What does post-COVID leverage mean for investing?

04/24/2020

Samantha Azzarello

Listen to On the Minds of Investors

While many changes are likely to emerge, one clear trend, with far-reaching macro and market implications, is the increase in leverage, says Azzarello.

While significant uncertainty around the current economic situation persists, many investors are already considering what the world will look like after COVID-19. What are the possible economic scars? And what will the new cycle be characterized by? While many themes and structural changes are likely to emerge, one clear trend, with far-reaching macro and market implications, is the increase in leverage. The massive amount of debt that will have been taken on during this period across different segments of the economy is likely to be unprecedented.

In the aftermath, we expect the following:

- For consumers: an increase in the savings rate, as caution decreases discretionary spending to shore up household balance sheets, and an increase in demand for wealth management, asset management and insurance products.

- For governments: in addition to a raging debate around the sustainability of current debt levels, it seems clear that tax rates must increase at some point in the future. This implies an even greater need for tax-aware investing strategies and tax-efficient portfolios.

- For corporations: companies with greater leverage will have a heavier burden to carry – even at very low rates – and one that will likely be less tolerated by investors looking to focus on quality, which continues to be a suggested overweight in portfolios.

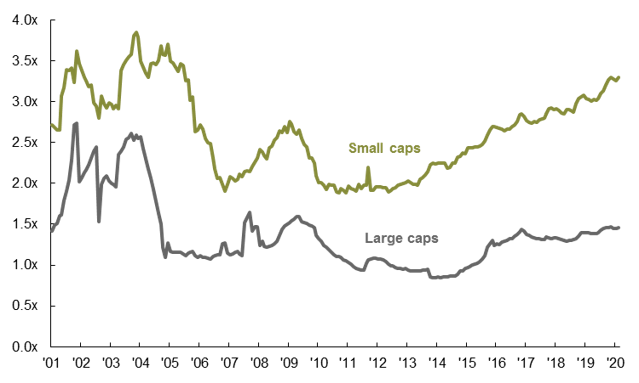

These trends will likely manifest themselves in both stocks and bonds, and across market capitalizations, sectors and styles. For example, the chart below shows the gap between leverage levels for small and large cap companies has been widening for the last 5 years. Moreover, while small caps have historically carried about 1.3x more debt than large caps, they now have close to 1.9x more. Given that small cap stocks are likely to take on additional debt while experiencing large negative earnings hits in the near future, this trend will like be amplified.

Dynamics such as these will bifurcate the way companies are viewed and rewarded by investors. Therefore, an increased focus on security selection, both in the equity and fixed income markets, will be crucial.

Debt levels for small cap companies are significantly higher than large cap companies

Net debt to EBITDA for large and small caps

Source: FTSE Russell, Standard & Poor’s, J.P. Morgan Asset Management.

0903c02a8289b2f0