The macroeconomics of climate risk: how global warming could impact global growth

2019/06/27

In Brief

- Traditional macroeconomic models run the risk of overstating potential global growth by not adequately accounting for natural resource constraints and climate change.

- Among the potential threats to economic activity: the impact of global warming on a degraded environment and an increase in the number and geographic reach of “extreme weather” natural disasters that could challenge food production and impact global migration.

- The investment implications of climate risk are wide-ranging and may well imply a more tempered forecast for global growth in the coming decades.

The macroeconomics of climate risk: How global warming could impact economic growth

Traditional macroeconomic models suggest there is plenty of capacity for the global economy to continue expanding production. Economic theory argues that expanded production will make people happier given that they derive “utility” solely from consuming goods and services.

But these models are fundamentally flawed: they account for neither the environmental and resource constraints on growth, nor the sense of well-being that people take from a safe, stable and pleasant natural environment. As governments seek to secure future growth and well-being for their populations, environmental factors and climate risk are influencing public policy.

In the following pages we consider the macroeconomics of climate risk. We examine the limitations of traditional economic models, exploring the nexus between the environmental and economic impact of climate change-for example, in growing threats to food security and transportation systems, shifting migration patterns and changing consumer preferences. The investment implications of climate risk are wide-ranging and may well imply a more tempered forecast for global growth in the coming decades. Investors should increasingly factor in the impact of climate risk as they take into account both its economic and policy implications.

Traditional macroeconomic models

Undergraduate economics students spend their first year understanding the two work horses of economic theory which have barely changed in the past few decades.

The first is the production function. It states that an economy’s growth is dependent on the growth of two key inputs - workers and physical capital - and the manner in which they combine to produce output, known as technological progress.

The second model describes consumer demand. It states that consumers derive “utility” (an economic term for pleasure) solely from consuming goods and services. An individual’s aim is to consume as much as possible over a lifetime.

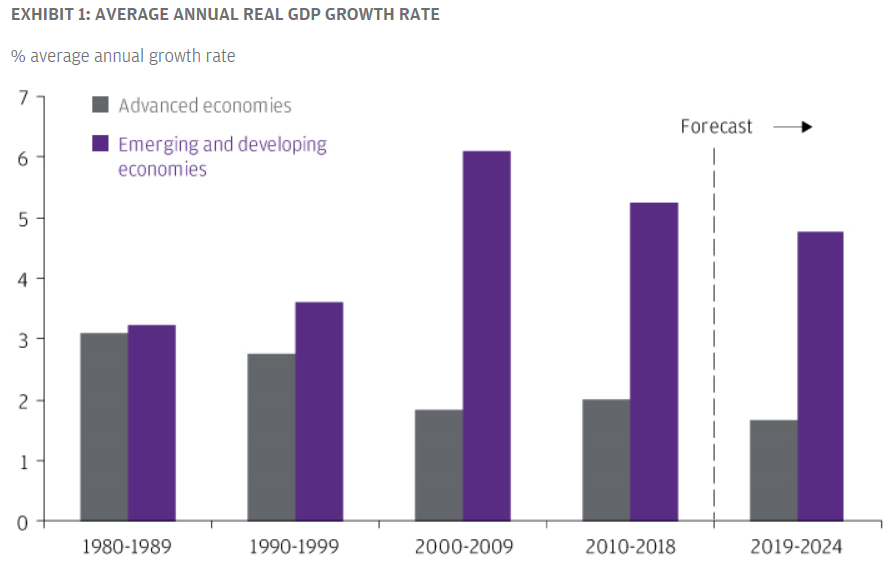

Armed with these models and the latest economic data, a student may conclude that there are few impediments to global growth in the coming decades. Although supply potential will be constrained by slowing population growth, particularly in developed economies, the accumulation of physical capital, and technological catch up in the emerging markets should be enough to sustain global growth.

EXHIBIT 1: AVERAGE ANNUAL REAL GDP GROWTH RATE

% average annual growth rate

Source: IMF, Refinitv Datastream, J.P. Morgan Asset Management. Forecasts are from IMF World Economic Outlook, April 2019. Data as of 31 May 2019.

