Are We There Yet?

The Fed is driving the bus toward higher for longer, while the market continues to probe from the back seat. I explore three paths that rates can take from here.

07/13/2023

The Federal Reserve has raised interest rates 500bps since March 2022 in one of the fastest tightening cycles in history. They are driving the bus toward two further rate hikes this year, which would bring the terminal rate to 5.625%. Yet, they also recognize that the economy is slowing and a shift from hikes to pauses, and ultimately cuts, is on the horizon; the question is when this will occur. Guidance from the Fed and signals from the market offer mixed messages around whether policy is currently restrictive enough, and as a result, market participants continue to heckle the Fed from the back seats by asking: “Are we there yet!?!?” The below examines 3 potential answers to this vexing question.

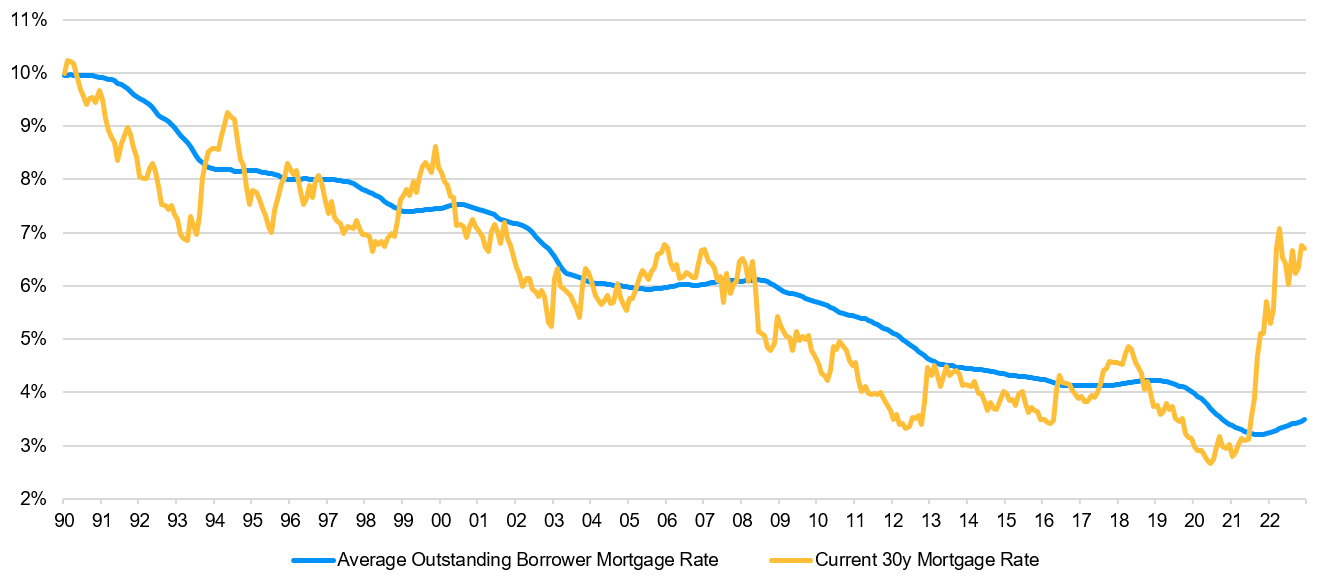

1) No, we have much further to go. When the Fed paused in June, it was actually refilling its gas tank, and higher rates are on the horizon. In the most recent FOMC minutes, several participants “highlighted the possibility that much of the effect of past monetary policy tightening may have already been realized” without seeing material weakness in the economic data. First, usage of the Fed’s bank term funding program (BTFP) has plateaued, suggesting the worst of the deposit flight is behind us. Second, core inflation is 4.8%, still well above the Fed’s 2% target, while the unemployment rate remains pinned around 3.6%. Third, the consumer remains resilient; after a weak fourth quarter, real personal consumption jumped from 1% to 4.2% in 1Q23, the highest level since 2Q21. With this confluence of data, what does it tell us about the economy’s sensitivity to interest rates? It’s possible that Covid helped both the private sector and consumers improve their balance sheets to withstand higher rates. Corporate earnings remain robust even as companies position for a slowdown, and the consumer’s effective interest rate may be much lower than what the market implies. This is especially pronounced in housing, where the average outstanding mortgage is more than 3% below those that are currently being issued.

