Will tensions with Iran cause an oil spike?

01/10/2020

Jordan Jackson

Rising geopolitical tensions with Iran have led to some fears over potential oil supply shocks out of the Middle East. Indeed, Brent crude prices have risen 3.5% year-to-date as markets try and account for this risk. However, it is unlikely that these tensions will lead to a significant climb in oil prices that spell danger for the global economy for a few reasons:

- First, while Iran produced crude oil at roughly 2.4mb/d in 2019, this accounted for just 8% of total OPEC supply and less than 3% of total world production. Moreover, it is reasonable to assume that any supply disruptions out of Iran will be offset by an increase in production from other OPEC+ countries.

- Second, typically, a 70-80% year-over-year increase in the price of oil is needed to negatively impact growth. Therefore, the roughly 20% rise in the price of Brent oil over the past year should not be enough to curtail global consumption.

- Lastly, data suggests that global growth is still finding some footing. Therefore, global oil demand is likely to remain tepid in the coming months, offsetting any supply shock premium.

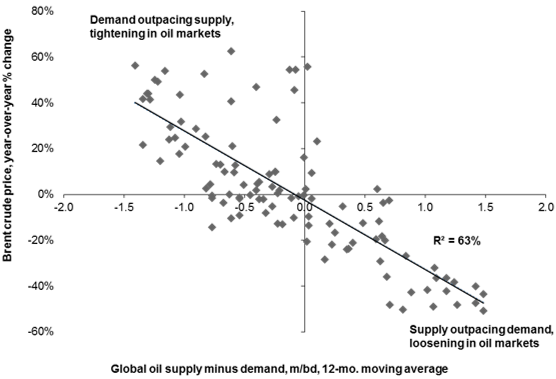

While futures markets try to price the impact of US-Iran tensions, spot prices should reflect actual supply disruptions. As shown, a tightening in global supply/demand balance by about 1mb/d (in other words, almost half of all Iranian production taken offline) would be needed to cause a spike in oil prices large enough for concern. For investors, the global coordination of oil production are likely to keep price swings short-lived and provide a ceiling for oil prices in the medium term, keeping the global economy from avoiding a recession.

Supply/demand balance should drive the change in oil prices

2011-2019

Source: Bloomberg, Energy Intelligence Group, FactSet, ICE, J.P. Morgan Global Economic Research. Data are as of January 8, 2020.

0903c02a827b8bd6