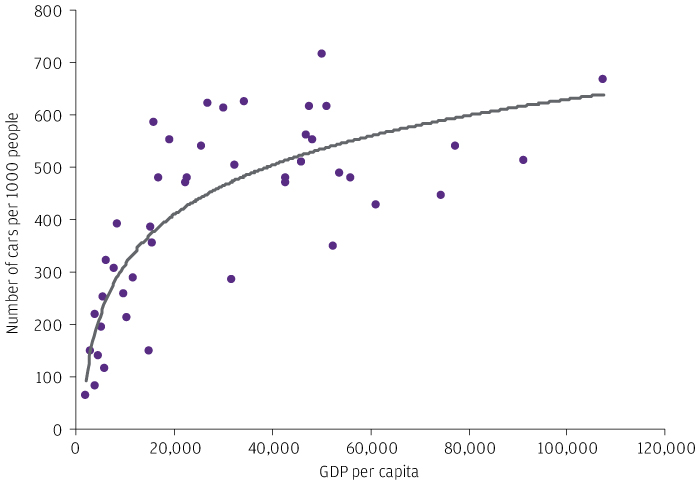

On the assumption that households will spend all this extra income the students might then predict a massive expansion in consumer demand -particularly from the new middle income households in the emerging world. This would likely include a huge increase in demand for cars (Exhibit 2). In China there are 100 cars per 1,000 people, vs. 380 cars per 1,000 people in the U.S1 . Shifting food preferences appears to be another consequence, since as incomes rise we tend to see diets shift from a plant-based diet towards a more protein-heavy, animal based diet.

EXHIBIT 2: REAL GDP AND NUMBER OF CARS

x-axis is real GDP per capita in USD, y-axis is number of cars per 1000 people

Source: UNECE, World Bank, J.P. Morgan Asset Management. Data as of 31 May 2019.

Source: UNECE, World Bank, J.P. Morgan Asset Management. Data as of 31 May 2019.

There are two gaping flaws in these traditional economic models. They do not account for the limits to growth from resource constraints and environmental degradation, nor do they account for the fact that consumers derive “utility”’ from a secure and pleasant environment.

Natural resource constraints

Economic output requires more than people and machine tools. Natural resources, such as land and fuel, are also needed.

Shortfalls in natural resources have clearly impacted global growth throughout history. In the 1970s periods of significant imbalance between demand and supply in the oil market led to energy price shocks that helped lay the foundation for periods of global economic contraction.

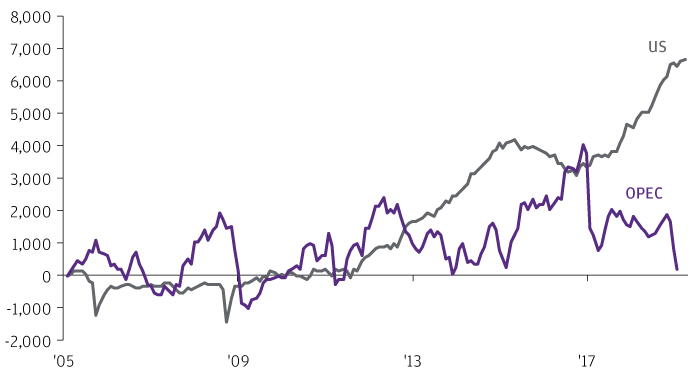

The direct supply constraint from fossil fuels has been partially overcome by the enormous expansion in oil supply in North America in recent years, in part through the fracking of shale rock to produce oil and gas. Fears of rocketing prices and “peak oil” have therefore not been borne out even as demand for fuel has increased with rising global activity and more cars on the road.

EXHIBIT 3: CUMULATIVE CHANGE IN CRUDE OIL PRODUCTION SINCE 2005

Thousands of barrels per day

Source: EIA, Refinitiv Datastream, J.P. Morgan Asset Management. Data as of 31 May 2019.

Source: EIA, Refinitiv Datastream, J.P. Morgan Asset Management. Data as of 31 May 2019.

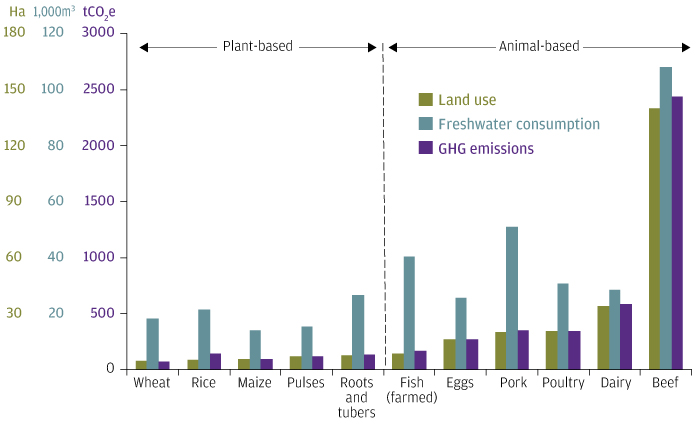

It is much less clear that solutions are being found to overcome other resource constraints, particularly the land that will be required to sustain heavier demand for protein based diets as emerging market incomes rise. Exhibit 4 demonstrates the increased land, water and energy consumption used to generate an animal-based versus a plant-based diet.