Source: Bloomberg, JPMAM, Freddie Mac; as of 6/30/2023

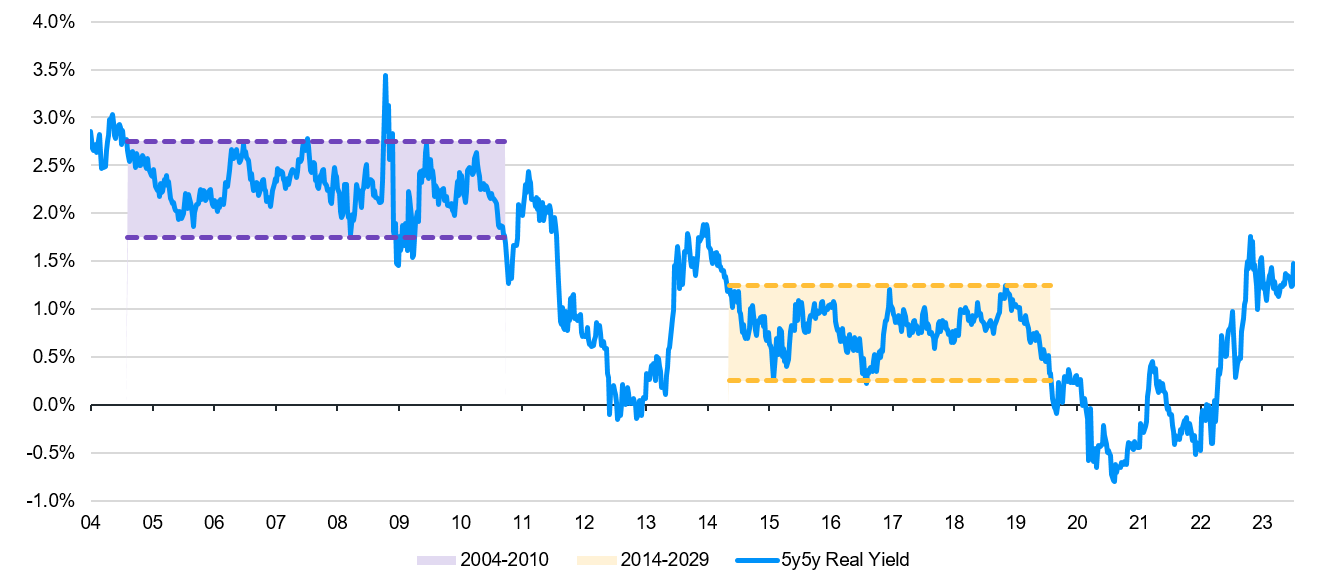

And if recession isn’t imminent and cuts aren’t necessary, what does that say about the long-run real neutral rate? The five-year forward, five-year real rate (5y5y) is often used as a proxy for this measure and is currently 1.5%, right in between the 2004-2010 range and the 2014-2019 range. The latter post-Global Financial Crisis period was one of stagnant economic growth, bouts of sub-2% inflation, and immense quantitative easing. We are now past the era of financial repression, and real rates should be returning to the 1.75%-2.75% range we saw in the 2000s.

