What is the Fed doing and what does it mean for fixed income?

03/25/2020

What has the Fed done?

The U.S. Federal Reserve (Fed) has pulled out its alphabet bazooka in an effort to ensure sufficient liquidity and the smooth functioning of financial markets, while also providing credit to businesses that are affected by the spread of COVID-19 and the stall in global economic activity. In addition to lowering the Federal Funds rate to a range of 0-0.25%, the Federal Reserve has restarted its quantitative easing program (QE), expanding the mandate to include commercial mortgage backed securities (CMBS) and putting no limit on the size of asset purchases. The Fed has also restarted the term asset backed securities loan facility (TALF), included municipal bonds as eligible collateral at the Money Market Mutual Fund Liquidity Facility (MMLF) and Commercial Paper Funding Facility (CPFF), and created both the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCP).

What is this supposed to do?

Each of these programs has a specific goal; while most investors are familiar with what the Fed is trying to do by lowering rates to zero and restarting quantitative easing, the impact of these other programs may not be as clear. Details regarding these facilities can be found on the Fed’s website, but we have tried to outline the main purpose of each below:

- Term Asset Backed Securities Loan Facility (TALF) – A funding facility created during the Financial Crisis which allows the Fed to purchase asset-backed securities tied to consumer and business loans. The purpose of this program is to provide support for the flow of credit to businesses and households.

- Money Market Mutual Fund Liquidity Facility (MMLF) – The Fed will extend loans backed by high quality financial assets held by money market mutual funds in an effort to help them meet redemptions.

- Commercial Paper Funding Facility (CPFF) – The Fed will buy commercial paper from U.S. issuers in the event that they cannot obtain financing from the market; because commercial paper markets support a range of economic activity, the effects of this program are far reaching.

- Primary Market Corporate Credit Facility (PMCCF) – This new facility will either purchase bonds or make direct loans to U.S.-based investment grade companies; the purpose of this program is to allow businesses to more easily maintain operations during this period of stress.

- Secondary Market Corporate Credit Facility (SMCCP) – This is another new facility which will purchase investment grade bonds issued by U.S. corporations, as well as U.S.-listed investment grade bond exchange traded funds (ETFs), in the secondary market. The goal is to support liquidity in high quality corporate bond markets.

- Main Street Business Lending Program – There is a lot we do not know about this program, as limited details have been provided. However, it seems to be a lending facility that will target small and medium-sized U.S. businesses.

What is driving liquidity issues in credit markets?

High-risk areas of the bond market tend to be capricious in nature. During good times, investors focus on yield; but during periods of stress, market attention suddenly switches to downgrades and defaults.

The economic damage caused by COVID-19 is encouraging investors to look for safety and move away from the higher risk areas of the credit markets, including BBB investment grade bonds and high-yield debt. The status of these markets is as follows:

- BBB investment grade debt – There is currently $600bn of bond issuance rated at BBB- and therefore at risk of being downgraded to junk. History suggests that around 33% of the BBB- space will be downgraded during a downturn. This equates to roughly $200bn in downgrades, which if achieved would be a record.

- U.S. high yield – 13% of the U.S. high yield universe is energy and another 16% is in the consumer cyclical sector. Given falling oil prices and reduced demand due to “social distancing,” investors are concerned that these two large sectors could be particularly vulnerable, and are therefore keen to exit the asset class.

What is happening in the U.S. Treasury market?

U.S. Treasury markets have witnessed an increase in the spread between on-the-run – the most recently issued bonds at certain maturities – and off-the-run – older issuances that have not yet matured – bonds.

In calm financial markets, risk-seeking investors, like hedge funds, conduct arbitrage trades between on-the-run and off-the-run Treasuries. However, during periods of volatility, hedge funds deleverage and sell their off-the-run Treasuries to primary dealers, financial institutions approved to trade securities with the U.S. government. However, regulatory requirements can make it more expensive for these dealers to hold off-the-run Treasuries rather than on-the-run Treasuries. This supply and demand mismatch, combined with regulatory pressures, is leading to a disjointed market.

What does all of this mean for investors?

Dramatic Fed action should provide investors with some sense of stability in an otherwise extremely volatile world. The “whatever it takes” mentality should be seen as reassuring, and the speed and severity with which the Fed has acted, proof that policy action can be swift when necessary. Ultimately, though, it is important to remember that while the Fed has done an admirable job in securing the health of U.S. financial market plumbing, the effectiveness of monetary policy in a crisis not caused by interest rates is inherently limited; large-scale and rapid fiscal stimulus must happen alongside Fed action should a prolonged recession hope to be avoided.

Nonetheless, there are some major implications that investors can use when allocating assets:

- Stability in the financial system should provide a confidence boost to investors otherwise worried about potential liquidity crises, particularly as they relate to redemptions of investments.

- Support for small and medium-sized businesses, in any form, should help to shore up economic health, and potentially prevent the spread of wider-reaching damages related to rising unemployment and falling income.

- Ample liquidity and the option for the Fed to buy nontraditional bonds should help to compress spreads, which have otherwise blown out rapidly.

- Increased Fed activity should put downward pressure on yields across the curve, supporting a duration trade, at least in the short run, and positioning bonds as an “insurance” asset.

- And finally, low interest rates in the U.S. and around the world should encourage – and necessitate – risk taking, as the opportunities for yield in fixed income dry up. For this reason, an increased reliance on public equities and, when appropriate, private assets, is warranted, especially for those investors seeking income.

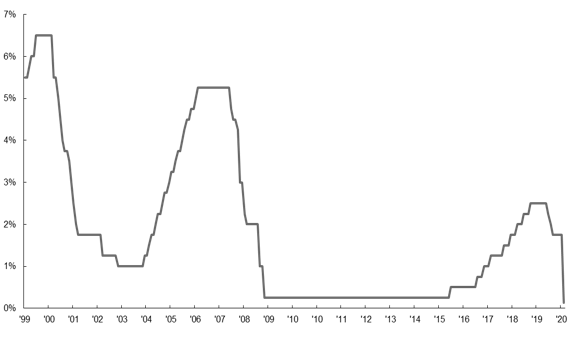

The Fed’s response has gone beyond the funds rate

Target Federal Funds rate %

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. Data are as of March 24, 2020.

0903c02a828586f9