10/16/2023

New York, Just Like I Pictured It

A CEO client asked if I would present a forensic analysis of New York City for their September board meeting. I agreed as long as I could share it with our clients. Our report compares NYC to 21 other US cities with respect to post-COVID urban recovery, commercial real estate, mass transit, crime, outmigration, work-from-home trends, tax rates, economic pulse (population, labor force, payrolls, housing), fiscal health, unfunded pensions, energy prices, industry diversification and competitiveness. You can read the entire 100-page deck here.

The good news: NYC has unique advantages regarding its outright size (output, labor force, purchasing power), business sector diversification and global financial sector dominance. Some NYC measures have now reached pre-pandemic levels: total employment, airport utilization and seated restaurant diners are notable examples. NYC crime stats also compare favorably to many large other cities (which sometimes comes as a surprise), and its industrial and multifamily sectors show very high occupancy rates.

However, NYC currently faces a lot of challenges:

My recommendation to the board: treat NYC the way an asset manager might treat a megacap stock in a diversified portfolio: avoid being “overweight” relative to some agnostic benchmark of regionally diversified assets. In other words, the risks argue against too much concentration for corporate or real estate entities.

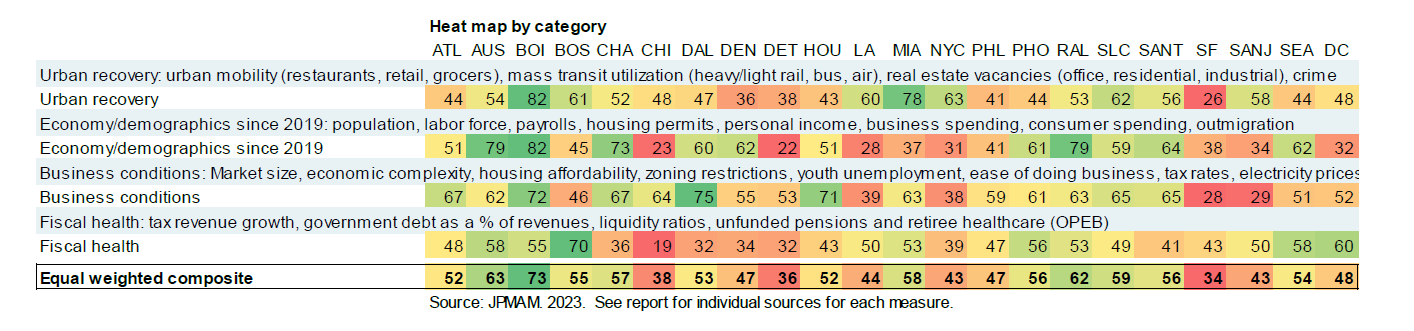

Don’t a lot of large cities face these problems? Yes, and that’s why we built a multi-city comparison of current conditions, a summary of which appears below. NYC ranks above median with respect to high frequency measures of urban recovery, but is dragged down by a weak economic recovery since 2019, structural problems related to its business conditions and poor fiscal health. NYC’s aggregate score ends up above only Chicago, Detroit and (of course) San Francisco. The full table with all categories by city appears in the deck linked above.

If there were an unforeseen negative change in a city, what might the catalysts be? In a city that’s already a difficult place to do business, a combination of fiscal pressures, outmigration of the tax base and high tax rates lead politicians to raise taxes further, fueling a decline in investment and more outmigration. This is the story of Detroit1, whose decline was exacerbated by high auto sector concentration of its employment and tax base. NYC is way more diversified and economically sound than Detroit in 2013, but this is a very low bar.

What might NYC do about the unfavorable trends shown above? I’m not a public policy expert and will not pretend to be. Instead, here are some recommendations from people who are.

Zoning needs an overhaul. NYC ranks second worst of 44 major US cities according to Wharton’s Residential Land Use Regulation Index, and dead last in University of Arizona’s survey of 83 US cities on zoning rules. There’s a lot to be gained by changing that. Research from USC and the Department of Transportation analyzed “upzoning”, which refers to relaxation of zoning restrictions. They found that upzoning can substantially increase output per worker, increase mean wages and decrease commuting times (particularly for people forced to live far from where the jobs are due to the cost of real estate)2. The authors also found that upzoning was a much more powerful tool than simply investing in more public transit or road infrastructure.

