Chinese GDP in Recession amid Virus Outbreak

04/19/2020

Chaoping Zhu

Amid the COVID-19 global outbreak, China reported negative year-over-year growth of GDP for the first time since 1992, when the National Bureau of Statistics started to release economic growth numbers on a quarterly basis. The real GDP growth declined 6.8% year-over-year, worse than market expectation. Among sectors, the industrial sector was hit most seriously as a result of production suspension, with a year-over-year decline of 9.6% in sector value-add. Meanwhile, a 5.2% decrease was reported in value-add of service industry due to lockdown measures.

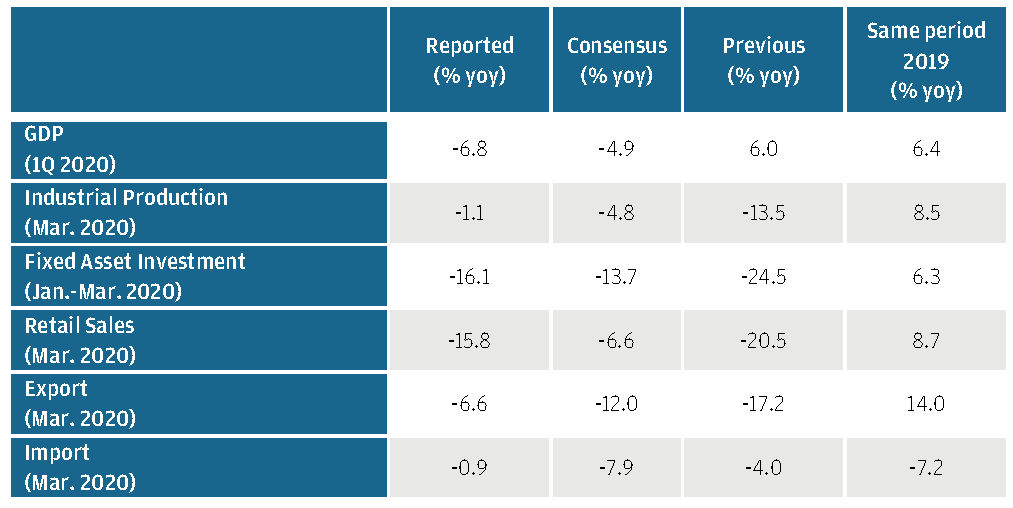

Despite the dim GDP numbers, economic activities have been on track for normalization since early March. Improvements are seen in the monthly indicators including industrial production, retail sales (consumption) and fixed asset investment.

Negative growth reported in 1Q, with signs of improvement in March

EXHIBIT 1: CHINA ECONOMIC ACTIVITIES

Source: China National Bureau of Statistics, Wind, J.P. Morgan Asset Management. Data reflect most recently available as of 20/04/20.

Looking forward, we expect to see low single-digit GDP growth on a year-over-year basis in the upcoming quarters as domestic economic activities largely resume. The recovery trajectory will be largely driven by developments in the global pandemic and control measures adopted by each country. At this stage, we remain cautious about the prospects for a V-shaped recovery on a year-over-year basis in China in 2Q 2020, since external demand might remain weak as a result of lockdown measures in the United States and Europe. Meanwhile, to prevent a potential second outbreak, partial social distancing measures are being maintained, which continue to weigh on parts of services sectors. For instance, sports events and cinema chains might remain closed until May. That said, upside risk also exists in medicine development. Potential breakthroughs in treatment might trigger the removal of lockdown measures in the rest of the world and a quick economic recovery.

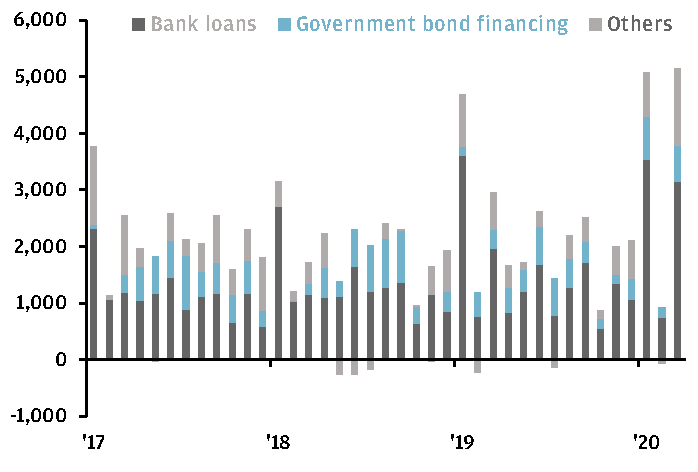

In terms of policies, the Chinese government is on the track of a gradual escalation in its stimulus policies. On April 15, the People’s Bank of China (PBoC) cut the rate for its 1-year medium-term lending facility (MLF) by 20 bps, which was the second cut since the beginning of this year, bringing down the rate below 3%. Following that, the loan prime rates (LPR) for 1-year and 5-year were lowered by 20 and 10 bps respectively on April 20. As shown in Exhibit 2, the social financing data released earlier also points to acceleration in loan issuance by banks and bond financing by the government sector. Supported by the loosening liquidity condition, government-led investment might stabilize and mitigate the downside risk on the demand side.

Given the high uncertainties in the global economy, the Chinese authority might tolerate a lower growth rate this year. A specific growth target might not be set as usual during the annual session of the National People’s Congress, which is delayed and likely to be convened in May. Instead, stability in employment might become the top policy priority for this year. Against this background, the PBoC might continue to follow a data-driven approach in its policies, and have further cuts to policy rates and required reserve ratio when economic data reveal a worsening outlook.

Financial condition keeps improving

EXHIBIT 2: TOTAL SOCIAL FINANCING

RMB BILLION

Source: People’s Bank of China, Wind, J.P. Morgan Asset Management. Data reflect most recently available as of 20/04/20.

Investment implications

As the uncertainties are sustained in the global and local economy, it is essential for investors to keep a diversified and balanced portfolio. In the fixed income market, Chinese government and quasi-government bonds might benefit from the continuous policy easing. The relatively high yields compared with zero yields in developed markets might also help boost the demand for onshore bond market. In equities, current low valuations in A-share and Hong Kong stocks imply opportunities for long-term investors. Meanwhile, quality names in the internet services, health care and consumer staples sectors might see improvements in their performance during the lockdown.