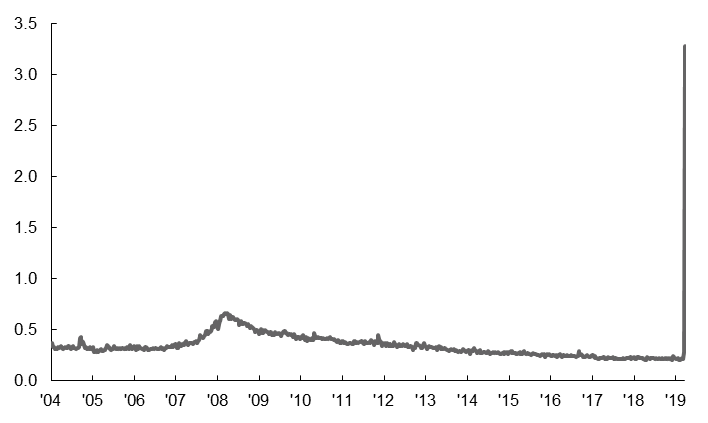

This morning, initial claims for unemployment insurance surged to the highest level ever. Initial claims came in at 3,283,000, spiking from a slightly revised 282,000 last week. They also exceeded the prior peak of 695,000 reached in October 1982, and the 2009 peak of 665,000.

This report is based on claims filed during the week ending March 21st, and is compiled at the state level. Almost every state claimed the spike was due to impacts from COVID-19, which is apparent given the sectors where claims increased the most: accommodation, food services, health care and social assistance, arts, entertainment and recreation, transportation and warehousing, and manufacturing industries.

Looking to the weeks ahead, we anticipate initial claims will remain elevated for several reasons. First, many of the states with the largest increases have since been put under shelter-in-place orders, which should result in additional layoffs in industries most impacted by social distancing. As the virus spreads across the country, other cities may also impose activity limits in the coming weeks, adding to the geographic mix of layoffs. Second, there were reports of claims office closures or overloading, as well as technology issues that could have delayed some filers from filing last week. Instead, they will file this week. Lastly, some businesses might be holding off letting workers go for as long as they can, until cash flow issues force their hand.

This final point is important because the $2.2 trillion USD stimulus package passed in the Senate this morning does aim to help workers by enhancing unemployment insurance, and supporting small and medium-sized businesses to keep their companies afloat during this period. However, the speed and efficiency with which that support is delivered will be critical in mitigating the impact to the labor markets.

The spike in claims has eclipsed both 2008 and the all-time high

Initial claims for unemployment insurance, millions

Sources: DOL, J.P. Morgan Asset Management. Data are as of March 26, 2020.

0903c02a8285c53b