EXHIBIT 4: IMPACT OF FOOD PRODUCTION PER TON OF PROTEIN CONSUMED

Total land use is measured in hectares (Ha), freshwater consumption in thousands of cubic meters (1,000 m3), and greenhouse gas emissions in tonnes of carbon dioxide equivalent (tCO2e)

Source: World Resources Institute, J.P. Morgan Asset Management. GHG emissions are greenhouse gas emissions. Data as of 31 May 2019.

Source: World Resources Institute, J.P. Morgan Asset Management. GHG emissions are greenhouse gas emissions. Data as of 31 May 2019.

Indeed, it seems increasingly evident that in overcoming fossil fuel constraints we have in fact increased risks and constraints in other areas of natural resource.

This is partly a direct substitution effect as crops are used for biofuels rather than food. But there is also evidence that the use of fossil fuels is impacting the quality or productive capacity of other natural resources. For example, in Asia, particularly China, the increased use of fossil fuels, especially coal, by power stations and for other heavy industrial processes has led to a surge in pollutant particles in the air. Numerous manufacturing processes involving chemicals have contaminated rivers, lakes and ground water sources, in turn affecting their capacity to produce food and other products.

Natural disasters on the rise

There is then the question of whether the broader rise in CO2 from the use of fossil fuels can explain increasingly frequent natural disasters and the damaging effects of climate change, and the economic cost they entail. Natural disasters possibly triggered by climate change can have an immediate impact on economic output, as in the case of an earthquake; or they can have slower more medium-term impacts. The Asian Development Bank’s models (produced in 2009) suggested that climate change could reduce the yield on irrigated paddy fields in Asia by 14%-20% by 2050 compared with the no-climate change scenario. Irrigated wheat and soybean yield could drop by 32%-44% and 9%-18%, respectively.

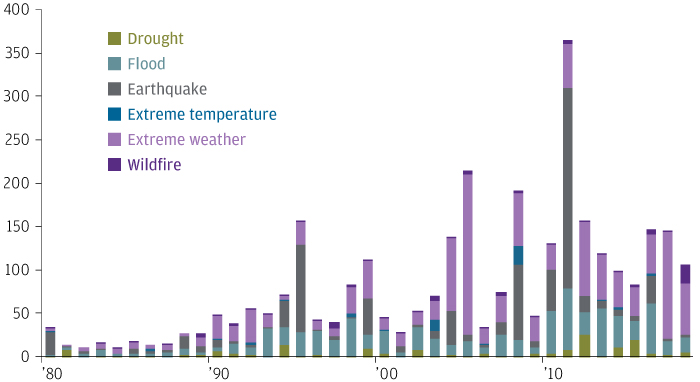

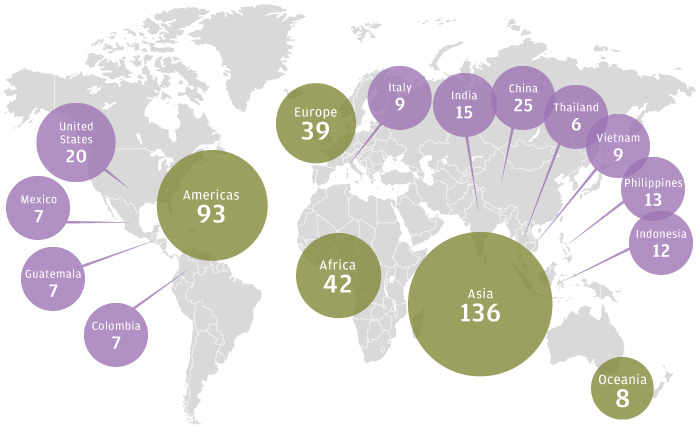

Exhibit 5 shows this trend in rising natural disasters broken down by type and exhibit 6 shows the geographic dispersion. We highlight two points. First, there is an increase in reported natural disasters described as “extreme weather,” which could be reasonably expected to affect food production. Second, we note the geographic reach of the problem: roughly one third of economic disasters affected the Americas in 2017.

EXHIBIT 5: ECONOMIC DAMAGE BY NATURAL DISASTER TYPE

USD billions

Source: EMDAT: The Emergency Events Database - Université catholique de Louvain - CRED, J.P. Morgan Asset Management. Data as of 31 May 2019.

EXHIBIT 6: NUMBER OF DISASTERS BY CONTINENT AND TOP COUNTRIES

Source: EMDAT: The Emergency Events Database - Université catholique de Louvain - CRED, J.P. Morgan Asset Management. Data as of 31 May 2019.

