Trading the thrill of the ECB chase

2019/08/22

During July’s ECB monetary policy meeting, president Draghi managed to convince governing council members to make a number of dovish alterations to the opening statement (including references to lower levels of rates, tiering and QE), although he underwhelmed in the delivery of his dovish message during the press conference. Nevertheless, with Eurozone growth and inflation data continuing to disappoint and trade tensions, which have hit the export orientated German economy particularly hard, remaining elevated, we have maintained a view that the ECB will cut rates and restart QE at their September policy meeting.

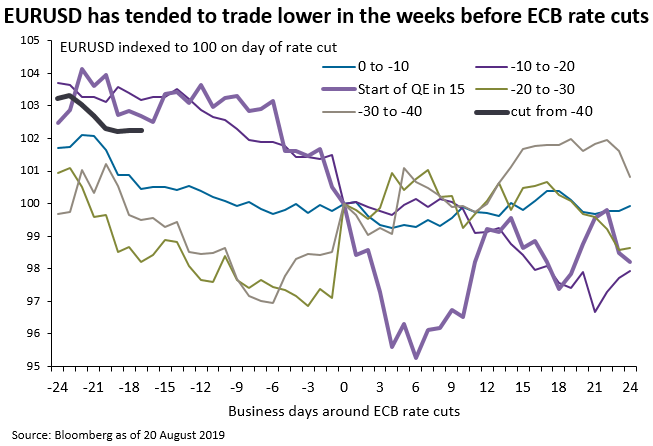

Market expectations of a substantial easing package from the ECB were reinforced by last week’s comments by the Finnish central bank governor Olli Rehn who emphasised the importance of the ECB outlining a ‘significant’ and ‘impactful’ stimulus package that overshoots market expectations. The impact of his comments were to significantly push Eurozone (and global) bond yields lower with roughly 2/3s of the Euro denominated investment grade bond market now trading with a negative yield. We believe the prospects of further significant easing by the ECB will be Euro negative, particularly as the ECB pushes Eurozone rates deeper into negative territory and investors reach for investments in other markets that offer more attractive yields. This trend has been apparent before each of the prior 4 ECB rate cuts in negative rate territory.

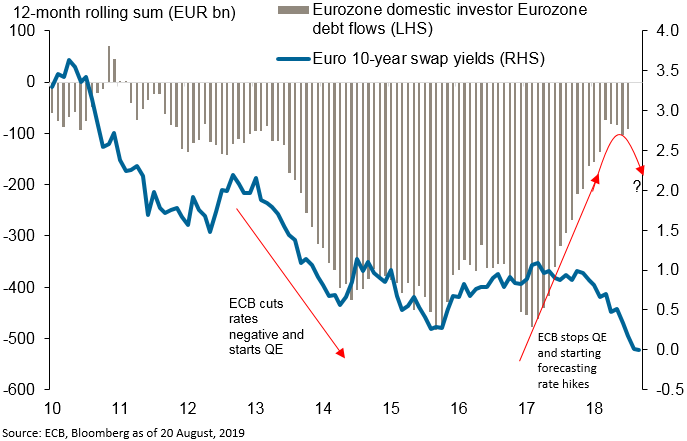

Evidence that significant changes in the ECB policy stance can drive domestic portfolio flows can be seen in the changes to domestic portfolio allocations as the ECB cut the deposit rate to negative levels in 2014 and prepared the market for the start of QE purchases. Domestic flows in Eurozone bonds turned sharply negative as investors fled abroad seeking higher yields. Substantial domestic fixed income outflows were featured throughout the period when the ECB was conducting QE and were partly responsible for suppressing the Euro’s value. It was only when the ECB signaled the end of QE was near that the trend in domestic fixed income outflows turned. With yields now substantially more negative than when the ECB first cut the deposit rate negative and the prospect of substantial QE purchases ahead, we anticipate Eurozone domestic investor fixed income flows will turn sharply negative again.

Beyond the September meeting, the outlook for the Euro is likely to become more nuanced as the market will need to weigh the increasingly prevalent smoke signals of German fiscal easing (likely Euro positive), a likely twitter storm from President Trump arguing that the Euro is being unfairly devalued, a global trade outlook that is likely to remain challenging, and easing by other central banks. It may be that once ECB easing has been delivered, the value of the Euro could stabilise or even bounce. However, we believe in the short-term it will be the prospect of sub-par growth and significantly more negative rates that will likely drive capital flows from Eurozone markets keeping the Euro under pressure over the next few weeks.