Source: Bloomberg, JPMAM; as of 7/11/2023

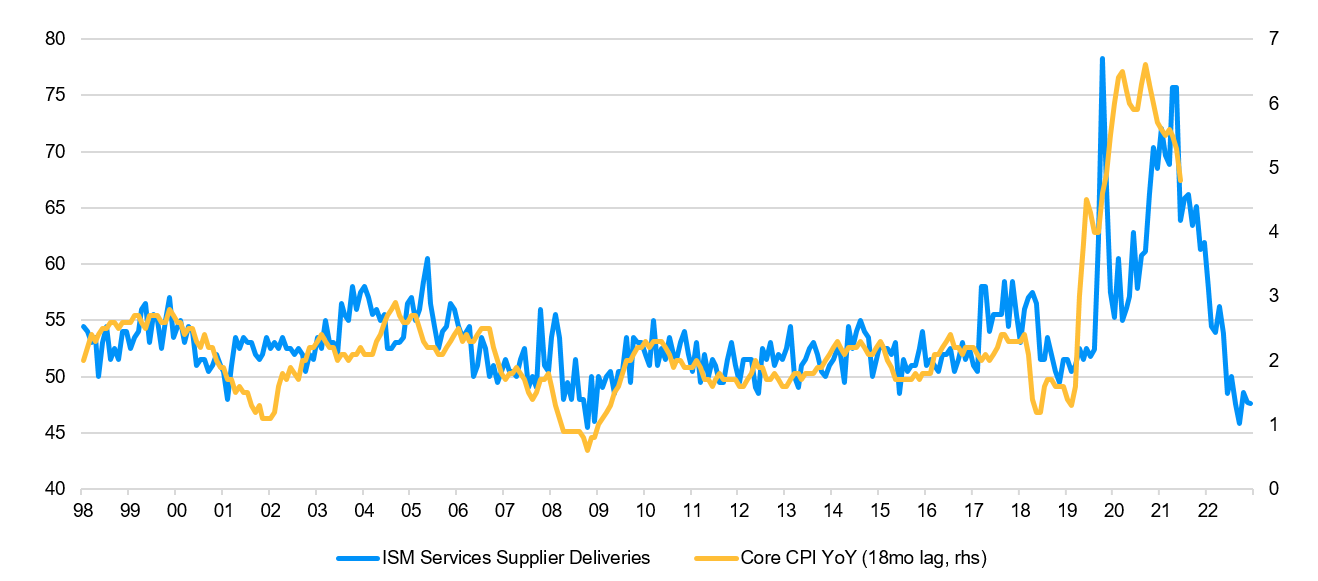

2) We are almost there, and a gentle off-ramp is around the corner. While the inflation surge was painful, it was also transitory, caused predominately by supply chain bottlenecks. Mapping ISM Services Supplier Delivery Times to Core CPI suggests inflation should revert to its pre-covid range, a process which has already begun.

