Emerging markets debt: The new core allocation

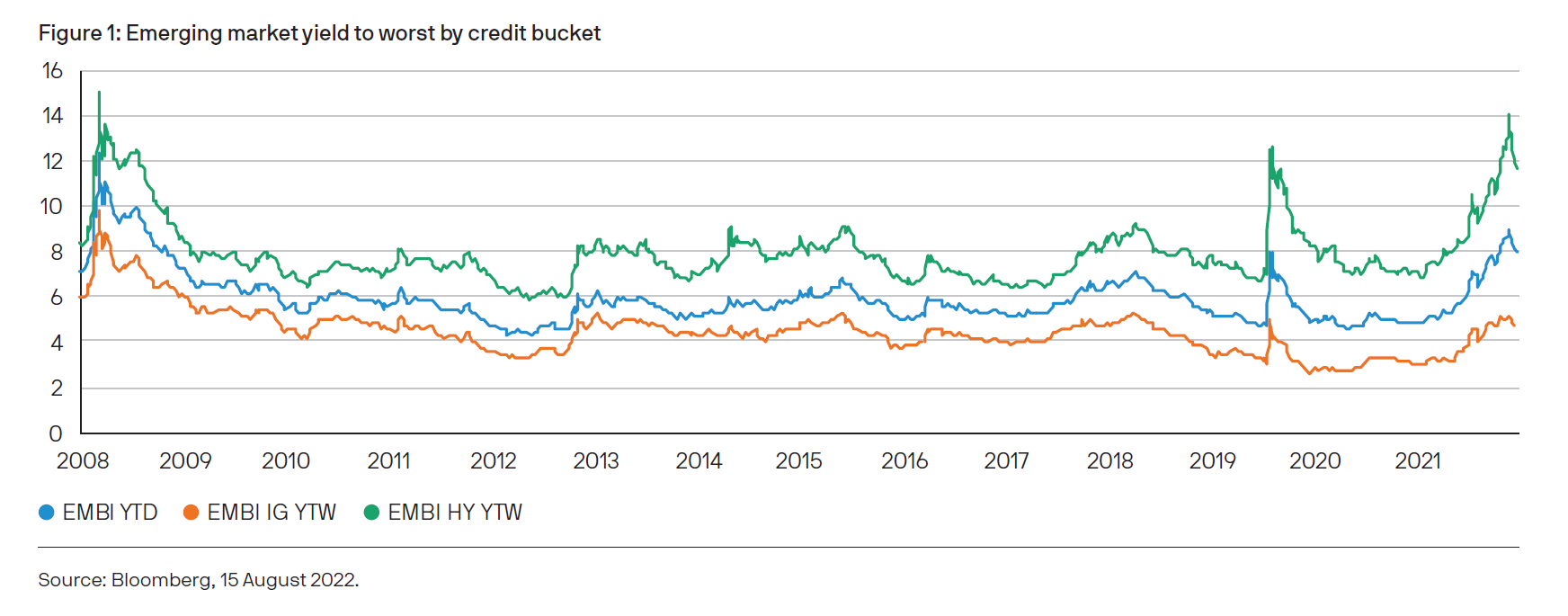

Emerging market debt’s role in the portfolio is changing. Previously, emerging markets’ small size and relatively high volatility had led many investors to see the space as a tactical asset allocation tool. The segment’s higher yields meant that smaller positions could contribute to income while an underweight allocation protected the portfolio’s relative performance from potential drawdown risk. China’s inclusion in the Bloomberg Global Aggregate Index has increased the space’s overall weighting to 15% of the index, and in doing so required investors to look more closely at including emerging market debt in the core of the portfolio. How to best build exposure to the space remains an area of interest. Long-term investors know that emerging markets’ performance can be volatile. Since the outbreak of Covid and Russia’s invasion of Ukraine, volatility has increased (Figure 1). Such moves challenge asset allocators, as investors may not always be compensated for the excess volatility.

Comparing emerging market sovereign debt benchmarks

In a rapidly expanding, diverse space, differences in index design can result in meaningful differences in both returns achieved and the character of those returns through the cycle. The most widely followed hard currency sovereign bond index in the emerging markets space is the J.P. Morgan Emerging Market Bond Index (“EMBI”) family, of which the EMBI Broad Diversified Index enjoys an elevated profile. This is because the EMBI Broad Diversified Index’s variant reflects the widest sample across markets and ratings in the range, while others more narrowly define the opportunity.