Some specifics: there are parts of NYC where new apartment buildings cannot be constructed in parking lots or where one-story retail establishments once existed; new apartments and new retail often require off-street parking which can be prohibitively expensive to provide; some areas benefit from limited development “special district” status in place since 1978; some areas have never been zoned for apartment buildings at all; and some streets preclude the development of new housing units even along streets adjacent to public transit3.

Residential floor-area ratios (FAR) in many locations are too low to permit apartment buildings, even in places well served by public transit and where low-intensity businesses could be located on the ground floor of new multistory mixed-use buildings. A map of NYC FAR ratios shows that the vast majority of land in boroughs outside Manhattan is zoned only for one- and two-family homes.

The best way to deal with the “office apocalypse” is to encourage development of more housing stock, which would bring down real estate prices and encourage in-migration of employees and firms that would eventually fill some of the vacant space. As explained in the deck, complex and costly office-to-residential conversions are unlikely to be implemented on a broad scale.

More public/private partnerships to fill the skills gap and reduce structural unemployment. More NYC employers should develop apprenticeship programs in technology, finance and operations, including those geared towards those without a 4-year degree who can qualify with an Associate of Applied Science degree. Congress can help increase by reauthorizing legislation to streamline administrative barriers, such as allowing reciprocity registrations so that employers do not have to reregister the same programs in multiple states4.

The Mayor’s Office should foster more partnerships between employers and colleges that outline skills needed for specific positions, design curricula and provide internships. One example: LaGuardia Community College partnered with Master Card to create a training program in cybersecurity and hired all of its graduates. LaGuardia is planning a similar program with Wells Fargo and is also in discussions with healthcare providers. Other ways to get involved: the New York Jobs CEO Council and the Business Roundtable’s Apprenticeship Accelerator Corporate Initiative.

Negotiate PILOT payments from tax-exempt owners of NYC real estate (tax exempt hospitals, universities and their medical centers, museums, religious institutions, etc). There are two issues in play here: a property tax exemption and an income tax exemption.

PILOT payments are one way for cities to reduce the burden on homeowners and small businesses whose taxes have to make up for what exempt institutions aren’t paying on both property and income.

Support “second chance” legislation and support the Second Chance Business Coalition:

Encourage more migration to NYC by reducing state licensing requirements. Licensing requirements increase wages for those able to obtain one, but reduce job opportunities, depress wages and reduce worker mobility. Around 25% of US workers require an occupational license; a report from the Obama Administration found that in many cases, the governing entities involved are not groups of elected officials but a board of practitioners whose primary job is to provide services in the same market they regulate, resulting in higher prices without increased quality of goods or services12. Among the occupations that require licensing in New York: bail bondsmen, barbers, shorthand court reporters, nail cosmetologists, interior designers, horse trainers, jockeys, “creative arts therapists”, notary publics, librarians, road race officials and ticket resellers.