Source: Bloomberg, JPMAM; as of 6/30/2023

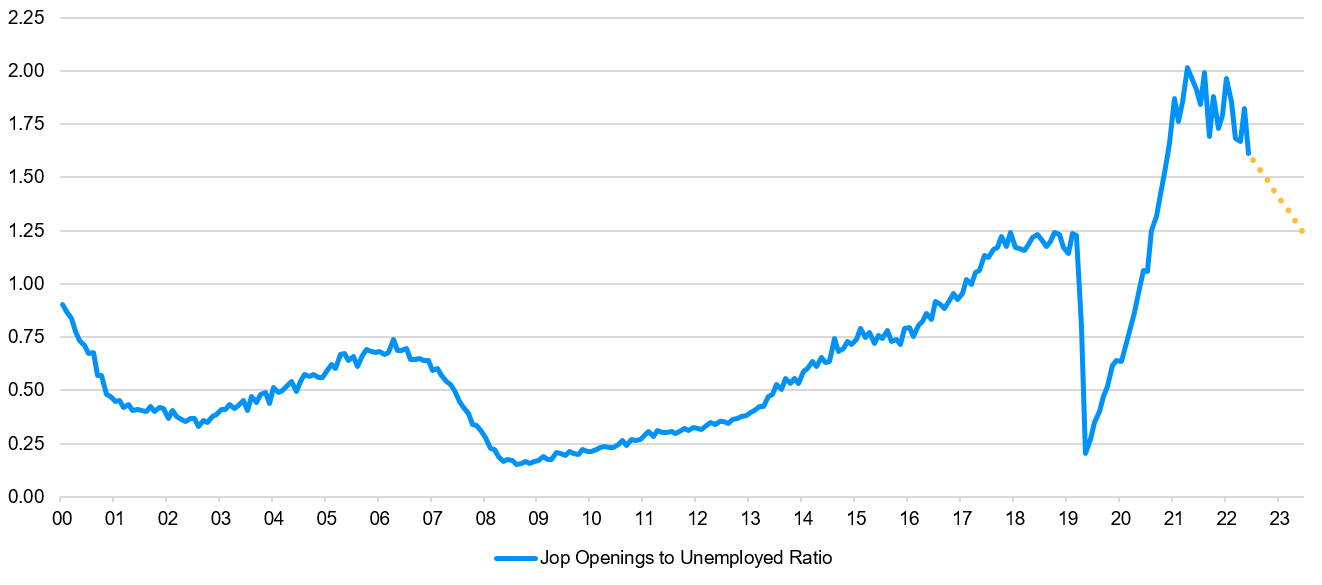

Indeed, core services ex-shelter printed 0% MoM in the latest inflation report. Furthermore, there is a path to rebalancing the labor market without the unemployment rate spiking higher. Right now, there are 1.6x as many job openings as unemployed persons, down from 2x at its peak. Should these openings decline as the economy slows, but companies retain their workers out of fear of the rigorous competition they faced post-Covid, this ratio can gradually decline toward the 1.25x we saw from 2017-2019. The modest pace of the decline in nonfarm payrolls without a rise in layoffs supports the possibility that this is already happening.

Source: Bloomberg, JPMAM; as of 6/30/2023

As a result, this would put downward pressure on wages, allowing the Fed to have more confidence that inflation will return to its 2% target. An immaculate slowdown in inflation, combined with only a gradual move higher in the unemployment rate, would enable the Fed to be less data-dependent and more forward-looking. As long as inflation expectations remain anchored, the Fed can slowly cut the funds rate toward 2.5% over the next 2 years, keeping the real policy rate stable as inflation declines.

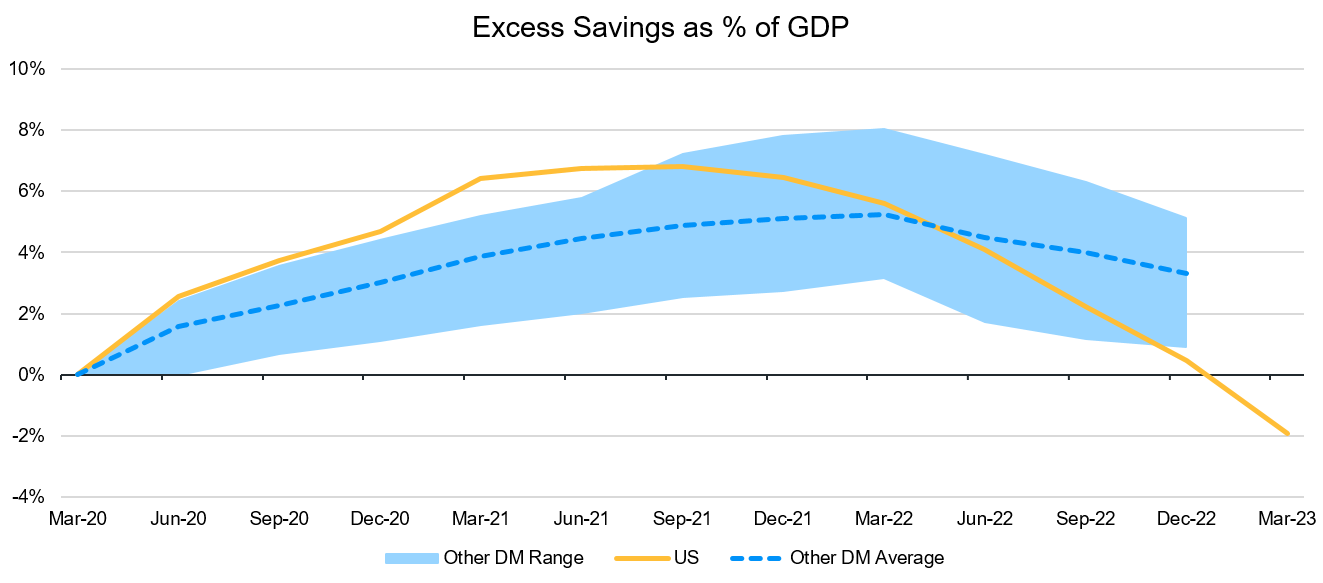

3) Oops, we just sped past the exit. The Fed has already overtightened and will need to slam on the breaks and reverse course; it’s only a matter of time before they realize it. First, banks may not be failing, but they are hurting, and this is influencing the economy. The most recent Senior Loan Officer Opinion Survey showed the lowest demand for loans since 2008, and nearly 50% of respondents indicated they are tightening lending standards, a level consistent with recession. Additionally, 95% of community bankers believe the US is already in recession according to the Community Bank Sentiment Index. Second, the manufacturing sector has been ailing for months. The ISM manufacturing PMI (Purchasing Managers Index) has been in contraction since November, and the new orders to inventories ratio is firmly in recessionary territory. Third, the resilience of the consumer is a mirage attributed to excess savings accumulated post-Covid. According to the Fed’s research, the US has eaten through these savings faster than any other developed market country.

