COVID-19: Plotting a path to eventual recovery

04/17/2020

Quarantine measures to tackle the COVID-19 coronavirus outbreak pushed down global economic activity in March. We expect further steep declines through April and May, leading to a sharp plunge in second-quarter activity data.

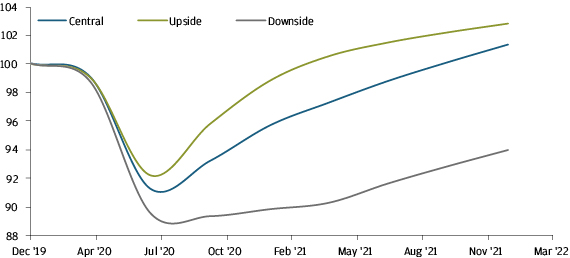

Beyond that, however, thoughts will turn to when and how the current crisis will end. We describe three scenarios for the expected economic and asset market recovery (the central case, the downside case and the upside case). A guiding principle is that asset markets will react first and foremost to the peak in infection rates, with economic data the next to turn and employment data the last to follow.

Three major questions guide our analysis:

1) How long will the restrictions stay in place, preventing any meaningful recovery from taking hold?

2) To what extent will second-order effects kick in, such as failing businesses producing additional layoffs and spending cutbacks?

3) How will individual behavior change once social distancing measures have lifted?

Stylized quarterly profile for U.S. activity data in each scenario (Q4 2019 = 100)

Source: J.P. Morgan Asset Management

0903c02a8288eeb9