV bonds may have higher price volatility. On the other hand, we expect that the local government has a strong willingness to prevent LGFV bond defaults because it could impact funding access of other SOEs (State owned enterprises)/LGFVs in the same region, which could last for 3-4 months referencing past experience.

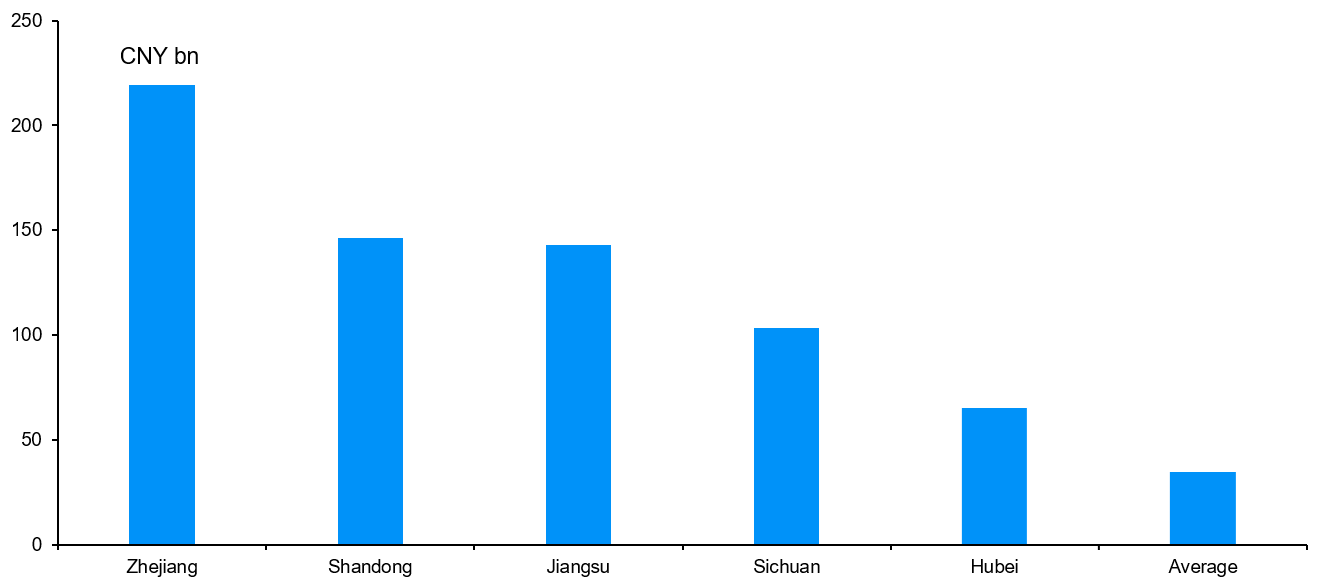

There is differentiation in funding access of LGFVs. We observed that LGFVs from economically developed regions, such as provinces from coastal areas, have maintained access to onshore funding. For example, the Zhejiang province had a higher net increase in LGFV bond financing in 2022 compared with average, indicating overall lower refinancing risks for LGFVs in that province. We also expect LGFVs with higher strategic importance to local governments to have stronger government support.

LGFV bond net financing by provinces in 2022

Source: WIND, JPMAM Estimate as of 28 June 2023.

Given financial stability is a top priority for policymakers, we expect central and local governments to take a cautious approach in LGFV and local government debt issuance, where general directions include curbing the increase of new hidden debt, lowering funding costs and improving the maturity profile.

1 Theoretically, there is ~CNY2.6trn local debt quota available for re-financing bond, but in practice ~CNY2trn is a more reasonable assumption to keep some buffer for other spending

09m0230307163922