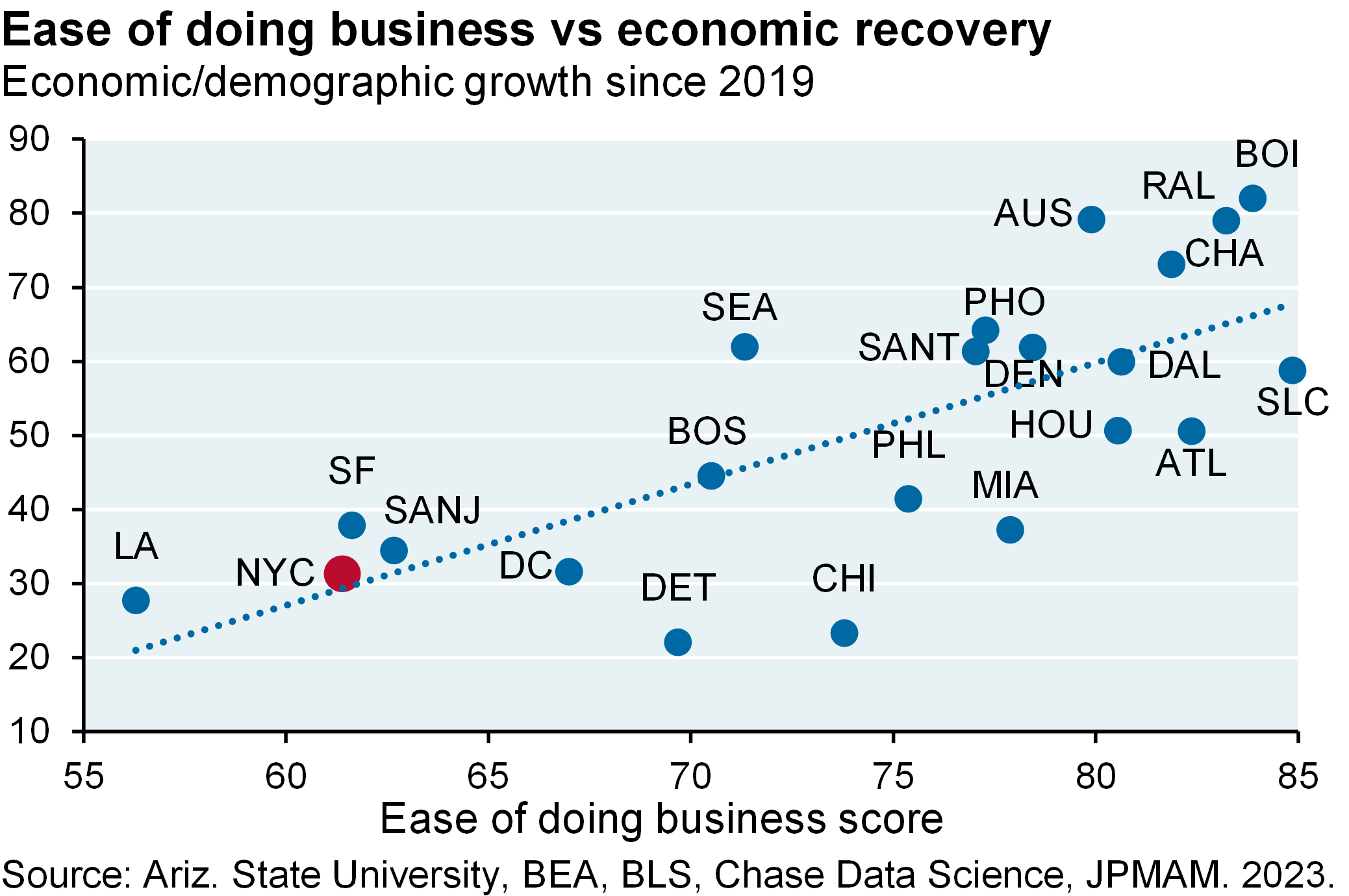

What about NYC’s relationship with the business community? In the fall of 2021, Mayor Adams said: “New York will no longer be anti-business...This is going to be a place where we welcome business and not turn into the dysfunctional city that we have been for so many years”13. Well, his Administration has a lot of work to do. As shown below, NYC ranks next to last in the city peer group regarding “ease of doing business”. Most cities that are easier places to operate have seen faster economic and demographic recoveries since 2019.

Michael Cembalest

JP Morgan Asset Management

The y-axis measures changes in population, the labor force, payrolls, housing permits, personal income, business spending, consumer spending and outmigration since the end of 2019

Ease of doing business scores include the cost and time required to start a business and employ workers, the cost of energy, tax rates, the cost and complexity of transferring title on real property, zoning requirements and the efficiency and time for resolving business insolvencies

1 See “How Different is Detroit”, Eye on the Market, Michael Cembalest, August 6, 2013

2 “Zoning and the Density of Urban Development”, Delventhal (Claremont), Kwon (USC) and Parkhomenko (USC), Pacific Southwest Region University Transportation Center, August 2020

3 “How to Solve NYC’s Housing Crisis”, Eric Kober, Manhattan Institute, June 2022

4 “Harnessing the power of apprenticeships to build a strong workforce for the future”, Heather Higginbottom, JP Morgan Corporate Responsibility (head of policy research), October 2023, TheHill.com

5 “Three policy questions for non-profit property tax exemptions”, Charles Brecher (NYU and Research Co-Director of the Citizens Budget Commission) and Thad Calabrese (NYU), 2015

6 “The Untouchables: How Columbia and NYU Benefit From Huge Tax Breaks”, NYT, September 23, 2023

7 “Higher education has a tax problem and it’s hurting local communities, Time, Davarian Baldwin, April 2021

8 Brennan Center for Justice, Matthew Friedman, November 2015

9 “Barred from employment: More than half of unemployed men in their 30s had a criminal history of arrest”, Bushway et al, Science Advances, 2022

