Should I wait to buy the dip?

01/17/2020

Buying the dip - the coveted strategy (almost) all investors like to employ. And why not? Just like buying any item on sale leads to extra utility, the same holds true for buying the market when it has dipped. This is especially true when the dip is caused by noise or an overreaction to news and not any true change in fundamentals.

The issue is that buying the dip has become an increasingly elusive strategy. Changes in market structure over the last 10 years has meant that an increase in systematic flows (a term used to describe a large umbrella of investors and strategies*) has led to swifter, deeper selloffs as well as quicker snapbacks when buying momentum bounces back.

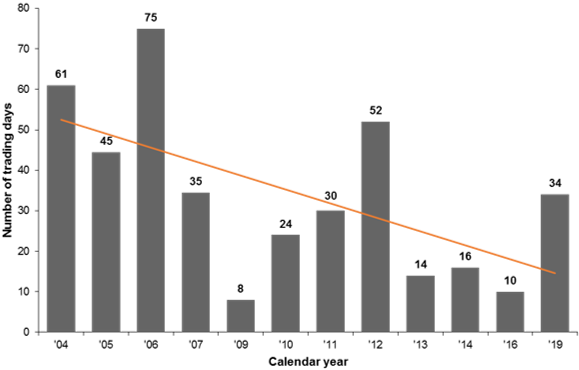

Looking at the number of days it takes for the market to recover a previous high after a 5-10% decline (Exhibit 1), we can see just how the trend has quickened with markets recovering faster than they did in the past.

Adding to the logistics of buying the dip, there has forever and always been the behavioral matter of actually putting money to work when markets are down. Some investors are always ready to put money into the market, while others - understandably so - use waiting to buy the dip as a crutch to simply not invest. Even being more than a decade out from the global financial crisis, this is still prevalent among investors. Under-allocation to equities broadly and international equities, in particular, is still apparent in many portfolios.

What is a better strategy than buying the dip? Dollar Cost Averaging (DCA) comes to mind - one we can liken to tip-toeing into the ocean versus running right in. In the end, it doesn’t matter how you get in, as long as you do. While DCA has been shown to bolster returns in a down-market and penalize in an up-market, the psychological benefits and ease it provides for hesitant individuals cannot be understated- especially for clients with disproportionate cash holdings.

Additionally, hedged strategies which limit downside (even with the trade-off of capping some potential upside) are especially timely for the current market and macro environment of increased uncertainty and a wider range of possible outcomes. Overall, noting that equities, in the long run, are the main wealth generator for many investors, suggests that investing steadily and consistently has always been - and still is - paramount.

*Systematic flows encompasses a wide range of market segments including passive indexers, quantitative asset managers, market making programs, the insurance industry, derivatives etc.

Average recovery time of independent 5%-10% drawdowns per year

DRAWDOWNS AND SUBSEQUENT RECOVERIES ARE MEASURED BETWEEN INTRA-YEAR PEAKS

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management. Independent drawdowns are declines of 5-10% from a prior peak reached in a calendar year and the average recovery time is the number of trading days to the next peak reached in that same calendar year. For example, the largest peak-to-trough decline in 2017 was -3% and is therefore not included in this analysis. The decline experienced in 4Q2018 exceeded 10% and is therefore not included in this analysis. Past performance is not indicative of future results. Data are as of January 15, 2020.

0903c02a827c9648