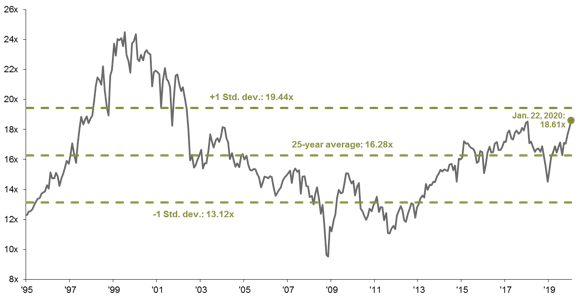

Equity market valuations have risen substantially in recent months, with the forward P/E ratio of the S&P 500 now at a level of 18.6x. Elevated valuations are not a problem in and of themselves, particularly against a backdrop of fading geopolitical headwinds and low interest rates. But what are investors currently pricing in? And has the stock market moved too far, too fast?

To start, investors seem to believe that there will not be any further escalation in trade tensions. The recently signed Phase One trade deal between the U.S. and China contained few surprises - the market’s reaction (or lack thereof) to the deal was evidence of this. Equities sold off in the immediate aftermath of the deal being signed, before rebounding into the end of the trading day. This is a textbook example of buying the rumor, and selling the news.

At the same time, investors seem to be pricing in a rebound in global growth and an accommodative Federal Reserve (Fed). While the geographic and sectoral distribution of global growth may even out over the coming months as trade tensions fade and manufacturing comes back online, a synchronized acceleration in global growth like we saw in 2017 seems a bit out of scope. At the same time, while the bar for further Fed action seems quite high, it should not be ruled out. A backdrop of fading trade risks and improving growth could gradually lead the Fed to change its tune, and begin to suggest that resuming rate normalization might be appropriate down the road.

So has the stock market moved too far, too fast? There is quite a bit of optimism priced in to equity markets, but that does not mean elevated valuations are unsustainable. Rather, markets will need to grow into these valuations, which at the end of the day will be dependent on earnings. As highlighted in our 4Q earnings bulletin, we expect low to mid-single digit earnings growth in the coming year. If this occurs against a backdrop of modest price appreciation, it will reduce the chances of a near-term pullback. But if for some reason outcomes disappoint relative to expectations, a focus on total yield (dividends + buybacks) should help investors weather the storm.

S&P 500 Index: Forward P/E ratio

Source: FactSet, FRB, Robert Shiller, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management. Price to earnings is price divided by consensus analyst estimates of earnings per share for the next 12 months as provided by IBES since January 1995, and FactSet for January 22, 2020. Average P/E and standard deviations are calculated using 25 years of IBES history. Data are as of January 22, 2020.

0903c02a827dabe5