10 Colorado Law & Policy Center, “Ban the box legislation boosts employment and reduces recidivism”, Nov 2015

11 “Expungement of Criminal Convictions: An Empirical Study”, Prescott and Starr, Univ. of Michigan, 2020

12 “Occupational Licensing: a Framework for Policymakers”, Department of the Treasury, 2015

13 New York Times, October 13, 2021

Comments on NYC compared to 21 other US cities with respect to urban recovery, commercial real estate, mass transit, crime, outmigration, work-from-home trends, tax rates, economic pulse, fiscal health, unfunded pensions, energy prices, industry diversification and competitiveness.

[START RECORDING]

FEMALE VOICE: This podcast has been prepared exclusively for institutional, wholesale professional clients and qualified investors only as defined by local laws and regulations. Please read other important information, which can be found on the link at the end of the podcast episode.

MR. MICHAEL CEMBALEST: Good morning, everybody. This is Michael Cembalest with the October 2023 Eye on the Market podcast. This one’s called New York: Just like I Pictured It. A couple months ago, a client of the firm, which is one of the largest apartment owners in the United States, asked me if I would prepare a forensic study of New York City, specifically, to present at their board meeting at the end of September for purposes of a discussion about the rationale for continued long-term capital investments in the city.

And I agreed to do it, under the condition that I would be able to share it with our clients after I was finished with the project because I knew it would be a lot of work. And they said yes, and so here we are. There’s a four-page Eye on the Market Word doc HTML that you can read, and then there’s an attached deck that’s got over 100 slides. I’m just going to walk through some of the main points here, but you should look to those two other resources if you want to see what we did.

And here’s the summary. New York City has a lot of advantages related to its outright size. It dwarfs every other city, including Los Angeles and Chicago, just in terms of its overall economic output, size of its labor force, its purchasing power. New York City has a lot of business sector diversification, which is surprising, ‘cause a lot of people think it’s just about finance and it’s not. Within the financial sector, New York City still has global financial sector dominance versus other competitive cities.

And then in terms of the post-COVID recovery, a lot of measures have now reached pre-pandemic levels, like the labor force, people going out to dinner, airport utilization. The residential and industrial sectors within commercial real estate are in pretty good shape in terms of low vacancy rates.

And the thing that would surprise you is that New York City crimes statistics, at least the way they’re reported by the FBI and by the city itself, compare favorably to a lot of other cities, and sometimes that comes as a surprise. But mass transit utilization is still only around three-quarters of 2019 levels, and that’s pretty much unsustainable given all the capital operating costs, even at 100% utilization rates.

New York City office vacancy rates are the highest as they’ve been since the early ‘90s. There’s a lot of leased but underutilized space. Around 35% of New York City workdays are still done from home, according to the work that Nick Bloom at Stanford does, where he compares different cities. And as we explain in the deck, office-to-residential conversions are in principle possible, but once you filter through all of the regulatory and economic costs, there unlikely to make that much of a dent.

The city has some very daunting operating deficits in front of it and will have to enact some very deep budget cuts or tax likes, while at the same time trying to figure out how to reinvest in aging infrastructure, in public housing. New York City is still a really difficult place to do business, and the zoning restrictions in particular are burdensome at a time when flexibility is paramount.

And the city’s tax rates are very high, the municipal debt burdens are high, home affordability is low, and that may explain when New York City has had one of the highest net outmigration rates of all the cities we looked at, and why New York State actually ranked next-to-last, other than Alaska, over the last decade regarding outmigration of both the number of taxpayers and their adjusted gross income.

As things stand now, the asylum situation threatens to substantially impair the city’s financial situation; I think the mayor has been clear about that as well. And to top it all off, the electricity prices are very high. New York State has among the lowest wind and solar capacity factors, which is a measure of raw material, solar and wind power. And then on top of that, the city is increasingly exposed to national gas prices with the closure of Indian Point.

So now, somebody might say a lot of cities face these problems. And that’s true, which is why we compared New York to 21 other large cities according to four main categories. An urban recovery Score, which looks at urban mobility and are people going back to restaurants and supermarkets and retail stores. Within that category, we also look at mass transit utilization and real estate vacancies. And on that basis, New York City actually ranks above median compared to the, within this 22-city group. And there’s a color-coded heat map, summarizes some of this, and green is good and red is bad as you might expect. And here New York ranks slightly above median.

