Hello, my name is Jack Manley and I am a global market strategist here at JP Morgan Asset Management. Welcome to On the Minds of Investors. Today's topic is now the time to invest in small cap stocks and how should investors think about navigating that space.

Global markets have been especially turbulent in recent weeks in the face of COVID-19 and social distancing and, as a result, many investors are looking to pick up the pieces, looking for that next big opportunity in investing. Given that there are a number of dramatic dislocations still present in markets, there are a number of potential candidates that have presented themselves. With the Russell 2000 having significantly underperformed in the S&P 500 year to date almost 2 to 1, it is tempting for investors to wonder is now the time to invest in small cap stocks?

But when we are assessing the viability of small cap investing at the current juncture, relative price performance is really only one of the many necessary considerations and, in fact, it may be the least important. Instead investors should focus on three other key relative metrics. First, sector weights. Second, earnings potential. And third, financial health.

In terms of sector weights, whereas the largest sector weighting in the S&P 500 is technology or roughly a quarter of the index, tech plays a comparatively much smaller role in the Russell 2000 at only 15%. Instead, small cap US equities are dominated chiefly by health care, which represents roughly a quarter of the index. Moreover, small cap stocks are much more heavily exposed to cyclical sectors, like financials and REITs, compared to what you see in the S&P 500.

While a tilt in favor of health care should be beneficial for small cap stocks given the current health crisis, the underweight technology and perhaps more importantly the overweights to those cyclical parts of the market puts small cap stocks at a disadvantage as long as the pandemic persists. On earnings potential, small cap earnings quality is generally speaking much lower than that of larger cap stocks. Roughly 40% of the Russell 2000 currently has negative earnings, a trend that started in the aftermath of the financial crisis, with very low interest rates providing support for otherwise unprofitable businesses.

Moreover, consensus estimates for 2020 small cap earnings growth are far worse than the estimates for large cap companies. And the revisions that we have seen year to date have been much more severe. Russell 2000 EPS is expected to contract by 43% this year compared to 18% contraction for the S&P 500. And those EPS figures have been revised down 52 percentage points year to date for the Russell 2000, compared to a contraction of 27 percentage points for the S&P 500. This contraction in earnings estimates has put significant upward pressure on small cap valuations, which are now quite rich relative to history and relative to their larger cap peers.

And finally, on financial health, small cap companies have a significantly greater debt burden than large cap companies. With a net debt-to-EBITDA ratio roughly three times the size of that for large cap stocks, the Russell 2000 is highly leveraged at a time when companies will likely be looking to add to their debt burden. Rising leverage, which will likely be a broad outcome of the current crisis, is going to be felt particularly acutely in small cap names.

Looking forward, we anticipate elevated uncertainty and it suggest that the most prudent course of action for investors continues to be one of caution rather than of aggression. For this reason, it seems that quality above all else should be the focus of most investment portfolios. And given the struggles we just outlined, that focus should preclude an overweight to small cap stocks. Instead, investors must temper expectations and above all remain patient. There will likely be a time for small caps to recover in the future but now is not it.

This content has been produced for information purposes only and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the recipient. The material was prepared without regard to specific objectives, financial situation, or needs of any particular receiver. Any research in this asset has been obtained and may have been acted upon by JP Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of JP Morgan Asset Management.

Any forecasts, figures, opinions, statements of financial market trends, or investment techniques and strategies expressed are those of JP Morgan Asset Management, unless otherwise stated, as of the date of production. They are considered to be reliable at that time but no warranty as to the accuracy, and reliability, or completeness in respect of any error or omission is accepted. They may be subject to change without reference or notification to you. JP Morgan Asset Management is the brand for the asset management business of JPMorgan Chase and Company and its affiliates worldwide. JP Morgan Distribution Services, Inc. Copyright 2018. JPMorgan Chase and Company.

Global markets have roiled in the face of COVID-19 and social distancing, and many investors are looking to “pick up the pieces,” eagerly hunting for the next big opportunity. Given the dramatic dislocations still present in markets, a number of potential candidates have presented themselves. With the Russell 2000 having significantly underperformed the S&P 500 year-to-date, it is tempting for investors to wonder: is now the time to invest in small cap stocks?

When assessing the viability of small caps at the current juncture, relative price performance is only one of the many necessary considerations. Instead, investors should focus on three key relative metrics: sector weights, earnings potential and financial health.

- Sector weights: Whereas the largest sector weighting in the S&P 500 is technology (just over 25%), tech plays a comparatively smaller role in the Russell 2000 (15%). Instead, small cap U.S. equities are dominated chiefly by Health Care (roughly 23%). Moreover, the Russell 2000 is much more heavily exposed to cyclical stocks, particularly Financials and REITs (16% and 7%, respectively) than the S&P 500 (11% and 3%, respectively).

While a tilt in favor of Health Care could be beneficial given the current health crisis, the underweight to technology and, perhaps more importantly, the overweight to highly sensitive sectors, put small cap stocks at a disadvantage as long as the pandemic persists.

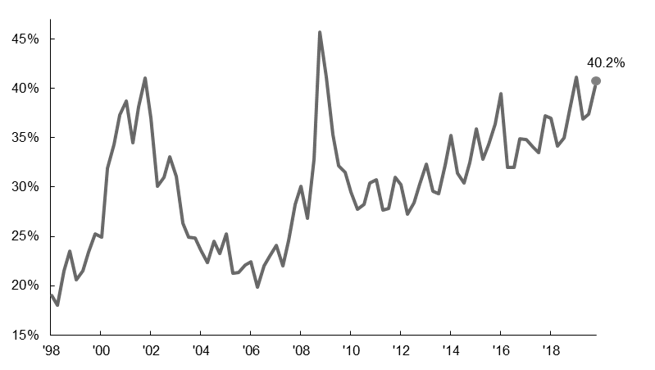

- Earnings potential: Small cap earnings quality is, generally speaking, low. As seen in the below chart, roughly 40% of the Russell 2000 currently has negative earnings, a trend that started in the aftermath of the financial crisis, with low interest rates providing support for otherwise unprofitable businesses.

Moreover, consensus estimates for 2020 small cap earnings growth are far worse than for large cap companies, and revisions have been more severe: Russell 2000 EPS is expected to contract by 43% in 2020, compared to 18% for the S&P 500; and small cap EPS growth has been revised down 52 percentage points year-to-date, compared to 27 percentage points for the S&P 500. This contraction in earnings estimates has put significant upward pressure on small cap valuations, which are now quite rich relative to history.

- Financial health: Small cap companies have a significantly greater debt burden than large cap companies. With a net debt-to-EBITDA ratio roughly three times the size of that for large cap stocks, the Russell 2000 is highly leveraged at a time when companies will likely be adding to their debt burden. Rising leverage, likely a broad outcome of the current crisis, will be felt acutely, particularly in small cap names.

Looking forward, elevated uncertainty suggests that the most prudent course of action is one of caution, rather than aggression. For this reason, it seems that quality above all else should be the focus of most investment portfolios; given the struggles outlined above, that focus should preclude an overweight to small cap stocks. Instead, investors must temper their expectations and remain patient. There will likely be a time for small caps to recover in the future, but now is not it.

Nearly half of Russell 2000 companies have negative earnings

% of Russell 2000 companies with negative earnings

Source: FactSet, FTSE Russell, J.P. Morgan Asset Management. Data are monthly and as of April 28, 2020.

0903c02a828aa072