EMBI Global Index and EMBI Global Diversified Index are sister variations, with each offering exposure to 70 markets and 160 issuers. Where their composition differs is around weight, with EMBI Global Diversified Index offering more exposure to the BB space (21%), a common target for active managers, compared to EMBI Global Index (19%). As a result, EMBI Global Index is slightly less volatile than its diversified sister.

Concerns around liquidity are a common criticism of both indexes and the broader space, an effect magnified by increasing levels of market inclusion. As the emerging market universe has grown, so too has the EMBI Global Index. Addressing this criticism, the provider introduced EMBI Core Index, which imposes liquidity filters around issue size and maturities. The resulting index offers exposure to 44 markets, with a concentration in Latin America. EMBI Core Index has proven to be a popular variant, especially in the index replication community where the smaller tail is less costly to replicate.

The three-step solution: Introducing EMBI Risk Aware Index

EMBI Risk Aware Index is a distinct alternative to EMBI Global Index, EMBI Diversified Index and EMBI Core Index. This is because the EMBI Risk Aware Index is built around the active filtration of the EMBI Index’s universe, to provide a more efficient reflection of the opportunity. Recognizing that investors are commonly challenged by liquidity and market risk, the index seeks to reduce these through active filtration of both short dated and smaller issuance, and removing the riskiest markets. From there, the index rebalances into higher yielding credit, effectively elevating the index’s return.

Relative to two variants – EMBI Core Index and EMBI Global Index – the EMBI Risk Aware Index has produced stronger returns on lower volatility. More importantly, the EMBI Risk Aware Index’s tail returns are much smaller versus more traditional peers. Using kurtosis, a measure of the combined weight of the portfolio tails relative to the center of the distribution, helps to show this quality: selectors often favor lower kurtosis assets for core positions in the portfolio. With a kurtosis of 1.25, EMBI Risk Aware Index’s returns are notably less variable than either EMBI Global Index (1.45) or EMBI Core Index (1.56).

EMBI Risk Aware Index also stands out for its relative resilience. We think the Sortino ratio offers an appealing way to assess drawdown resilience, because it differentiates downside volatility from total volatility. For investors looking for core exposure, a higher Sortino ratio may be desirable. Comparing Sortino ratios against EMBI Core Index and EMBI Global Diversified Index, we find EMBI Risk Aware Index’s three-year track record superior for the majority of the sample period. This may be explained by EMBI Risk Aware Index’s higher quality and more liquid portfolio: when emerging markets draw down, higher quality, more liquid bonds have a tendency to bounce back more quickly than less liquid, riskier peers.

Simply better beta

Taken together, we think these three measures – returns, kurtosis, and Sortino – contribute to the conclusion that the EMBI Risk Aware Index offers a distinctive emerging markets beta relative to better known peers EMBI Global Index, EMBI Global Diversified Index and EMBI Core Index. For selectors seeking exposure to the diverse, broad, and deep universe of emerging market debt, we see an argument for a more focused engagement with risk, which focuses on the benefits of a more liquid exposure.

In our view, it is fair to call an asset exhibiting a lower kurtosis, higher average return and superior Sortino measure a higher quality play versus peers. While index inclusion typically broadens sponsorship, the benefits do not always accrue equally to issuers. Issuers showing a track record of quality public policy and credible central banking will always attract interest versus less reliable alternatives. By increasing exposure to the former, while reducing the latter, the EMBI Risk Aware Index’s active approach presents opportunities for compelling beta.

Provided to illustrate macro trends and is not indicative of current or future results, does not consider any specific investor's objectives or circumstances and is not to be construed as offer, research or investment advice. Not all investments are suitable for all investors. Investors cannot invest in indexes directly. Risk management does not imply elimination of risks.

Diversification does not guarantee positive returns or eliminate risk of loss. Risk management does not imply elimination of risks. Past performance is not indicative of future performance

Unless otherwise stated, all data sources are from J.P. Morgan Asset Management as of 9 September 2022.