The problem is the city is dragged down by a very slow economic recovery since 2019. When you look at the labor force and payrolls and housing permits, personal income spending and outmigration here, the city ranks way below median. The city also ranks way below median on things like housing affordability, zoning, unemployment, ease of doing business, tax rates, electricity prices. And then lastly, the fourth category looks at fiscal health, which is tax revenues, government debt, liquidity and unfunded pensions, and retiree healthcare, and here the city ranks below median as well.

So when we put all those four categories together, New York is in a difficult spot ahead of only Chicago, Detroit, and unsurprisingly, San Francisco. The stories that we read when we started this project about the doom loop in San Francisco have been confirmed by the data that we actually came across as we were pulling this all together. So I’m not going to go into too much detail; we’re just going to show you a few pictures and then talk about some of the policy options that we were thinking about.

We have a chart in here that shows this is the urban recovery. Apple did some tracking on this, so did Google, but there’s a University of Toronto study which uses mobile phones to track visits to retail stores, markets, restaurants, museums. Again, New York ranks at the high end here, a 30% gap versus 2019, still significant, but New York ranks better than a lot of other cities.

Here we also have a table on mass transit recovery. And here as I mentioned, the city is around 75% of pre-COVID levels. But again, these a very capital and operating-intensive systems to run, and that’s a very expensive problem for New York that’s going to have to be resolved.

But here we have a chart that that shows in a lot of different ways what the city’s facing. We have a chart that shows the utilization rates of the Long Island Railroad, the subway, Metro North, and the bus systems, ranging anywhere from 60 to 70%, 75% maybe. But New York City office building utilization is still at around 50% pre-pandemic levels. And that gap is essentially telling you all about people that are circulating and going places. They’re just not going to their white-collar office jobs, and this is the work-from-home issue.

The vacancy rates in the city, when you include pending vacancies, have hit about 18%. That’s as high as we’ve seen certainly since the early ‘90s. What’s kind of remarkable is that the city ranks ninth-best compared to other cities. So this underutilized office space issue is a national phenomenon. And were 11 or 12 cities in the peer group that had vacancy rates, office vacancy rates even higher than New York.

The issue is that New York has the highest work-from-home percentage, and at least as of July of this year, was showing little signs of changing. We’ll see in the next few months whether that that shifts. But a lot of the people who study this don’t think it will, which raises a lot of complicated questions about how cities can change and repurpose underutilized office space instead of letting it become vacant, affecting tax revenues, resulting in areas that are underpopulated. You end up with a lot of squatters and all of the things that you might imagine would take place.

We have a few slides in the in the main deck on crime reported by the city from the FBI, which allows us to compare it to other cities. And New York kind of ranked in the middle in terms of violent crime and much better than a lot of cities in terms of property crime. Recently there’s been a surge in auto larceny.

But I thought this was interesting, ‘cause it was very timely. This is a table from the census. They do a household pulse survey. And each week they do surveys and they ask what percentage of people are feeling pressure to move from where they live because they’re in an unsafe neighborhood. And here again New York ranked kind of in the middle and was outflanked by Seattle, San Francisco, Phoenix, surprisingly, and LA and Philadelphia and Chicago. So again, another data point that complements the notion that sometimes the crime situation in New York City, at least from a statistical perspective, doesn’t look as bad as you might think.

But where New York definitely has an issue is in the outmigration of its population. And this is hard data to get, because the IRS reports migration of taxpayers, but only with a three-year lag and only at the state level. So we went to our colleagues in Chase Data Science and we asked them can you try to figure this out based on change-of-address forms with respect to their credit card bills, and they did. They then matched it up with some historical data from the census and was remarkably close, like out to the second or third decimal.

When I complimented the Chase Data Science people on how well their approach went, their response was well, we knew it was going to be really good and they were very confident in their data, ‘cause we do bank somewhere like two-thirds or more of the country’s households, so they felt confident that it was going to match and it did. And here you can see the net migration data from New York was among the highest in the country over the last few years.

And that’s complemented by this. As I mentioned, this is the IRS data, which looks at migration statistics, both in terms of number of filers and adjusted gross income. We have a table in here that shows the five states with the most inflows and the five states with the most outflows, and New York ranks 49 out of 50, only head of Alaska, on both measures. So there’s something going on in New York that is resulting in people leaving, and that’s a bad fact.

