Listen to On the Minds of Investors

During nearly every client conversation over the past few weeks, there has been some mention of inflation. One camp thinks that significant fiscal stimulus has pushed us to the cusp of a new inflation regime, whereas others believe that structural forces like technology adoption and income inequality will prevent inflation from becoming a problem in the long-run. It is impossible to know which of these views will prove to be correct, but good investors play the hand they are dealt. This begs the question of what types of equities tend to do best against a backdrop of accelerating inflation.

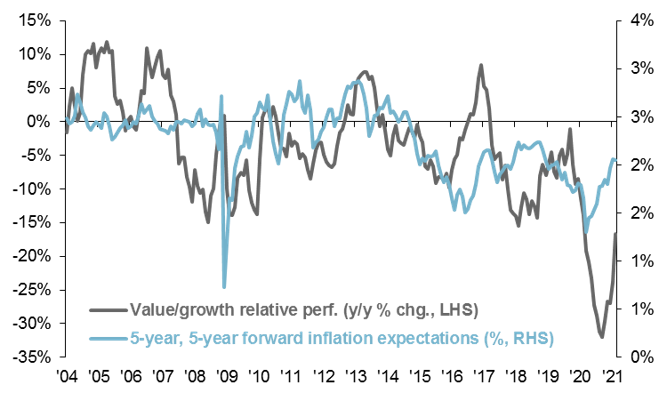

To start, equity markets are forward looking, and therefore tend to exhibit a stronger correlation with inflation expectations, rather than spot inflation. However, some parts of the equity market tend to be more sensitive to inflation expectations than others. As shown in the chart below, the outperformance of value relative to growth has historically exhibited a strong positive correlation to inflation expectations.

Taking a step back, this makes sense – the largest sector weights in value indices are things like financials, industrials, and energy, and the earnings that these types of companies generate tend to be highly levered to the overall pace of economic growth. Inflation can be a symptom of an economy that is operating above its potential; therefore, it makes sense that value stocks tend to outperform their growth counterparts when inflation expectations are rising, as higher inflation should in theory coincide with stronger earnings growth.

The remainder of 2021 should see an acceleration in economic activity, rising inflation, and higher interest rates. In general, this dynamic should support the outperformance of value relative to growth, with attractive relative valuations acting as an additional tailwind for value outperformance. However, clients are starting to ask whether the “reopening trade” has run its course; this does not seem to be the case, as robust earnings growth and further steepening of the yield curve should allow value to continue to outperform.

Value outperformance tends to coincide with rising inflation expectations

Relative performance of value vs. growth, y/y % chg., 5-yr., 5-yr. fwd. inflation expectations, %

Sources: Russell, St. Louis Fed, FactSet, J.P. Morgan Asset Management. Data are as of March 11, 2021.

0903c02a82b0c283