Earlier this week, oil prices turned negative for the first time in history, with WTI trading as low as -$37 a barrel.

Earlier this week, oil prices turned negative for the first time in history, with WTI trading as low as -37 USD a barrel. In light of the seemingly impossible phenomenon, many investors are rightly asking how and why something like this could be possible. To answer this, one must understand the unique issues facing oil markets right now: falling demand, sticky supply and limited storage.

• Falling demand: While oil demand was already under pressure due to slowing Chinese growth, the sudden global economic shock caused by COVID-19 has seen oil demand collapse. The International Energy Agency (IEA) predicts that global oil demand will fall by a record 9.3 million barrels per day (mb/d) in 2020 versus last year. Much of this demand destruction will occur in the next two months, with demand falling by 20 mb/d in April and May.

• Sticky supply: After an initial disagreement in March, major oil producers agreed to cut production by a record 9.7mb/d beginning May 1, with further cuts expected in the next 12 months. However, it takes time to implement production cuts and compliance amongst countries is not guaranteed.

• Limited storage: Imbalances between oil demand and supply are common. Normally, any excess supply of oil would be placed into storage facilities and the owner would wait for the market to move back into equilibrium. However, oil storage facilities are already over 70% full up from 40% at the start of the year and are forecasted to be completely full by mid-2020 based on current production levels.

This combination of factors has forced oil producers into a precarious situation. Oil contracts settle physically, meaning individual buyers must take possession of the commodity upon settlement and pay all associated storage costs, which are often expensive. Spot oil prices and near-term contracts have turned negative because oil holders are willing to pay investors to take the commodity off their hands to avoid those expenses.

For investors, negative oil prices will continue to damage the near-term prospects of oil producers. The U.S. high yield market is particularly vulnerable, with a 13% exposure to the energy; and equity investors will likely have to grapple with an energy sector that is no longer able to return capital to shareholders in the way it once did. However, over the long term, there are tentative signs of stabilization. The oil futures curve is currently in ‘super contango’ whereby the implied oil price of near-term contract may be very low but the market is implying a price for WTI of 35 USD a barrel one year from now. As a result, it seems safe to say that the pressure of negative oil prices will not be in place forever.

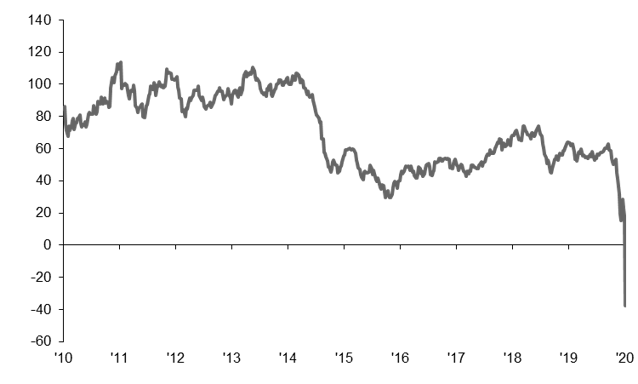

WTI prices

U.S. dollars per barrels

Source: FactSet, J.P. Morgan Asset Management. Data are as of April 21, 2020.

0903c02a82897fbd