As I mentioned, one of the benefits of the city is the sheer size of the place, which attracts a lot of people and employers. And this is the way that we’ve decided to show it. We created an index that combines economic output in dollars, labor force in terms of number of people, and personal income in dollars. New York on this basis is almost twice as large as Los Angeles, almost three times bigger than Chicago, and almost four times bigger than Dallas. So there’s a size advantage to New York City that draws people here.

But New York also has among the lowest home-affordability metrics in the country, and that’s bad too, because that’s one of the things that was going on in San Francisco before the city imploded. And what’s notable is that it’s not just the number of people that affects housing affordability. We looked at the Wharton, Wharton at the University of Pennsylvania has a residential land, the land-use index. And they score each city based on its restricted sub-zoning. And we have a chart in here that shows that there’s a pretty decent correlation between how severe your zoning restrictions are and the affordability of housing in that city. And so that’s something that has to be, we’ll talk more about later.

This is the tax data. You have to look at tax rates for households as a function of their income. We picked $75,000 a year because it’s reasonably close to median income for a lot of these big cities. And here you can see that New York is close to the top in terms of the combination of income, property sales, and auto-tax rates. So that’s part of the issue that’s pressuring the city.

And then the city is facing a pretty big fiscal cliff. And the way this kind of stuff works with cities is they can’t run large deficits generally the way the federal government does. So whenever you see projections of deficits, those deficits have to be closed by some combination of tax increases or spending cuts. And what’s interesting about New York is on the left, you get a projection of the deficits from the mayor, essentially the Office of Management and Budget of the mayor’s office. But separately there’s an independent New York City controller that is projecting budget deficits that are twice as large as the mayor’s office, and the single largest component of that difference is the asylum costs that the city is expected to incur in the next few years.

The other analysis that we do, for those of you that have been fans and readers of the Eye on the Market, is we look at the cost of not just government debt but also paying off unfunded pension and retiree healthcare plans. I won’t go through all the details here, other than to say that New York is not at the top, right. I mean, Chicago will continue to set world records of insolvency as it comes to these kind of things. But New York is definitely on the high side related on this measure too. So that’s an additional pressure point.

Energy prices, they’re high. Here you can see that New York has one of the highest electricity costs per kilowatt hour in the country and I’m not surprised. The chart on the right is interesting in the following regard. A few years ago, Indian Point was shut down, and I understand why people wanted to shut down Indian Point. There’s a natural gas line that runs underneath Indian Point. So combining a gas line with a nuclear power plant’s not a great idea.

At the time, NYSERDA, which is the New York Energy Agency, said don’t worry about it, wind and solar is going to make up the gap. That turned out to be about 95% false. As you can see in the chart, most of the gap is made up by natural gas and imports of electricity from neighboring states that produce it with natural gas. So while this might have been an important decision to make, I think the energy gurus in the city, at least so far, have misunderstood what the dynamics were going to be in terms of electricity generation.

I’m not going to spend too much time on the office conversion issue. There are pathways by which they can happen, but they tend to require, they’re very expensive to do. They only make economic sense when they can be purchased at 60 to 70% discounts from the prior owners. And then basically, the only way you can make money is to charge rental income in the 90th percentile of rents. And so while some of those projects may take place, I can’t imagine how that’s going to end up impacting the kind of stock of affordable housing, or even upper-middle-class housing in the city.

So what should the city do about it? I don’t know; I’m not a public policy expert. But I consulted people who are. And there’s no magic bullets, just a few ideas on the margin to increase efficiency and productivity. New York ranks last or close to last in every single zoning regulation index that you can possibly find. And according to the Department of Transportation, who did a study on this kind of thing, when you relaxed owning restrictions in big cities, you can really increase output and wages, because you can decrease commuting times for a lot of people that are forced to live so far from the city that it decreases what their job options are.

And just to kind of tick through some of the things about New York, in parts of the city, you can’t build apartment buildings in parking lots or where one-story retail used to exist. New apartments often have to, and new retail often require off-street parking, which can be prohibitively expensive, and which is strange in a city that’s trying to encourage mass transit. Some areas have limited development, special-district status that have been in place since the ‘70s. Some places have never been zoned for apartment buildings at all.