Source: Federal Reserve, JPMAM; as of 6/30/2023; other includes Australia, Canada, France, Germany, Italy, Japan, Spain, UK

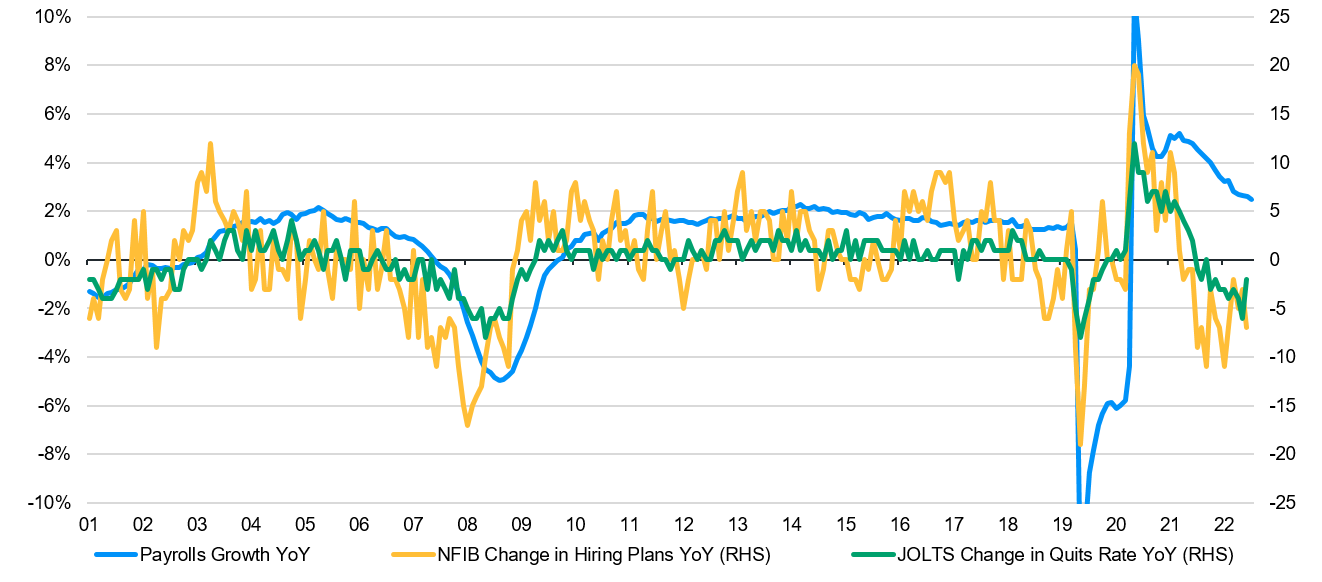

As a result, pressure is beginning to bubble up under the surface. Earnings reports suggest that consumers are trading down for cheaper products, buying in bulk, and becoming more responsive to promotions. Fourth, inflation is less sticky than it appears, and is predominantly a housing problem, with the 3m, 6m, and 12m annualized rates of CPI ex-shelter all below 1.5%. Lastly, while previous payrolls reports paint a picture of a healthy labor market, it does not mean this trend will continue. Initial jobless claims have been slowly inching higher, and adjacent measures such as hiring plans and quits rates suggest payrolls growth should be much weaker, if not negative.

Source: Bloomberg, JPMAM; as of 6/30/2023

The Fed is cognizant of the long and lagged effects of monetary policy yet is choosing to ignore them. Once the consumer starts to falter and the labor market cracks, the Fed will realize it hiked too much and rates will rally, but it will be too late to avert a downturn.

09os231207145342