Source: EMDAT: The Emergency Events Database - Université catholique de Louvain - CRED, J.P. Morgan Asset Management. Data as of 31 May 2019.

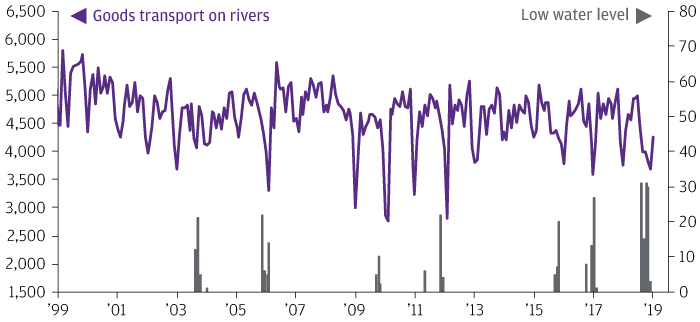

The eurozone’s largest economy - Germany - experienced a significant climate event in 2018 that challenged the macroeconomy. A plunge in the water levels in the Rhine, Germany’s main waterway-while its exact cause was unclear- impaired the ability of companies to transport goods and contributed to a broader economic decline.

EXHIBIT 7: GERMANY TRANSPORT OF GOODS ON RIVERS AND RHINE WATER LEVELS

Thousands of tonnes (LHS); number of days per month with Rhine water level below 80cm (RHS)

Source: WSV, Federal Statistical Office of Germany, J.P. Morgan Asset Management. Data as of 31 May 2019.

Source: WSV, Federal Statistical Office of Germany, J.P. Morgan Asset Management. Data as of 31 May 2019.

Consumer preferences and government policy

Shifting our perspective from economic supply to demand, we note that consumers are also increasingly making clear that they derive utility from a safe, stable and pleasant natural environment. This is manifesting itself in many ways. At one extreme, regions affected by climate risk - whether the impact on people’s ability to produce food or a greater risk of natural disaster - is affecting migration flows. Among those fleeing the northern triangle of Central America (Guatemala, Honduras and El Salvador) are farmers whose livelihood has been affected by climate change (In Honduras, for example, agriculture accounts for around 30% of total employment, according to the World Bank). Other shifts in behaviour include environmentally focused changes in consumer demand. A recent case in point: the recent aversion to single use plastics in Europe.

It’s no wonder, then, that environmental concerns are rising in the policy agenda. Whilst the U.S. withdrawal from the Paris Agreement represented a set back at the multilateral policy level, there is considerable momentum behind national and regional policy change. The EU’s 2030 targets include a 40% cut in greenhouse gas emissions (from 1990 levels) and at least 32% of total energy to come from renewables. And the European Council and European Parliament have agreed on rules that would require all institutional investors to disclose the impact of sustainability risks on their financial performance.

Asian policymakers in particular are rethinking their approach to climate change. Reducing poverty is no longer sufficient, if citizens see their incomes rise but no longer have access to clean air and water.

More than a decade ago the Chinese Premier proposed the idea of “Green GDP”’ and China is increasingly focused on more environmentally sustainable growth. China has been the largest country in renewable energy investment, according to the United Nations Environment Programme (UNEP). China invested USD 127 billion in 2016, or 45% of the global total. Solar and wind power took up the majority of this investment, or 68% and 29%, respectively. Beijing has also provided subsidies to promote hybrid cars and electric vehicles. Regulations on polluting industries were also tightened, with some factories required to improve their filtration systems to reduce the release of air and water pollutants. Other factories saw their operating times limited with clear implications for overall industrial output.

Conclusion

Traditional macroeconomic models run the risk of overstating potential global growth by not adequately accounting for natural resource constraints and climate risk. The direct constraints posed by the finite availability of fossil fuels has been partially overcome with the rise in supply in North America and the broader innovation in extraction techniques. However, as we have discussed, in time it may become apparent that in overcoming fossil fuel constraints we have increased risks and constraints in other areas of natural resource. These range from climate change’s more gradual impact on environmental degradation and food security to more sudden climate “incidents” linked to global warming- which can have an immediate and significant impact on economic activity.

The implications for analysts and investors are wide ranging. At the most macro level increased climate risk implies a more tempered forecast for global growth. There are also potential consequences for the distribution of that growth and the risk associated with growth in certain countries, not least because migration patterns will be affected as individuals attempt to flee climate-stressed areas.

Finally, investors must also consider the implications for policy and regulation as policymakers respond to pressure to improve welfare today as well as secure prosperity for future generations. Their choices will involve trade-offs whose economic impact will be difficult to discern.

1 Data comes from International Organization of Motor Vehicle Manufacturers and is for 2015.

0903c02a8261e6a0