And some streets preclude development of new housing, even though they’re adjacent to public transit. So there’s an enormous amount of work that can be done here, and a lot of people are focused on this. I know the mayor’s office is focused on it as well. But one of the reasons that you rank last in some of these indices is when a city - - really hard to change those things.

The city should encourage more public-private partnerships to develop apprenticeship programs, particularly for those people without four-year degrees. J.P. Morgan is active - - the New York CEO Jobs Council. More companies should get involved. Second-chance legislation is important. You would be amazed at how many adult males have some kind of criminal records, serious or not, and which can severely impair their ability to get a job and obtain housing and raise a family. And so second-chance legislation is something that helps increase employment and reduce recidivism.

The city should probably reduce the licensing requirements that make it difficult in terms of impairing interstate mobility. Occupations that require licensing in New York City include barbers, court reporters, nail cosmetologists, horse trainers and jockeys, notary public. You get the point.

And then the last one that I thought was notable was it may be time for the city and a lot of cities to rethink the tax-exempt status of hospitals, universities, museums, and religious institutions in terms of being tax-exempt owners of New York City real estate. A lot of universities in the country have technology-transfer offices to privatize and profit from federally-sponsored research. They collect millions of royalties, and all of that’s tax-exempt.

Entities like the Trinity Church has a real estate portfolio reportedly worth $6 billion. Columbia University is the city’s largest land owner, and its property tax savings are 50% larger than those given to Yankee Stadium. And the city, and it gets worse every time Columbia expands ‘cause it’s taking over property that used to be on the tax rolls. All in, there’s around 12,000 New York City properties that were worth at least $40 billion ten years ago and that were exempt from property taxes, even though the entities that owned that real estate earned $134 billion in revenues that year, and that’s something that should probably change.

So the last comment I would make is New York is a very difficult place to do business and is being outflanked by cities with a different approach. And we have a chart in here that shows as the ease of doing business score goes up, so has the economic and demographic growth of that city since 2019, so something for the city and its officials to think about. And then we close with a discussion about Detroit. For everybody that is inclined to think that raising taxes is the answer, it’s a difficult one when you’re in a downward spiral. And we have a chart in here that shows that Detroit continued to raise tax rates, but as entities fled the city, their actual collection of tax revenues fell.

So anyway, that’s just a quick podcast synopsis of the research that we did. If you want to take a closer look, all the information is available in the Eye on the Market that was released today. Good to see everybody, and we’ll be back to you before Thanksgiving with an update on the markets.

FEMALE VOICE: Michael Cembalest’s Eye on the Market offers a unique perspective on the economy, current events, markets and investment portfolios, and is a production of J.P. Morgan Asset and Wealth Management. Michael Cembalest is the Chairman of Market and Investment Strategy for J.P. Morgan Asset Management and is one of our most renowned and provocative speakers. For more information, please subscribe to the Eye on the Market by contacting your J.P. Morgan representative. If you’d like to hear more, please explore episodes on iTunes or on our website.

This podcast is intended for informational purposes only and is a communication on behalf of J.P. Morgan Institutional Investments Incorporated. Views may not be suitable for all investors and are not intended as personal investment advice or a solicitation or recommendation. Outlooks and past performance are never guarantees of future results. This is not investment research. Please read other important information, which can be found at www.JPMorgan.com/disclaimer-EOTM.

[END RECORDING]

IMPORTANT INFORMATION

This report uses rigorous security protocols for selected data sourced from Chase credit and debit card transactions to ensure all information is kept confidential and secure. All selected data is highly aggregated and all unique identifiable information, including names, account numbers, addresses, dates of birth, and Social Security Numbers, is removed from the data before the report’s author receives it. The data in this report is not representative of Chase’s overall credit and debit cardholder population.

The views, opinions and estimates expressed herein constitute Michael Cembalest’s judgment based on current market conditions and are subject to change without notice. Information herein may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of J.P. Morgan Chase & Co. or its affiliates.

For J.P. Morgan Asset Management Clients:

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

ACCESSIBILITY

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), which this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For J.P. Morgan Private Bank Clients:

ACCESSIBILITY

J.P. Morgan is committed to making our products and services accessible to meet the financial services needs of all our clients. Please direct any accessibility issues to the Private Bank Client Service Center at 1-866-265-1727.

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

In the United States, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB”) offer investment products, which may include bank-managed investment accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (“JPMS”), a member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPM. Products not available in all states.

In Germany, this material is issued by J.P. Morgan SE, with its registered office at Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). In Luxembourg, this material is issued by J.P. Morgan SE – Luxembourg Branch, with registered office at European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier (CSSF); registered under R.C.S Luxembourg B255938. In the United Kingdom, this material is issued by J.P. Morgan SE – London Branch, registered office at 25 Bank Street, Canary Wharf, London E14 5JP, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. In Spain, this material is distributed by J.P. Morgan SE, Sucursal en España, with registered office at Paseo de la Castellana, 31, 28046 Madrid, Spain, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE, Sucursal en España is also supervised by the Spanish Securities Market Commission (CNMV); registered with Bank of Spain as a branch of J.P. Morgan SE under code 1567. In Italy, this material is distributed by J.P. Morgan SE – Milan Branch, with its registered office at Via Cordusio, n.3, Milan 20123, Italy, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Milan Branch is also supervised by Bank of Italy and the Commissione Nazionale per le Società e la Borsa (CONSOB); registered with Bank of Italy as a branch of J.P. Morgan SE under code 8076; Milan Chamber of Commerce Registered Number: REA MI 2536325. In the Netherlands, this material is distributed by J.P. Morgan SE – Amsterdam Branch, with registered office at World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Amsterdam Branch is also supervised by De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM) in the Netherlands. Registered with the Kamer van Koophandel as a branch of J.P. Morgan SE under registration number 72610220. In Denmark, this material is distributed by J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland, with registered office at Kalvebod Brygge 39-41, 1560 København V, Denmark, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland is also supervised by Finanstilsynet (Danish FSA) and is registered with Finanstilsynet as a branch of J.P. Morgan SE under code 29010. In Sweden, this material is distributed by J.P. Morgan SE – Stockholm Bankfilial, with registered office at Hamngatan 15, Stockholm, 11147, Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Stockholm Bankfilial is also supervised by Finansinspektionen (Swedish FSA); registered with Finansinspektionen as a branch of J.P. Morgan SE. In France, this material is distributed by JPMCB, Paris branch, which is regulated by the French banking authorities Autorité de Contrôle Prudentiel et de Résolution and Autorité des Marchés Financiers. In Switzerland, this material is distributed by J.P. Morgan (Suisse) SA, with registered address at rue de la Confédération, 8, 1211, Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority (FINMA), as a bank and a securities dealer in Switzerland. Please consult the following link to obtain information regarding J.P. Morgan’s EMEA data protection policy: https://www.jpmorgan.com/privacy.

In Hong Kong, this material is distributed by JPMCB, Hong Kong branch. JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch (as notified to you). Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions. You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. JPMorgan Chase Bank, N.A. is a national banking association chartered under the laws of the United States, and as a body corporate, its shareholder’s liability is limited.

With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions. We may offer and/or sell to you securities or other financial instruments which may not be registered under, and are not the subject of a public offering under, the securities or other financial regulatory laws of your home country. Such securities or instruments are offered and/or sold to you on a private basis only. Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful. Furthermore, such securities or instruments may be subject to certain regulatory and/or contractual restrictions on subsequent transfer by you, and you are solely responsible for ascertaining and complying with such restrictions. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund’s securities in compliance with the laws of the corresponding jurisdiction. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission— CVM is completely prohibited. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms.

JPMorgan Chase Bank, N.A. (JPMCBNA) (ABN 43 074 112 011/AFS Licence No: 238367) is regulated by the Australian Securities and Investment Commission and the Australian Prudential Regulation Authority. Material provided by JPMCBNA in Australia is to “wholesale clients” only. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Corporations Act 2001 (Cth). Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

JPMS is a registered foreign company (overseas) (ARBN 109293610) incorporated in Delaware, U.S.A. Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J.P. Morgan Securities LLC (JPMS), to hold an Australian Financial Services Licence (AFSL), unless an exemption applies. JPMS is exempt from the requirement to hold an AFSL under the Corporations Act 2001 (Cth) (Act) in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under U.S. laws, which differ from Australian laws. Material provided by JPMS in Australia is to “wholesale clients” only. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Act. Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

This material has not been prepared specifically for Australian investors. It:

May contain references to dollar amounts which are not Australian dollars;

May contain financial information which is not prepared in accordance with Australian law or practices;

May not address risks associated with investment in foreign currency denominated investments; and

Does not address Australian tax issues.